Exam 10: Recording and Evaluating Revenue Process Activities

Exam 1: Accounting and Business104 Questions

Exam 2: Business Processes and Accounting Information85 Questions

Exam 3: Operating Processes: Planning and Control69 Questions

Exam 4: Short-Term Decision Making103 Questions

Exam 5: Strategic Planning Regarding Operating Processes54 Questions

Exam 6: Planning, The Balanced Scorecard, and Budgeting70 Questions

Exam 7: Accounting Information Systems115 Questions

Exam 8: Purchasinghuman Resourcespayment Process: Recording and Evaluating Expenditure Process Activities62 Questions

Exam 9: Recording and Evaluating Conversion Process Activities98 Questions

Exam 10: Recording and Evaluating Revenue Process Activities92 Questions

Exam 11: Time Value of Money88 Questions

Exam 12: Planning Investments: Capital Budgeting78 Questions

Exam 13: Planning Equity Financing98 Questions

Exam 14: Planning Debt Financing74 Questions

Exam 15: Recording and Evaluating Capital Resource Process Activities: Financing122 Questions

Exam 16: Recording and Evaluating Capital Resource Process Activities: Investing89 Questions

Exam 17: Company Performance: Profitability63 Questions

Exam 18: Company Performance: Owners Equity and Financial Position85 Questions

Exam 19: Company Performance: Cash Flows99 Questions

Exam 20: Company Performance: Comprehensive Evaluation94 Questions

Select questions type

Which of the following is not an advantage of LIFO over FIFO?

(Multiple Choice)

4.8/5  (28)

(28)

Allowance for Doubtful Accounts had a beginning and ending balance of $3,500 and $4,600,respectively.If uncollectible accounts expense was $9,500 for the period,the total dollar amount of accounts written off during the period was:

(Multiple Choice)

4.7/5  (35)

(35)

If prices don't change over time,what will be the differences between LIFO and FIFO?

(Essay)

4.8/5  (37)

(37)

The journal entry to remove a specific customer's account,once it is identified as uncollectible,would include a:

(Multiple Choice)

4.8/5  (26)

(26)

Under which costing method is cost of good sold not systematically determined?

(Multiple Choice)

4.8/5  (44)

(44)

Graphite Industries sells tennis racquets to sporting goods stores throughout the northeastern U.S.Selected transactions relating to accounts receivable are presented below.Prepare journal entries as appropriate and indicate how each transaction affected the net accounts receivable balance.

Identified the Borg Company account as uncollectible and wrote off the $6,700 balance.

Identified the Connors Company account balance of $2,500 as uncollectible,and wrote it off.

Allowance for Doubtful Accounts had a $1,000 credit balance at December 31,2008 prior to adjustment.An analysis of the accounts receivables indicates that the company expects $19,000 of the receivables will be uncollectible.

(Essay)

4.8/5  (30)

(30)

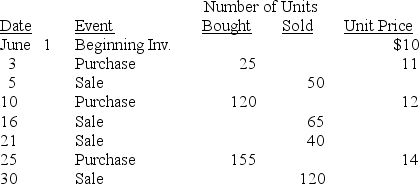

Use the following to answer questions

Ashland Company has a perpetual inventory system and uses the FIFO method of inventory costing. Ashland had a beginning inventory of 50 units and reported the following events during the month of June:

-The cost of goods sold for the June 16 sale is:

-The cost of goods sold for the June 16 sale is:

(Multiple Choice)

4.8/5  (47)

(47)

Candle Corporation's adjusted trial balance includes Allowance for Doubtful Accounts at $37,500,Uncollectible Accounts Expense at $18,700,Notes Receivable at $25,000,and Accounts Receivable at $136,800.Net accounts receivable amounts to:

(Multiple Choice)

4.8/5  (35)

(35)

Kozicek Corporation reported credit sales of $200,000,accounts receivable of $110,000 at the beginning of the year,and accounts receivable of $150,000 at the end of the year.During the year Kozicek wrote off $10,00 as bad debt.Cash collections from customers during the year were:

(Multiple Choice)

4.7/5  (28)

(28)

During the current year,cost of goods sold was higher under the LIFO method than under the FIFO method.Which of the following statements about price changes is true?

(Multiple Choice)

4.8/5  (32)

(32)

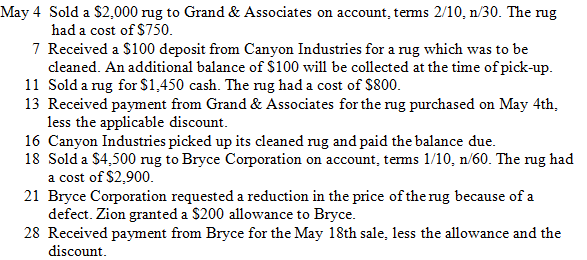

-Prepare all journal entries necessary to record the following transactions of Zion Enterprises for the month of May.

May 4 Sold a rug to Grand \& Associates on account, terms . The rug had a cost of .

7 Received a deposit from Canyon Industries for a rug which was to be cleaned. An additional balance of will be collected at the time of pick-up.

11 Sold a rug for cash. The rug had a cost of .

13 Received payment from Grand \& Associates for the rug purchased on May 4th, less the applicable discount.

16 Canyon Industries picked up its cleaned rug and paid the balance due.

18 Sold a rug to Bryce Corporation on account, terms . The rug had a cost of .

21 Bryce Corporation requested a reduction in the price of the rug because of a defect. Zion granted a \$200 allowance to Bryce.

28 Received payment from Bryce for the May 18 th sale, less the allowance and the discount.

-Prepare all journal entries necessary to record the following transactions of Zion Enterprises for the month of May.

May 4 Sold a rug to Grand \& Associates on account, terms . The rug had a cost of .

7 Received a deposit from Canyon Industries for a rug which was to be cleaned. An additional balance of will be collected at the time of pick-up.

11 Sold a rug for cash. The rug had a cost of .

13 Received payment from Grand \& Associates for the rug purchased on May 4th, less the applicable discount.

16 Canyon Industries picked up its cleaned rug and paid the balance due.

18 Sold a rug to Bryce Corporation on account, terms . The rug had a cost of .

21 Bryce Corporation requested a reduction in the price of the rug because of a defect. Zion granted a \$200 allowance to Bryce.

28 Received payment from Bryce for the May 18 th sale, less the allowance and the discount.

(Essay)

4.9/5  (32)

(32)

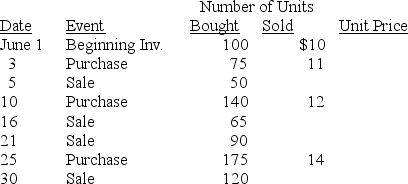

Use the following to answer questions

Convisor Company has a perpetual inventory system and uses the LIFO method of inventory costing. Convisor reported the following events during the month of June:

-The cost of goods sold for the June 16th sale is:

-The cost of goods sold for the June 16th sale is:

(Multiple Choice)

4.8/5  (29)

(29)

Showing 81 - 92 of 92

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)