Exam 8: Analysis of Risk and Return

Exam 1: The Role and Objective of Financial Management81 Questions

Exam 2: The Domestic and International Financial Marketplace78 Questions

Exam 3: Evaluation of Financial Performance104 Questions

Exam 4: Financial Planning and Forecasting67 Questions

Exam 5: The Time Value of Money113 Questions

Exam 6: Fixed Income Securities: Characteristics and Valuation126 Questions

Exam 7: Common Stock: Characteristics, Valuation, and Issuance114 Questions

Exam 8: Analysis of Risk and Return114 Questions

Exam 9: Capital Budgeting and Cash Flow Analysis92 Questions

Exam 10: Capital Budgeting: Decision Criteria and Real Option Considerations106 Questions

Exam 11: Capital Budgeting and Risk78 Questions

Exam 12: The Cost of Capital104 Questions

Exam 13: Capital Structure Concepts75 Questions

Exam 14: Capital Structure Management in Practice85 Questions

Exam 15: Dividend Policy96 Questions

Exam 16: Working Capital Policy and Short-term Financing81 Questions

Exam 17: The Management of Cash and Marketable Securities80 Questions

Exam 18: Management of Accounts Receivable and Inventories80 Questions

Exam 19: Lease and Intermediate-term Financing52 Questions

Exam 20: Financing With Derivatives80 Questions

Exam 21: Risk Management49 Questions

Exam 22: International Financial Management51 Questions

Exam 23: Corporate Restructuring75 Questions

Exam 24: Continuous Compounding and Discounting28 Questions

Exam 25: Mutually Exclusive Investments Having Unequal Lives21 Questions

Exam 26: Breakeven Analysis23 Questions

Exam 27: Bond Refunding Analysis19 Questions

Exam 28: Taxes19 Questions

Select questions type

Gates Industries current common stock dividend (year 0) is $2.50 per share and is expected to continue growing at a rate of 5% per year for the foreseeable future. Currently the risk-free rate is 7.5% and the estimated market risk premium (i.e., km - rf) is 8.3%. Value Line has estimated Gates Industries beta to be 1.10. Determine the expected price for Gates Industries common stock.

(Multiple Choice)

4.7/5  (34)

(34)

All other things being equal, what is the major impact that an increase in the expected inflation rate would be expected to have on the security market line?

(Multiple Choice)

5.0/5  (38)

(38)

Arbitrage pricing theory is a model that relates expected returns on securities to

(Multiple Choice)

4.9/5  (33)

(33)

Investors can obtain high returns in their investments if:

(Multiple Choice)

4.8/5  (40)

(40)

The term structure of interest rates is the pattern of interest rate yields for securities that differ only in

(Multiple Choice)

4.9/5  (42)

(42)

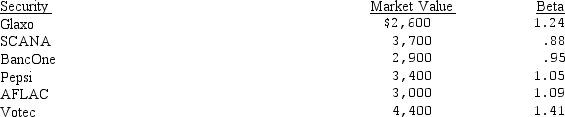

Determine the beta of a portfolio consisting of the following common stocks:

(Multiple Choice)

4.8/5  (40)

(40)

The ____ of a portfolio of two or more securities is equal to the weighted average of the ____ of each of the individual securities in the portfolio.

(Multiple Choice)

4.7/5  (42)

(42)

Quick Start, Inc. is expected to pay a dividend of $1.05 next year and dividends are expected to continue their 7 percent annual growth rate. The SML has been estimated as follows:

Ke = 0.08 + 0.064b?

If Quick Start has a beta of 1.1, what would happen to its stock price if inflation expectations went from the current 5 percent to 8 percent?

(Multiple Choice)

4.8/5  (42)

(42)

Richtex Brick has a current dividend of $1.70 and the market value of its common stock is $28. The expected market return is 13 percent and the risk-free rate is 9 percent. If Richtex stock is half as volatile as the market, and the market is in equilibrium, what rate of growth is expected for Richtex's dividends assuming a constant growth valuation model is appropriate for Richtex?

(Multiple Choice)

4.8/5  (36)

(36)

The expected rate of return for 3COM is 18 percent, with a standard deviation of 10.98 percent. The expected rate of return for Just the Fax is 26 percent with a standard deviation of 15.86%. Which firm would be considered the riskier from a total risk perspective?

(Multiple Choice)

4.9/5  (31)

(31)

The ____ is a statistical measure of the mean or average value of the possible outcomes.

(Multiple Choice)

4.9/5  (43)

(43)

Which of the following (if any) is a relative (rather than absolute) measure of risk?

(Multiple Choice)

4.9/5  (34)

(34)

What will happen to the Security Market Line if: (1) inflation expectations increase, and (2) investors become more risk averse?

(Multiple Choice)

4.9/5  (44)

(44)

Showing 101 - 114 of 114

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)