Exam 3: Governmental Operating Statement Accounts; Budgetary Accounting

Exam 1: Introduction to Accounting and Financial Reporting for Government and Not-for-Profit Entities62 Questions

Exam 2: Principles of Accounting and Financial Reporting for State and Local Governments73 Questions

Exam 3: Governmental Operating Statement Accounts; Budgetary Accounting91 Questions

Exam 4: Accounting for Governmental Operating Activities–Illustrative Transactions and Financial Statements91 Questions

Exam 5: Accounting for General Capital Assets and Capital Projects83 Questions

Exam 6: Accounting for General Long-Term Liabilities and Debt Service75 Questions

Exam 7: Accounting for the Business-type Activities of State and Local Governments75 Questions

Exam 8: Accounting for Fiduciary Activities—Custodial and Trust Funds72 Questions

Exam 9: Financial Reporting of State and Local Governments66 Questions

Exam 10: Analysis of Government Financial Performance60 Questions

Exam 11: Auditing of Government and Not-for-Profit Organizations65 Questions

Exam 12: Budgeting and Performance Measurement60 Questions

Exam 13: Not-for-Profit Organizations—Regulatory, Taxation, and Performance Issues59 Questions

Exam 14: Accounting for Not-for-Profit Organizations77 Questions

Exam 15: Accounting for Colleges and Universities63 Questions

Exam 16: Accounting for Health Care Organizations63 Questions

Exam 17: Accounting and Reporting for the Federal Government66 Questions

Select questions type

All purchases of goods and services and all interfund transfers of the General Fund are recorded as Expenditures.

(True/False)

4.8/5  (38)

(38)

An allotment may be described as an internal allocation of funds on a periodic basis usually agreed upon by the department heads and the chief executive.

(True/False)

4.8/5  (34)

(34)

On the government-wide statement of activities, depreciation expense for assets that essentially benefit all functions, such as the city hall, may be reported as a separate line item or on the same line as the General Government or similar function.

(True/False)

4.9/5  (33)

(33)

Interfund transfers are shown as general revenues on the government-wide statement of activities.

(True/False)

4.9/5  (48)

(48)

Public school systems tend to follow the revenue and expenditure classifications of the National Center for Education Statistics rather than the GASB classifications.

(True/False)

4.9/5  (48)

(48)

At the end of the fiscal year Encumbrances is closed to Budgetary Fund Balance with a credit.

(True/False)

4.7/5  (39)

(39)

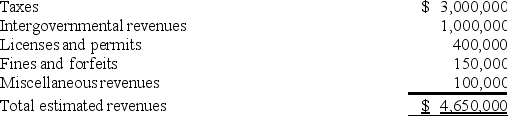

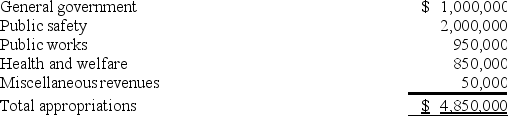

The City of Jackson Hole adopted the following General Fund budget for the fiscal year:

Estimated revenues:

Appropriations:

Appropriations:

Prepare a summary general journal entry to record the adopted budget at the beginning of the fiscal year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

Prepare a summary general journal entry to record the adopted budget at the beginning of the fiscal year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

(Essay)

4.9/5  (40)

(40)

When supplies ordered for use in an activity accounted for in the General Fund are received at an actual price that is more than the estimated price on the purchase order, the Encumbrance account is:

(Multiple Choice)

4.8/5  (36)

(36)

When the budget for the General Fund is recorded, the required journal entry will include:

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following will increase the fund balance of a government at the end of the fiscal year?

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following terms refers to an actual cost rather than an estimate?

(Multiple Choice)

4.8/5  (38)

(38)

When the budget of a government is recorded and Appropriations exceeds Estimated Revenues, the Budgetary Fund Balance account is:

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following accounts is not closed at the end of the reporting period?

(Multiple Choice)

4.8/5  (36)

(36)

Any balance in Encumbrances Outstanding that remains at the end of the fiscal year is reported as a line item under Fund Balances on the governmental funds balance sheet.

(True/False)

4.9/5  (33)

(33)

An encumbrance represents the estimated future liability for goods or services resulting from placing a purchase order or signing a contract.

(True/False)

4.7/5  (37)

(37)

Available means that a revenue or other financing source is expected to be collected during the current fiscal period or within one month of the fiscal year end.

(True/False)

4.8/5  (37)

(37)

The Expenditures control account of a government is credited when:

(Multiple Choice)

4.9/5  (43)

(43)

The County Commission of Canyon County adopted its General Fund budget for the year ending June 30, comprising estimated revenues of $13,200,000 and appropriations of $12,900,000. The budgeted excess of estimated revenues over appropriations will be recorded as:

(Multiple Choice)

4.7/5  (43)

(43)

Other financing sources increase fund balance in the same manner as revenues.

(True/False)

4.8/5  (43)

(43)

Showing 61 - 80 of 91

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)