Exam 20: Company Performance: Comprehensive Evaluation

Exam 1: Accounting and Business104 Questions

Exam 2: Business Processes and Accounting Information85 Questions

Exam 3: Operating Processes: Planning and Control69 Questions

Exam 4: Short-Term Decision Making103 Questions

Exam 5: Strategic Planning Regarding Operating Processes54 Questions

Exam 6: Planning, The Balanced Scorecard, and Budgeting70 Questions

Exam 7: Accounting Information Systems115 Questions

Exam 8: Purchasinghuman Resourcespayment Process: Recording and Evaluating Expenditure Process Activities62 Questions

Exam 9: Recording and Evaluating Conversion Process Activities98 Questions

Exam 10: Recording and Evaluating Revenue Process Activities92 Questions

Exam 11: Time Value of Money88 Questions

Exam 12: Planning Investments: Capital Budgeting78 Questions

Exam 13: Planning Equity Financing98 Questions

Exam 14: Planning Debt Financing74 Questions

Exam 15: Recording and Evaluating Capital Resource Process Activities: Financing122 Questions

Exam 16: Recording and Evaluating Capital Resource Process Activities: Investing89 Questions

Exam 17: Company Performance: Profitability63 Questions

Exam 18: Company Performance: Owners Equity and Financial Position85 Questions

Exam 19: Company Performance: Cash Flows99 Questions

Exam 20: Company Performance: Comprehensive Evaluation94 Questions

Select questions type

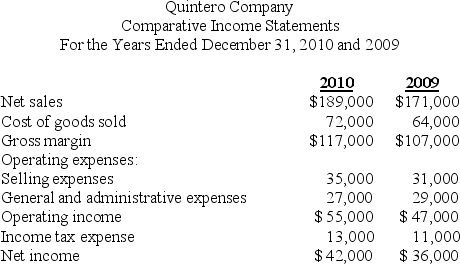

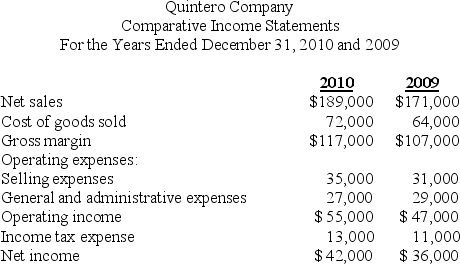

Use the following to answer questions

-Using horizontal analysis,the figure that would appear in the percent column for Net income is:

-Using horizontal analysis,the figure that would appear in the percent column for Net income is:

(Multiple Choice)

4.9/5  (28)

(28)

Use the following to answer questions

-If a vertical analysis were performed relative to the year ended December 31,2010,the figure that would appear in the percent column for Cost of goods sold would be:

-If a vertical analysis were performed relative to the year ended December 31,2010,the figure that would appear in the percent column for Cost of goods sold would be:

(Multiple Choice)

4.8/5  (36)

(36)

Financial ratios that help judge a firm's efficiency in using its current assets and liabilities are collectively referred to as:

(Multiple Choice)

4.9/5  (37)

(37)

Use the following to answer questions

Little Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

Curent Assets Long-Tenn Arsets 885 585 Curtert Liabilities 385 385 Long-Term Liabilities 575 575 Owners' Equity 575 265 Net Sales 975 775 Gross Margir 485 365 Net Income 255 100

-The gross margin percentage for 2010 was:

(Multiple Choice)

4.9/5  (32)

(32)

Write out the dividend payout ratio ( Show your work here).

Explain how is the dividend payout ratio is used.

(Essay)

4.9/5  (43)

(43)

Use the following to answer questions

The Ventura Company reported total stockholders' equity of $500,000 at December 31, 2010. In addition, there were 80,000 shares of common stock and zero shares of preferred stock outstanding for the entire year. During 2010, Ventura earned net income equal to $75,000, which included deductions of $7,000 for interest and $11,000 for income taxes. Total dividends paid to common stockholders during the year were $60,000. The company's statement of cash flows showed $56,000 in net cash inflows from operating activities, and its stock was selling for $17 per share on December 31, 2010.

-The cash flow per share was:

(Multiple Choice)

4.7/5  (38)

(38)

If a firm's return on assets decreases and its asset turnover increases,how has the return on sales changed? Was this change more or less than the change in asset turnover? Explain.

(Essay)

4.8/5  (32)

(32)

Use the following to answer questions

Pioneer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

Curent Assets Long-Tenn Arsets 790 720 Curtert Liabilities 280 310 Long-Term Liabilities 410 440 Owners' Equity 445 335 Net Sales 830 790 Gross Margir 375 355 Net Income 120 105

-The return on assets for 2010 was:

(Multiple Choice)

4.8/5  (37)

(37)

If sales for 2010 and 2009 were $680,000 and $625,000,respectively,then the percentage change shown in a horizontal analysis would be:

(Multiple Choice)

4.9/5  (32)

(32)

Get the financial actual financial statements of a publicly traded company (do not use bank or insurance company due to classification issues)and have students calculate selected ratios and explain what the ratios mean.Make sure at least one ratio is used from each of the 5 classifications.Have students use the EDGAR Data Base at SEC.gov and find the most recent 10-K and use its financial statements for the ratio.

Suggested Ratios

Activity: A/R turnover,Inventory Turnover

Liquidity and Solvency: Current and Quick

Debt-Paying : Debt to Equity and Times Interest Earned

Profitability: Return on Assets,Return on Common Equity

Market-Based: Dividend Payout,Price-Earnings

(Essay)

4.8/5  (30)

(30)

Use the following to answer questions

Big Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

Current Assets \ 450 \ 500 Long-Term Assets 810 620 Current Liabilities 310 420 Long-Term Liabilities 500 610 Owners' Equity 500 300 Net Sales 900 810 Gross Margin 410 400 Net Tncome 180 13

-The return on owners' equity for 2010 was:

(Multiple Choice)

4.8/5  (31)

(31)

Which of the following would be most useful in deciding whether or not to purchase a firm's common stock?

(Multiple Choice)

4.9/5  (28)

(28)

Moving Inc.had an average stock market price equal to $35.00.The current market price equals $55.00.During the current year,the earnings per share equaled $15.00.What is the price-earnings ratio? Explain the uses for the price-earning ratio.

(Essay)

4.9/5  (40)

(40)

Use the following to answer questions

Little Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

Curent Assets Long-Tenn Arsets 885 585 Curtert Liabilities 385 385 Long-Term Liabilities 575 575 Owners' Equity 575 265 Net Sales 975 775 Gross Margir 485 365 Net Income 255 100

-The return on assets for 2010 was:

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following helps analysts understand the relationship between two financial statement items?

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following pairs of ratios measure the profitability of a company?

(Multiple Choice)

4.7/5  (40)

(40)

Use the following to answer questions

Pioneer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

Curent Assets Long-Tenn Arsets 790 720 Curtert Liabilities 280 310 Long-Term Liabilities 410 440 Owners' Equity 445 335 Net Sales 830 790 Gross Margir 375 355 Net Income 120 105

-The return on owners' equity for 2010 was:

(Multiple Choice)

4.8/5  (41)

(41)

Showing 21 - 40 of 94

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)