Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis211 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control181 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control176 Questions

Exam 9: Inventory Costing and Capacity Analysis210 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy, Balanced Scorecard, and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management210 Questions

Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, Common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts151 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, Rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, Just-in-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations151 Questions

Exam 23: Performance Measurement, Compensation, and Multinational Considerations150 Questions

Select questions type

The market-share variance is the difference in budgeted contribution margin for actual market size in units caused solely by actual market share being different from budgeted market share.

(True/False)

4.9/5  (32)

(32)

Bar charts and a whale curve are some of the common ways of displaying the results of customer-profitability analysis.

(True/False)

4.9/5  (27)

(27)

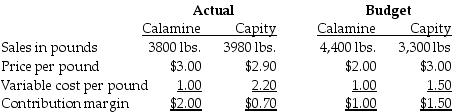

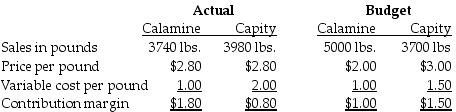

Capity Tea Products has an exclusive contract with British Distributors. Calamine and Capity are two brands of teas that are imported and sold to retail outlets. The following information is provided for the month of March:

Budgeted and actual fixed corporate-sustaining costs are $1,850 and $2,300, respectively.

What is the actual contribution margin for the month?

Budgeted and actual fixed corporate-sustaining costs are $1,850 and $2,300, respectively.

What is the actual contribution margin for the month?

(Multiple Choice)

4.9/5  (29)

(29)

To analyze customer profitability, corporate-sustaining costs should be allocated to customers.

(True/False)

4.8/5  (40)

(40)

When there is a lesser degree of homogeneity, fewer cost pools are required to accurately explain the use of company resources.

(True/False)

4.7/5  (30)

(30)

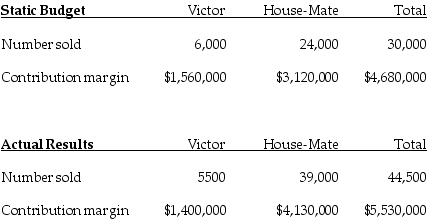

The Fortise Corporation manufactures two types of vacuum cleaners, the Victor for commercial building use and the House-Mate for residences. Budgeted and actual operating data for the year 2017 were as follows:

What is the total sales-mix variance in terms of the contribution margin? (Round any intermediary calculations two decimal places.)

What is the total sales-mix variance in terms of the contribution margin? (Round any intermediary calculations two decimal places.)

(Multiple Choice)

4.8/5  (43)

(43)

Which of the following classifications would be the most appropriate for the cost of the manager of a retail distribution channel?

(Multiple Choice)

4.8/5  (38)

(38)

For companies in which full allocation is not followed, which of the following is true of corporate sustaining costs?

(Multiple Choice)

4.9/5  (39)

(39)

To guide cost allocation decisions, the ability to bear criterion ________.

(Multiple Choice)

4.9/5  (45)

(45)

If deciding whether to eliminate a distribution channel, allocating corporate-sustaining costs to distribution channels ________.

(Multiple Choice)

4.9/5  (38)

(38)

Companies that only record the invoice price can usually track the magnitude of price discounting.

(True/False)

4.7/5  (41)

(41)

With the use of a bar chart, the number of "unprofitable" customers and the magnitude of their losses are apparent.

(True/False)

4.8/5  (32)

(32)

The sales quantity variance is the difference between budgeted contribution margin based on actual units sold of all products at the budgeted mix, and contribution margin in the flexible budget.

(True/False)

4.8/5  (37)

(37)

Why do managers prepare cost-hierarchy-based operating incomes statements?

(Essay)

4.9/5  (40)

(40)

Allocating all corporate costs motivates division managers to examine how corporate costs are planned and controlled.

(True/False)

5.0/5  (35)

(35)

Capity Tea Products has an exclusive contract with British Distributors. Calamine and Capity are two brands of teas that are imported and sold to retail outlets. The following information is provided for the month of March:

Budgeted and actual fixed corporate-sustaining costs are $1,850 and $2,300, respectively. For the contribution margin, what is the total flexible-budget variance?

Budgeted and actual fixed corporate-sustaining costs are $1,850 and $2,300, respectively. For the contribution margin, what is the total flexible-budget variance?

(Multiple Choice)

4.8/5  (34)

(34)

An individual cost item can be simultaneously a direct cost of one cost object and an indirect cost of another cost object.

(True/False)

4.9/5  (41)

(41)

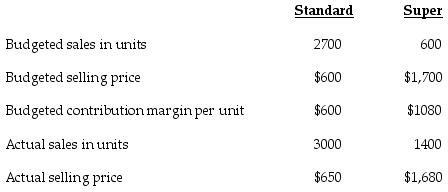

The Corata Appliance Manufacturing Corporation manufactures two vacuum cleaners, the Standard and the Super. The following information was gathered about the two products:

What is the total sales-mix variance in terms of the contribution margin? (Round intermediary calculations to two decimal places.)

What is the total sales-mix variance in terms of the contribution margin? (Round intermediary calculations to two decimal places.)

(Multiple Choice)

5.0/5  (43)

(43)

The Conity Corporation has an Electric Mixer Division and an Electric Lamp Division. Of a $13,000,000 bond issuance, the Electric Mixer Division used $9,500,000 and the Electric Lamp Division used $3,500,000 for expansion. Interest costs on the bond totaled $975,000 for the year. What amount of interest costs should be allocated to the Electric Mixer Division? (Round any intermediary calculations two decimal places and your final answer to the nearest dollar.)

(Multiple Choice)

4.8/5  (32)

(32)

Showing 61 - 80 of 167

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)