Exam 7: Finance, Saving, and Investment

Exam 1: What Is Economics479 Questions

Exam 2: The Economic Problem439 Questions

Exam 3: Demand and Supply515 Questions

Exam 4: Measuring GDP and Economic Growth396 Questions

Exam 5: Monitoring Jobs and Inflation407 Questions

Exam 6: Economic Growth353 Questions

Exam 7: Finance, Saving, and Investment240 Questions

Exam 8: Money, The Price Level, and Inflation583 Questions

Exam 9: The Exchange Rate and the Balance of Payments481 Questions

Exam 10: Aggregate Supply and Aggregate Demand418 Questions

Exam 11: Expenditure Multipliers454 Questions

Exam 12: Inflation, Jobs, and the Business Cycle401 Questions

Exam 13: Fiscal Policy263 Questions

Exam 14: Monetary Policy225 Questions

Exam 15: International Trade Policy197 Questions

Exam 16: Introduction23 Questions

Exam 17: Monitoring Macroeconomic Performance11 Questions

Exam 18: Macroeconomic Trends19 Questions

Exam 19: Macroeconomic Fluctuations23 Questions

Exam 20: Macroeconomic Policy25 Questions

Select questions type

The University of Central Florida (UCF) wanted "to create a town center where students can live,eat,study and revel in college traditions like football." In addition,the university needed funding to build dorms that would house 2000 students.UCF was able to secure financing by promising to pay a lender a specific amount of money on specific dates. This transaction takes place in the ________ market for ________ capital. www.sptimes.com 10/14/2007

Free

(Multiple Choice)

4.9/5  (40)

(40)

Correct Answer:

B

When the actual real interest rate is less than the equilibrium real interest rate,

Free

(Multiple Choice)

4.9/5  (26)

(26)

Correct Answer:

D

A small country is a net foreign borrower and its domestic demand for loanable funds increases.Consequently,the equilibrium quantity of loanable funds used in the country ________ and the country's foreign borrowing ________.

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

C

France's government is running a budget deficit. With no Ricardo-Barro effect,which of the following events will occur?

I. The supply curve of loanable funds will shift leftward.

II. A higher real interest rate crowds out investment.

III. Saving increases.

(Multiple Choice)

4.8/5  (34)

(34)

What are the factors that change investment demand and shift the demand for loanable funds curve?

(Essay)

4.8/5  (38)

(38)

If households believe their incomes will fall in the future,the result is a

(Multiple Choice)

4.8/5  (38)

(38)

In November 2008,Grand Canyon Education chose to finance expansion by offering ownership in its firm. These owners of Grand Canyon Education the are entitled to a share of the firm's profits. This financing is an example of ________.

(Multiple Choice)

4.9/5  (34)

(34)

In 2008,the financial and housing crisis caused firms to decrease their profit expectations. As a result,there was a ________ in the ________ for loanable funds curve.

(Multiple Choice)

4.8/5  (30)

(30)

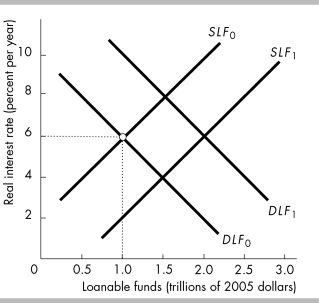

-In the above figure,the initial supply of loanable funds curve is SLF₀ and the initial demand for loanable funds curve is DLF₀.An economic expansion that raises disposable income and the expected profit would

-In the above figure,the initial supply of loanable funds curve is SLF₀ and the initial demand for loanable funds curve is DLF₀.An economic expansion that raises disposable income and the expected profit would

(Multiple Choice)

4.9/5  (32)

(32)

A decrease in the government budget deficit decreases the ________ loanable funds and an increase in the government budget surplus increases the ________ loanable funds.

(Multiple Choice)

4.8/5  (35)

(35)

At the beginning of the year,your wealth is $10,000.During the year,you have an income of $80,000 and you spend $90,000 on consumption.You pay no taxes.Your wealth at the end of the year is

(Multiple Choice)

4.8/5  (34)

(34)

People know that the inflation rate will increase from 3 percent to 5 percent.As a result

(Multiple Choice)

4.9/5  (36)

(36)

The total amount spent on new capital in a time period is equal to

(Multiple Choice)

4.8/5  (42)

(42)

Suppose the current real interest rate is 4 percent and the equilibrium real interest rate is 3 percent.Then

(Multiple Choice)

5.0/5  (40)

(40)

During the financial crisis in 2007 and 2008,financial institutions believed that default risks were higher. As a result,there was ________ in the supply of loanable funds and a ________ in the real interest rate.

(Multiple Choice)

4.9/5  (41)

(41)

In January,suppose that a share of stock in Meyer,Inc.had a price of $50 and that each share entitled its owner to $2 of Meyer,Inc.'s profit. During the year,the price of a share of Meyer's stock rose to $100. The interest rate paid on the share in January was ________ percent.

(Multiple Choice)

4.9/5  (40)

(40)

Showing 1 - 20 of 240

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)