Exam 10: Reporting and Interpreting Liabilities

Exam 1: Business Decisions and Financial Accounting211 Questions

Exam 2: Reporting Investing and Financing Results on the Balance Sheet193 Questions

Exam 3: Reporting Operating Results on the Income Statement235 Questions

Exam 4: Adjustments,financial Statements,and Financial Results246 Questions

Exam 5: Fraud, Internal Control, and Cash188 Questions

Exam 6: Internal Control and Financial Reporting for Cash and Merchandising Operations210 Questions

Exam 7: Reporting and Interpreting Inventories and Cost of Goods Sold214 Questions

Exam 8: Reporting and Interpreting Receivables,bad Debt Expense,and Interest Revenue230 Questions

Exam 9: Reporting and Interpreting Long-Lived Tangible and Intangible Assets266 Questions

Exam 10: Reporting and Interpreting Liabilities235 Questions

Exam 11: Reporting and Interpreting Stockholders Equity253 Questions

Exam 12: Reporting and Interpreting the Statement of Cash Flows208 Questions

Exam 13: Measuring and Evaluating Financial Performance170 Questions

Select questions type

On January 1,your company issues a 5-year bond with a face value of $10,000 and a stated interest rate of 7%.The market interest rate is 5%.The issue price of the bond was $10,866.Your company used the effective-interest method of amortization.At the end of the first year,your company should:

(Multiple Choice)

4.8/5  (39)

(39)

The gross earnings for all employees is credited to Salaries and Salaries and Wages Payable.

(True/False)

4.9/5  (34)

(34)

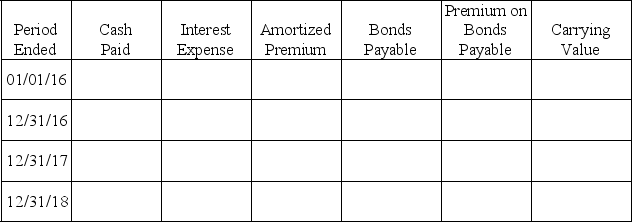

On January 1,2016,a company issues 3-year bonds with a face value of $50,000 and a stated interest rate of 7%.Because the market interest rate is 5%,the company receives $52,723 for the bonds.

Required:

Fill in the table assuming the company uses effective-interest bond amortization.

(Essay)

4.9/5  (40)

(40)

When a company has a contingent liability that is remote in likelihood,the company should:

(Multiple Choice)

4.9/5  (41)

(41)

Employees' gross earnings differ from their net pay because of:

(Multiple Choice)

4.9/5  (36)

(36)

When the times interest earned ratio increases,the likelihood of default on liabilities decreases.

(True/False)

5.0/5  (43)

(43)

Engstrom Company makes a sale and collects a total of $378,which includes an 8% sales tax.What is the amount that will be credited to the Sales Revenue account?

(Multiple Choice)

4.9/5  (40)

(40)

Bonds that are backed with a pledge of the company's assets are called:

(Multiple Choice)

4.8/5  (45)

(45)

Accruing a liability always involves ______ expenses and ______ liabilities.

(Multiple Choice)

4.8/5  (36)

(36)

ABC Company received $9,631 for its 5-year,10% bonds with a total face value of $10,000.The market rate of interest was 11%.The bonds pay interest annually on December 31.Approximately how much interest expense will ABC Corporation record on the first annual interest payment date using the effective-interest method?

(Multiple Choice)

4.9/5  (34)

(34)

If a company's gross salaries and wages are $12,000,and it withholds $1,800 for income taxes and $800 for FICA taxes,the journal entry to record the employees' pay should include a:

(Multiple Choice)

4.9/5  (30)

(30)

A 10-year bond that pays interest annually was issued at a $5,000 premium.The entry to record the payment of interest using straight-line amortization will include a ______ to Premium on Bonds Payable for ______ each period.

(Multiple Choice)

4.8/5  (35)

(35)

The entry to record the initial borrowing of cash by issuing a promissory note causes a(n):

(Multiple Choice)

4.9/5  (36)

(36)

John Smith works 40 hours for ABC Corp.for $15 per hour.Required payroll deductions are: Social Security $37.20; Medicare $8.70; Federal income tax $58; and State income tax $10.The entry to record his net pay would cause which of the following to change as described?

(Multiple Choice)

4.8/5  (37)

(37)

An entertainment company received $6 million in cash for advance season ticket sales.Prior to the beginning of the season,these sales should be recorded as a liability.

(True/False)

4.9/5  (35)

(35)

Use the information above to answer the following question.The journal entry to record this transaction would include the receipt of cash on November 1 a credit to:

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following statements about a 10-year bond issued at a discount is not correct?

(Multiple Choice)

4.9/5  (29)

(29)

On October 1,2015,Bill Burns borrowed $170,000 from the New National Bank on a 6-month,6% note.Assuming no interest has been recorded yet,what is the amount of accrued interest as of December 31,2015?

(Multiple Choice)

4.7/5  (44)

(44)

Showing 141 - 160 of 235

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)