Exam 10: Reporting and Interpreting Liabilities

Exam 1: Business Decisions and Financial Accounting211 Questions

Exam 2: Reporting Investing and Financing Results on the Balance Sheet193 Questions

Exam 3: Reporting Operating Results on the Income Statement235 Questions

Exam 4: Adjustments,financial Statements,and Financial Results246 Questions

Exam 5: Fraud, Internal Control, and Cash188 Questions

Exam 6: Internal Control and Financial Reporting for Cash and Merchandising Operations210 Questions

Exam 7: Reporting and Interpreting Inventories and Cost of Goods Sold214 Questions

Exam 8: Reporting and Interpreting Receivables,bad Debt Expense,and Interest Revenue230 Questions

Exam 9: Reporting and Interpreting Long-Lived Tangible and Intangible Assets266 Questions

Exam 10: Reporting and Interpreting Liabilities235 Questions

Exam 11: Reporting and Interpreting Stockholders Equity253 Questions

Exam 12: Reporting and Interpreting the Statement of Cash Flows208 Questions

Exam 13: Measuring and Evaluating Financial Performance170 Questions

Select questions type

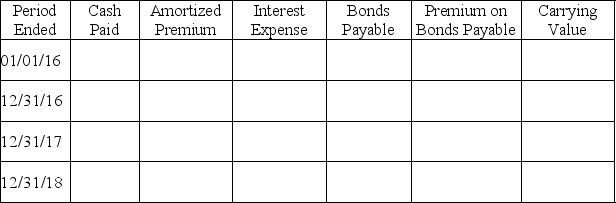

On January 1,2016,a company issues 3-year bonds with a face value of $200,000 and a stated interest rate of 8%.Because the market interest rate is lower than the stated interest rate,the company receives $209,000 for the bond.

Required:

Fill in the table assuming the company uses the straight-line bond amortization.

(Essay)

4.9/5  (34)

(34)

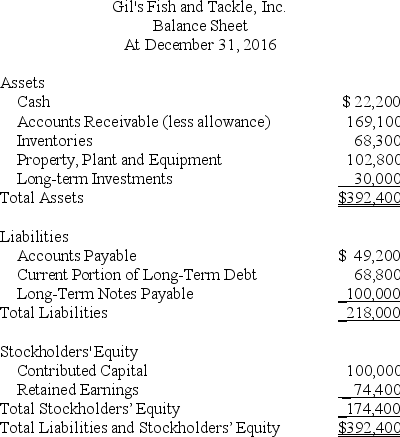

Consider the following information:

Required:

Part a.Calculate the debt-to-assets ratio.

Part b.Describe what the debt-to-assets ratio tells you and how to interpret it.

Part c.Calculate the times interest earned.

Part d.Comment on the results of your times interest earned analysis.

Required:

Part a.Calculate the debt-to-assets ratio.

Part b.Describe what the debt-to-assets ratio tells you and how to interpret it.

Part c.Calculate the times interest earned.

Part d.Comment on the results of your times interest earned analysis.

(Essay)

4.9/5  (37)

(37)

Payroll taxes paid by employees include which of the following?

(Multiple Choice)

4.8/5  (42)

(42)

A company issued 10-year,8% bonds with a face value of $200,000.Interest is paid annually.The market rate on the issue date was 7.5% and the company received $206,948 in cash proceeds.Which of the following statements is correct?

(Multiple Choice)

4.7/5  (34)

(34)

No mention is required in the financial statements for contingent liabilities that are:

(Multiple Choice)

4.8/5  (29)

(29)

Contingent liabilities arise from past transactions,but depend on future events.

(True/False)

4.9/5  (34)

(34)

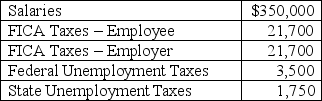

The Payroll records of Oregon Mist contained the following information for the month of November:

The journal entry to record the monthly Payroll Tax Expense would include a:

The journal entry to record the monthly Payroll Tax Expense would include a:

(Multiple Choice)

4.9/5  (44)

(44)

If total assets increase but total liabilities remain the same,what is the impact on the debt-to-assets ratio?

(Multiple Choice)

4.8/5  (36)

(36)

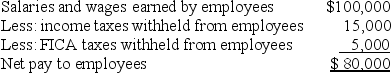

The Ideal Corp.has the following information its payroll records:

The employer amount of FICA taxes that Ideal is required to pay is equal to the amount that it withholds from its employees.Assume no other payroll taxes are incurred at this time.What is Ideal's total expense with regards to this payroll?

The employer amount of FICA taxes that Ideal is required to pay is equal to the amount that it withholds from its employees.Assume no other payroll taxes are incurred at this time.What is Ideal's total expense with regards to this payroll?

(Multiple Choice)

4.7/5  (40)

(40)

During the year,the company recorded services provided to customers on account.What effect will this transaction have on the debt-to-assets and times interest earned ratios?

(Multiple Choice)

4.8/5  (38)

(38)

A company issued 10-year,7% bonds with a face value of $100,000.The company received $97,947 for the bonds.Using the straight-line method of amortization,the amount of interest expense for the first interest period is:

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following are generally recorded as liabilities on the balance sheet if the loss can be reasonably estimated?

(Multiple Choice)

4.9/5  (33)

(33)

Use the information above to answer the following question.If the balance sheet date corresponded with the date of the bond issue,what carrying value would be reported on the balance sheet?

(Multiple Choice)

4.9/5  (39)

(39)

Acme Manufacturing retired an issue of bonds before they matured.The bonds had been issued at their face value of $500,000,and the cash paid for the retirement amounted to $503,250.What journal entry was made to record the bond retirement?

(Multiple Choice)

4.8/5  (38)

(38)

On November 1,2015,ABC Corp.borrowed $100,000 cash on a 1year,6% note payable that requires ABC to pay both principal and interest on October 31,2016.Given no prior adjusting entries have been recorded,the adjusting journal entry on December 31,2015,ABC's year end,would include a:

(Multiple Choice)

4.8/5  (38)

(38)

Your company sells $40,000 of one-year,10% bonds for an issue price of $39,000.The journal entry to record this transaction will include a credit to Bonds Payable in the amount of:

(Multiple Choice)

4.8/5  (48)

(48)

Using straight-line amortization,when a bond is sold at a discount:

(Multiple Choice)

4.8/5  (38)

(38)

Showing 21 - 40 of 235

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)