Exam 14: The Basic Tools of Finance

Exam 1: Ten Principles of Economics347 Questions

Exam 2: Thinking Like an Economist535 Questions

Exam 3: Interdependence and the Gains From Trade442 Questions

Exam 4: The Market Forces of Supply and Demand569 Questions

Exam 5: Elasticity and Its Application503 Questions

Exam 6: Supply, Demand, and Government Policies556 Questions

Exam 7: Consumers, Producers, and the Efficiency of Markets460 Questions

Exam 8: Application: The Costs of Taxation422 Questions

Exam 9: Application: International Trade409 Questions

Exam 10: Measuring a Nations Income428 Questions

Exam 11: Measuring the Cost of Living436 Questions

Exam 12: Production and Growth417 Questions

Exam 13: Saving, Investment, and the Financial System473 Questions

Exam 14: The Basic Tools of Finance419 Questions

Exam 15: Unemployment571 Questions

Exam 16: The Monetary System423 Questions

Exam 17: Money Growth and Inflation388 Questions

Exam 18: Open-Economy Macroeconomic Models448 Questions

Exam 19: A Macroeconomic Theory of the Open Economy374 Questions

Exam 20: Aggregate Demand and Aggregate Supply471 Questions

Exam 21: The Influence of Monetary and Fiscal Policy on Aggregate Demand416 Questions

Exam 22: The Short-Run Trade-Off Between Inflation and Unemployment400 Questions

Exam 23: Six Debates Over Macroeconomic Policy235 Questions

Select questions type

Two years ago Lenny put some money into an account. He earned 6 percent interest on this account and now he has about $1,000. About how much did Lenny deposit into his account two years ago?

Free

(Multiple Choice)

4.8/5  (32)

(32)

Correct Answer:

D

Sari puts $100 into an account with an interest rate of 10 percent. According to the rule of 70, about how much does she have at the end of 21 years?

Free

(Multiple Choice)

4.8/5  (33)

(33)

Correct Answer:

C

You could borrow $1,000 today from Bank A and repay the loan, with interest, by paying Bank A $1,060 one year from today. Or, you could borrow $1,500 today from Bank B and repay the loan, with interest, by paying Bank B $1,600 one year from today. Which of the following statements is correct?

Free

(Multiple Choice)

4.7/5  (26)

(26)

Correct Answer:

B

A company that can build a project that will cost $50,000, but returns $52,000 in one year would make a good decision by turning this project down if the interest rate were 3 percent.

(True/False)

4.7/5  (26)

(26)

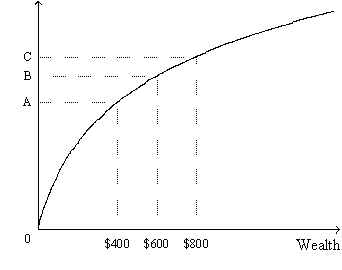

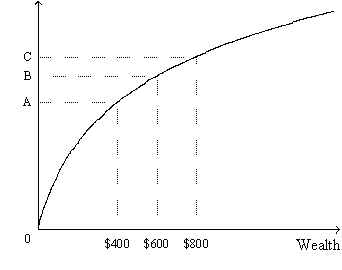

Figure 14-1. The figure shows a utility function.  -Refer to Figure 14-1. Suppose the person to whom this utility function applies begins with $600 in wealth. Starting from there,

-Refer to Figure 14-1. Suppose the person to whom this utility function applies begins with $600 in wealth. Starting from there,

(Multiple Choice)

4.7/5  (32)

(32)

Rosie is risk averse and has $1,000 with which to make a financial investment. She has three options. Option A is a risk-free government bond that pays 5 percent interest each year for two years. Option B is a low-risk stock that analysts expect to be worth about $1,102.50 in two years. Option C is a high-risk stock that is expected to be worth about $1,200 in four years. Rosie should choose

(Multiple Choice)

4.9/5  (31)

(31)

List three different ways that a risk-averse person can reduce financial risk.

(Essay)

4.8/5  (33)

(33)

Fundamental analysis shows that stock in Cedar Valley Furniture Corporation has a price that exceeds its present value.

(Multiple Choice)

4.8/5  (44)

(44)

Your financial advisor tells you that if you earn the historical rate of return on a certain mutual fund, then in three years your $20,000 will grow to $23,152.50. What rate of interest does your financial advisor expect you to earn?

(Multiple Choice)

4.9/5  (34)

(34)

Scott Adams, creator of the comic strip Dilbert, has a theory that you should

(Multiple Choice)

4.8/5  (45)

(45)

If unexpected news raised people's expectations of a corporation's future dividends and price, then before the price changes this corporation's stock would be

(Multiple Choice)

5.0/5  (32)

(32)

Allen Steel Company is considering whether to build a new mill. If the interest rate rises,

(Multiple Choice)

4.9/5  (37)

(37)

A University of Iowa basketball standout is offered a choice of contracts by the New York Liberty. The first one gives her $100,000 one year from today and $100,000 two years from today. The second one gives her $132,000 one year from today and $66,000 two years from today. As her agent, you must compute the present value of each contract. Which of the following interest rates is the lowest one at which the present value of the second contract exceeds that of the first?

(Multiple Choice)

4.8/5  (34)

(34)

Figure 14-1. The figure shows a utility function.  -Refer to Figure 14-1. For the person to whom this utility function applies,

-Refer to Figure 14-1. For the person to whom this utility function applies,

(Multiple Choice)

4.8/5  (43)

(43)

On the Internet you find the following offers for opening an online account. Which of them is the best offer if you have $5,000 to save for two years?

(Multiple Choice)

4.8/5  (41)

(41)

What is the future value of $500 one year from today if the interest rate is 6 percent?

(Multiple Choice)

4.9/5  (31)

(31)

In which of the following instances is the present value of the future payment the largest?

(Multiple Choice)

4.8/5  (34)

(34)

Suppose you win a small lottery and you are given the following choice: You can receive (1) an immediate payment of $5,000 or (2) two annual payments, each in the amount of $2,700, with the first payment coming one year from now, and the second payment coming two years from now. You would choose to take the two annual payments if the interest rate is

(Multiple Choice)

4.9/5  (35)

(35)

Which of the following is the correct way to compute the future value of $1 put into an account that earns 5 percent interest for 16 years?

(Multiple Choice)

4.8/5  (34)

(34)

Showing 1 - 20 of 419

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)