Exam 17: Company Performance: Profitability

Exam 1: Accounting and Business104 Questions

Exam 2: Business Processes and Accounting Information85 Questions

Exam 3: Operating Processes: Planning and Control69 Questions

Exam 4: Short-Term Decision Making103 Questions

Exam 5: Strategic Planning Regarding Operating Processes54 Questions

Exam 6: Planning, The Balanced Scorecard, and Budgeting70 Questions

Exam 7: Accounting Information Systems115 Questions

Exam 8: Purchasinghuman Resourcespayment Process: Recording and Evaluating Expenditure Process Activities62 Questions

Exam 9: Recording and Evaluating Conversion Process Activities98 Questions

Exam 10: Recording and Evaluating Revenue Process Activities92 Questions

Exam 11: Time Value of Money88 Questions

Exam 12: Planning Investments: Capital Budgeting78 Questions

Exam 13: Planning Equity Financing98 Questions

Exam 14: Planning Debt Financing74 Questions

Exam 15: Recording and Evaluating Capital Resource Process Activities: Financing122 Questions

Exam 16: Recording and Evaluating Capital Resource Process Activities: Investing89 Questions

Exam 17: Company Performance: Profitability63 Questions

Exam 18: Company Performance: Owners Equity and Financial Position85 Questions

Exam 19: Company Performance: Cash Flows99 Questions

Exam 20: Company Performance: Comprehensive Evaluation94 Questions

Select questions type

What items should be included in comprehensive income but not in net income?

Free

(Multiple Choice)

4.8/5  (29)

(29)

Correct Answer:

D

The effect of a switch from Average Costing to FIFO would affect which section of the income statement:

Free

(Multiple Choice)

4.9/5  (38)

(38)

Correct Answer:

A

During prior periods the Rocket Company used the double-declining balance method for depreciating its equipment,but in 2010 it decided to switch to the straight-line method.

The equipment was purchased in 2008 for $1,000,000 and had a 10 year life.The

Balance in the accumulated depreciation account for equipment at the beginning of 2010

Was $360,000.How will 2010's net income be changed by switching to the new

Depreciation if Rocket has an effective tax rate of 40%.

Free

(Multiple Choice)

5.0/5  (33)

(33)

Correct Answer:

B

Macroteledyne,Inc.'s income from continuing operations before taxes was $2,000,000 for the year ended December 31,2010.The company's effective tax rate is 40% and during the year the following events also took place:

The company sold one of its divisions at a gain of $250,000.The division had an operating loss of $185,000 through the date of disposal.

A flood destroyed a warehouse owned by the company.The amount of the uninsured loss was $375,000.This was the first flood ever in this area.

Required: Prepare the lower portion of the income statement,from "income from continuing operations before taxes" through "net income",for the year ended 12/31/10.

(Essay)

4.8/5  (42)

(42)

Bob Inc.has gross profit equal to $1,000,000.During the year Bob Inc.purchased $300,000 worth of inventory.The sales recorded during the year equaled $1,500,000.What is the value of Bob Inc.'s cost of goods sold?

(Multiple Choice)

4.8/5  (41)

(41)

What item would not be part of the cost of inventory under the variable costing method?

(Multiple Choice)

5.0/5  (37)

(37)

Advance Systems,Inc.had 840,000 shares of common stock outstanding on January 1,2010,and repurchased 75,000 shares on June 1,2010.Net income for the year ended December 31,2010,was $2,662,625,and preferred stock dividends for the year amounted to $35,000.The earnings per share for 2010 were:

(Multiple Choice)

4.7/5  (35)

(35)

Speed Inc.reported a net income equal to $15,000.The dividends declared & paid to the preferred shareholders equaled $ 5,000 and paid the common stockholders a dividend of $8,000.Speed Inc.had 10,000 shares outstanding all year long.What value is Speed Inc.'s earnings per share?

(Multiple Choice)

4.9/5  (32)

(32)

Use the following to answer questions

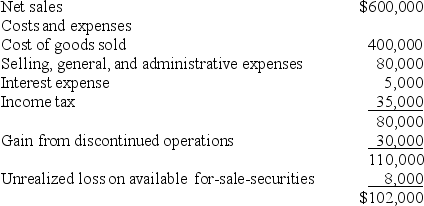

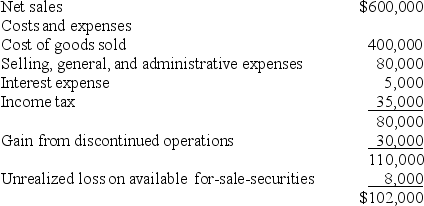

James Company had the following income statement for the year ended December 31, 2010:

-The firm's income before income tax for 2008 was:

-The firm's income before income tax for 2008 was:

(Multiple Choice)

4.8/5  (37)

(37)

A loss on the sale of equipment would be included in which element of net income:

(Multiple Choice)

4.8/5  (37)

(37)

What is compromised when a firm changes from one accepted accounting method to another?

(Multiple Choice)

4.8/5  (37)

(37)

Jackson,Inc.had 360,000 shares of common stock outstanding on January 1,2010 and issued 60,000 additional shares on July 1,2010.There was no preferred stock.If net income for the year ended December 31,2010 was $1,072,500,the earnings per share were:

(Multiple Choice)

4.7/5  (41)

(41)

Use the following to answer questions

Kaiser Corporation sold its Telecommunications Division during 2010. The company's accountants determined that the division earned $850,000 of pre-tax income during 2008 prior to disposal. The sale resulted in a $370,000 loss before taxes. Kaiser's income from continuing operations for 2008 amounted to $4,138,000. The company's effective tax rate is 35%.

-The amount of income from operations of the Telecommunications Division that would appear on the 2010 income statement of Kaiser Corporation is:

(Multiple Choice)

4.8/5  (30)

(30)

River Inc.had an extraordinary gain equal to $ 15,000 (before taxes).The net income for River Inc.equals $ 48,000.What was the value of "income from continuing operations?"

(Multiple Choice)

4.9/5  (39)

(39)

Use the following to answer questions

James Company had the following income statement for the year ended December 31, 2010:

-The firm's net income for 2010 was:

-The firm's net income for 2010 was:

(Multiple Choice)

4.8/5  (28)

(28)

Assume a company has no dilutive securities.What number will be greater?

(Multiple Choice)

4.9/5  (32)

(32)

Showing 1 - 20 of 63

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)