Exam 18: Macroeconomics in an Open Economy

Exam 1: Economics: Foundations and Models146 Questions

Exam 2: Trade-Offs, comparative Advantage, and the Market System153 Questions

Exam 3: Where Prices Come From: the Interaction of Demand and Supply147 Questions

Exam 4: Economic Efficiency, government Price Setting, and Taxes138 Questions

Exam 5: The Economics of Health Care115 Questions

Exam 6: Firms, the Stock Market, and Corporate Governance141 Questions

Exam 7: Comparative Advantage and the Gains From International Trade123 Questions

Exam 8: Gdp: Measuring Total Production and Income134 Questions

Exam 9: Unemployment and Inflation148 Questions

Exam 10: Economic Growth, the Financial System, and Business Cycles130 Questions

Exam 11: Long-Run Economic Growth: Sources and Policies141 Questions

Exam 12: Aggregate Expenditure and Output in the Short Run154 Questions

Exam 13: Aggregate Demand and Aggregate Supply Analysis145 Questions

Exam 14: Money, banks, and the Federal Reserve System146 Questions

Exam 15: Monetary Policy137 Questions

Exam 16: Fiscal Policy157 Questions

Exam 17: Inflation, unemployment, and Federal Reserve Policy130 Questions

Exam 18: Macroeconomics in an Open Economy142 Questions

Exam 19: The International Financial System132 Questions

Select questions type

According to the saving and investment equation,if net foreign investment falls by $35 million,

(Multiple Choice)

4.8/5  (36)

(36)

If the government finances an increase in government purchases with an increase in taxes,which of the following would you expect to see?

(Multiple Choice)

4.8/5  (46)

(46)

Since 1999,the U.S.________ account has recorded relatively minor transactions,such as migrants' transfers,and sales and purchases of nonproduced,nonfinancial assets.

(Multiple Choice)

5.0/5  (37)

(37)

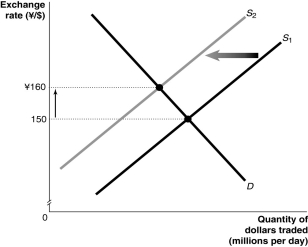

Figure 29-2

-Refer to Figure 29-2.Consider the market for U.S.dollars against the Japanese yen shown above. An event which could have caused the changes shown in the graph would be

-Refer to Figure 29-2.Consider the market for U.S.dollars against the Japanese yen shown above. An event which could have caused the changes shown in the graph would be

(Multiple Choice)

4.8/5  (28)

(28)

The current account deficits incurred by the United States in the 1980s were caused,in the opinion of many economists,by

(Multiple Choice)

4.7/5  (38)

(38)

If the balance on the current account is $842 billion and the balance on the financial account is -$603 billion,what is the balance on the capital account,assuming no statistical discrepancy?

(Multiple Choice)

4.9/5  (42)

(42)

Does the saving and investment equation imply that a country's national saving must always equal its domestic investment? Explain.

(Essay)

4.8/5  (37)

(37)

How would an increase in the U.S.federal budget deficit affect the exchange rate in the market for dollars?

(Multiple Choice)

4.9/5  (45)

(45)

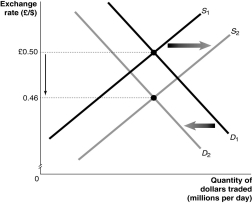

Figure 29-1

-Refer to Figure 29-1. Consider the market for U.S.Dollars against the British pound shown in the graph above. From this graph we can conclude that the dollar price of a British pound has ________ to ________ dollars per pound

-Refer to Figure 29-1. Consider the market for U.S.Dollars against the British pound shown in the graph above. From this graph we can conclude that the dollar price of a British pound has ________ to ________ dollars per pound

(Multiple Choice)

4.8/5  (34)

(34)

Figure 29-2

-You're traveling in Japan and are thinking about buying a new kimono.You've decided you'd be willing to pay $175 for a new kimono,but kimonos in Japan are all priced in yen.If the kimono you're looking at costs 14,000 yen,under which of the following exchange rates would you be willing to purchase the kimono? (Assume no taxes or duties are associated with the purchase.)

-You're traveling in Japan and are thinking about buying a new kimono.You've decided you'd be willing to pay $175 for a new kimono,but kimonos in Japan are all priced in yen.If the kimono you're looking at costs 14,000 yen,under which of the following exchange rates would you be willing to purchase the kimono? (Assume no taxes or duties are associated with the purchase.)

(Multiple Choice)

4.8/5  (35)

(35)

If the dollar appreciates,how will aggregate demand in the United States be affected?

(Multiple Choice)

4.7/5  (43)

(43)

An economy that does not have interactions in trade or finance with other economies is referred to as

(Multiple Choice)

4.8/5  (37)

(37)

The relative price of a country's goods and services in terms of foreign goods and services is the real exchange rate.

(True/False)

4.8/5  (34)

(34)

How does a decrease in value of a country's currency relative to other currencies affect its balance of trade?

(Multiple Choice)

4.8/5  (32)

(32)

A decrease in U.S.federal government budget deficits that lowers U.S.interest rates relative to the rest of the world should

(Multiple Choice)

4.8/5  (42)

(42)

Contractionary monetary policy and expansionary fiscal policy both reduce net exports in an open economy.

(True/False)

4.8/5  (43)

(43)

Suppose the government cuts taxes. We would expect interest rates to ________ and the dollar to ________ in foreign exchange markets.

(Multiple Choice)

4.8/5  (32)

(32)

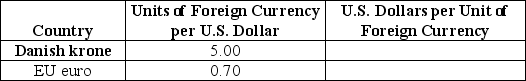

Table 29-2

-How will an interest rate increase in the United States affect equilibrium in the market for dollars against foreign currencies? (Assume the exchange rate is stated in terms of foreign currency per U.S.dollar.)

-How will an interest rate increase in the United States affect equilibrium in the market for dollars against foreign currencies? (Assume the exchange rate is stated in terms of foreign currency per U.S.dollar.)

(Multiple Choice)

4.8/5  (41)

(41)

If the exchange rate changes from $0.08 = 1 mexican peso to $0.09 = 1 mexican peso,then

(Multiple Choice)

4.8/5  (36)

(36)

Showing 121 - 140 of 142

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)