Exam 5: Net Present Value and Other Investment Rules

Exam 1: Introduction to Corporate Finance67 Questions

Exam 2: Financial Statements and Cash Flow94 Questions

Exam 3: Financial Statements Analysis and Financial Models120 Questions

Exam 4: Discounted Cash Flow Valuation134 Questions

Exam 5: Net Present Value and Other Investment Rules105 Questions

Exam 6: Making Capital Investment Decisions101 Questions

Exam 7: Risk Analysis, Real Options, and Capital Budgeting99 Questions

Exam 8: Interest Rates and Bond Valuation69 Questions

Exam 9: Stock Valuation77 Questions

Exam 10: Risk and Return: Lessons From Market History84 Questions

Exam 11: Return and Risk: the Capital Asset Pricing Model Capm136 Questions

Exam 12: An Alternative View of Risk and Return: The Arbitrage Pricing Theory51 Questions

Exam 13: Risk, Cost of Capital, and Valuation59 Questions

Exam 14: Efficient Capital Markets and Behavioral Challenges65 Questions

Exam 15: Long-Term Financing46 Questions

Exam 16: Capital Structure: Basic Concepts91 Questions

Exam 17: Capital Structure: Limits to the Use of Debt74 Questions

Exam 18: Valuation and Capital Budgeting for the Levered Firm57 Questions

Exam 19: Dividends and Other Payouts90 Questions

Exam 20: Raising Capital73 Questions

Exam 21: Leasing55 Questions

Exam 22: Options and Corporate Finance95 Questions

Exam 23: Options and Corporate Finance: Extensions and Applications46 Questions

Exam 24: Warrants and Convertibles58 Questions

Exam 25: Derivatives and Hedging Risk66 Questions

Exam 26: Short-Term Finance and Planning124 Questions

Exam 27: Cash Management59 Questions

Exam 28: Credit and Inventory Management61 Questions

Exam 29: Mergers, Acquisitions, and Divestitures83 Questions

Exam 30: Financial Distress52 Questions

Exam 31: International Corporate Finance95 Questions

Select questions type

Using internal rate of return,a conventional project should be accepted if the internal rate of return is:

(Multiple Choice)

4.9/5  (40)

(40)

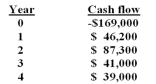

You are analyzing a project and have prepared the following data:  Required payback period 2.5 years

Required return 8.50%

Based on the net present value of _______ for this project,you should _______ the project.

Required payback period 2.5 years

Required return 8.50%

Based on the net present value of _______ for this project,you should _______ the project.

(Multiple Choice)

4.8/5  (46)

(46)

You are trying to determine whether to accept project A or project B. These projects are mutually exclusive. As part of your analysis,you should compute the incremental IRR by determining:

(Multiple Choice)

4.7/5  (35)

(35)

You are analyzing a project and have prepared the following data:  Required payback period 2.5 years

Required return 8.50%

Based on the profitability index of _______ for this project,you should _______ the project.

Required payback period 2.5 years

Required return 8.50%

Based on the profitability index of _______ for this project,you should _______ the project.

(Multiple Choice)

4.8/5  (45)

(45)

The length of time required for an investment to generate cash flows sufficient to recover the initial cost of the investment is called the:

(Multiple Choice)

4.8/5  (41)

(41)

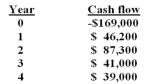

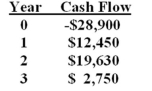

What is the internal rate of return on an investment with the following cash flows?

(Multiple Choice)

4.9/5  (37)

(37)

The present value of an investment's future cash flows divided by the initial cost of the investment is called the:

(Multiple Choice)

4.7/5  (42)

(42)

The length of time required for a project's discounted cash flows to equal the initial cost of the project is called the:

(Multiple Choice)

4.8/5  (40)

(40)

If a project is assigned a required rate of return equal to zero,then:

(Multiple Choice)

4.9/5  (42)

(42)

The Liberty Co. is considering two projects. Project A consists of building a wholesale book outlet on lot #169 of the Englewood Retail Center. Project B consists of building a sit-down restaurant on lot #169 of the Englewood Retail Center. When trying to decide whether to build the book outlet or the restaurant,management should rely most heavily on the analysis results from the _______ method of analysis.

(Multiple Choice)

4.8/5  (36)

(36)

An investment cost $10,000 with expected cash flows of $3,000 for 5 years. The discount rate is 15.2382%. The NPV is ______ and the IRR is ______ for the project.

(Multiple Choice)

4.9/5  (39)

(39)

The Ziggy Trim and Cut Company can purchase equipment on sale for $4,300. The asset has a three-year life,will produce a cash flow of $1,200 in the first and second year,and $3,000 in the third year. The interest rate is 12%. Calculate the project's Discounted Payback and Profitability Index assuming end of year cash flows. Should the project be taken?

If the Average Accounting Return was positive,how would this affect your decision?

(Essay)

4.8/5  (35)

(35)

Accepting positive NPV projects benefits the stockholders because:

(Multiple Choice)

4.9/5  (22)

(22)

A project has an initial cost of $8,600 and produces cash inflows of $3,200,$4,900,and $1,500 over the next three years,respectively. What is the discounted payback period if the required rate of return is 8%?

(Multiple Choice)

4.8/5  (31)

(31)

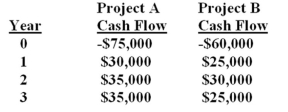

The Camel Company is considering two mutually exclusive projects with the following cash flows. The incremental IRR is _______ and if the required rate is higher than the crossover rate then project _______ should be accepted.

(Multiple Choice)

4.9/5  (36)

(36)

An investment with an initial cost of $14,000 produces cash flows of $4,000 annually for 5 years. If the cash flow is evenly spread out over the year and the firm can borrow at 10%,the discounted payback period is _____ years.

(Multiple Choice)

4.9/5  (42)

(42)

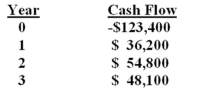

What is the net present value of a project with the following cash flows and a required return of 12%?

(Multiple Choice)

4.8/5  (38)

(38)

Consider an investment with an initial cost of $20,000 and is that expected to last for 5 years. The expected cash flows in years 1 and 2 are $5,000,in years 3 and 4 are $5,500 and in year 5 is $1,000. The total cash inflow is expected to be $22,000 or an average of $4,400 per year. Compute the payback period in years.

(Multiple Choice)

4.9/5  (34)

(34)

Showing 81 - 100 of 105

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)