Exam 4: Accounting for Governmental Operating Activities–Illustrative Transactions and Financial Statements

Exam 1: Introduction to Accounting and Financial Reporting for Government and Not-for-Profit Entities62 Questions

Exam 2: Principles of Accounting and Financial Reporting for State and Local Governments73 Questions

Exam 3: Governmental Operating Statement Accounts; Budgetary Accounting91 Questions

Exam 4: Accounting for Governmental Operating Activities–Illustrative Transactions and Financial Statements91 Questions

Exam 5: Accounting for General Capital Assets and Capital Projects83 Questions

Exam 6: Accounting for General Long-Term Liabilities and Debt Service75 Questions

Exam 7: Accounting for the Business-type Activities of State and Local Governments75 Questions

Exam 8: Accounting for Fiduciary Activities—Custodial and Trust Funds72 Questions

Exam 9: Financial Reporting of State and Local Governments66 Questions

Exam 10: Analysis of Government Financial Performance60 Questions

Exam 11: Auditing of Government and Not-for-Profit Organizations65 Questions

Exam 12: Budgeting and Performance Measurement60 Questions

Exam 13: Not-for-Profit Organizations—Regulatory, Taxation, and Performance Issues59 Questions

Exam 14: Accounting for Not-for-Profit Organizations77 Questions

Exam 15: Accounting for Colleges and Universities63 Questions

Exam 16: Accounting for Health Care Organizations63 Questions

Exam 17: Accounting and Reporting for the Federal Government66 Questions

Select questions type

The Town of Loveland levied property taxes in the amount of $1,600,000. The town estimates that 1 percent will be uncollectible. The journal entry to record the tax levy will include

(Multiple Choice)

4.8/5  (35)

(35)

Why might the property tax revenue in a given year differ between the governmental funds statement of revenues, expenditures, and changes in fund balances and the governmental activities column of the statement of activities?

(Essay)

4.8/5  (39)

(39)

The county received a $10,000,000 endowment, the terms of which indicate that earnings on the endowment are to be used by health and welfare to provide medical services to low-income children. Where would the $10,000,000 be recorded?

(Multiple Choice)

4.9/5  (41)

(41)

The account Deferred Inflows of Resources-Unavailable Revenues is used in governmental funds to record

(Multiple Choice)

4.8/5  (37)

(37)

An interfund transfer in should be reported in a governmental fund operating statement as a(an):

(Multiple Choice)

4.8/5  (27)

(27)

The Governmental Activities column of the statement of net position includes financial information for all funds of a government.

(True/False)

4.7/5  (42)

(42)

Which of the following should not be reported on the balance sheet of the General Fund?

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following would be reported on the operating statement of a governmental fund?

(Multiple Choice)

4.7/5  (40)

(40)

Some governments choose to sell the collection rights to unpaid property taxes in tax lien public auctions and therefore will not have property tax balances reported within the financial statements.

(True/False)

4.9/5  (31)

(31)

The General Fund used electricity provided by the city-owned electric utility (an enterprise fund of the city). The governmental activities journal entry to record the transaction will include:

(Multiple Choice)

4.9/5  (36)

(36)

A contribution was received by the city for the purchase of playground equipment. The contribution would not be recognized as revenue by the permanent fund until the playground equipment has been purchased.

(True/False)

4.9/5  (46)

(46)

The receipt of equipment that had previously been ordered should be recorded in the General Fund as a debit to

(Multiple Choice)

4.8/5  (38)

(38)

A tourist tax that is restricted for use on maintenance projects in the historic downtown district should always be recorded as general revenues in the governmental activities journal.

(True/False)

4.9/5  (32)

(32)

Whenever a significant revenue source is restricted for a specific operating purpose, a special revenue fund should be established.

(True/False)

4.8/5  (29)

(29)

Which of the following assets would appropriately be reported on the governmental funds balance sheet?

(Multiple Choice)

4.7/5  (28)

(28)

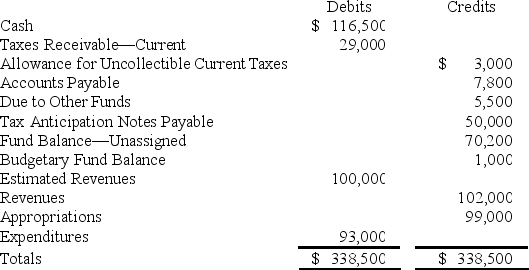

The following is a pre-closing trial balance for Sun City's General Fund as of June 30, 2020:

What is the fund balance as of June 30, 2020, after all closing entries have been made?

What is the fund balance as of June 30, 2020, after all closing entries have been made?

(Essay)

4.8/5  (32)

(32)

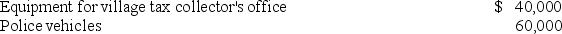

Cartier Village's capital expenditures during the year ended December 31 included:  What amounts should have been recorded in the General Fund and the governmental activities journal for the increase in the equipment account during the year ended December 31?

What amounts should have been recorded in the General Fund and the governmental activities journal for the increase in the equipment account during the year ended December 31?

(Multiple Choice)

4.8/5  (28)

(28)

A properly prepared schedule of revenues, expenditures, and changes in fund balances-budget and actual will include which of the following columns?

(Multiple Choice)

4.8/5  (39)

(39)

A payment made by a city-owned utility to the General Fund of the city in lieu of taxes is an example of a transaction that is recorded in the governmental activities journal.

(True/False)

4.9/5  (47)

(47)

When a fire truck purchased from General Fund revenues is received, what account, if any, should have been debited in the General Fund?

(Multiple Choice)

5.0/5  (43)

(43)

Showing 21 - 40 of 91

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)