Exam 4: Accounting for Governmental Operating Activities-Illustrative Transactions and Financial Statements

Exam 1: Introduction to Accounting and Financial Reporting for Governmental and Not-For-Profit Entities 46 Questions

Exam 2: Principles of Accounting and Financial Reporting for State and Local Governments 50 Questions

Exam 3: Governmental Operating Statement Accounts; Budgetary Accounting 76 Questions

Exam 4: Accounting for Governmental Operating Activities-Illustrative Transactions and Financial Statements 87 Questions

Exam 5: Accounting for General Capital Assets and Capital Projects 88 Questions

Exam 6: Accounting for General Long-Term Liabilities and Debt Service81 Questions

Exam 7: Accounting for the Business-Type Activities of State and Local Governments94 Questions

Exam 8: Accounting for Fiduciary Activities-Agency and Trust Funds61 Questions

Exam 9: Financial Reporting of State and Local Governments58 Questions

Exam 10: Analysis of Governmental Financial Performance46 Questions

Exam 11: Auditing of Governmental and Not-For-Profit Organizations66 Questions

Exam 12: Budgeting and Performance Measurement62 Questions

Exam 13: Accounting for Not-For-Profit Organizations57 Questions

Exam 14: Not-For-Profit Organizations-Regulatory, Taxation, and Performance Issues43 Questions

Exam 15: Accounting for Colleges and Universities45 Questions

Exam 16: Accounting for Health Care Organizations52 Questions

Exam 17: Accounting and Reporting for the Federal Government49 Questions

Select questions type

When an activity accounted for by the General Fund results in issuance of purchase orders or contracts for goods or services a record must be kept,but no journal entries in the General Fund are necessary.

(True/False)

4.8/5  (32)

(32)

Which of the following will require a debit to Fund Balance--Unassigned of a governmental fund when operating statement accounts are closed at the end of the year,assuming there are no other financing sources or uses?

(Multiple Choice)

4.9/5  (31)

(31)

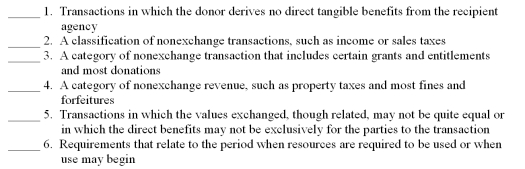

The following are key terms in Chapter 4 that relate to exchange and nonexchange transactions:

A.Derived tax revenues

B.Exchange-like transactions

C.Nonexchange transactions

D.Nonexchange revenue

E.Voluntary nonexchange transactions

F.Imposed nonexchange revenue

G.Exchange transactions

H.Time restrictions

I.Purpose restrictions

J.Eligibility requirements

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

(Not Answered)

This question doesn't have any answer yet

An interfund transfer in should be reported in a governmental fund operating statement as a(an)

(Multiple Choice)

4.8/5  (38)

(38)

On May 1,Vacca City was notified of approval of a $300,000 federal operating grant,payable on a reimbursement basis as the city expends resources for the intended purpose of the grant.As of May 1,no expenditures had been made for grant purposes.The journal entry to record approval of this grant will include

(Multiple Choice)

4.8/5  (34)

(34)

The governmental funds operating statement presents all of the following except

(Multiple Choice)

4.8/5  (47)

(47)

Which of the following assets would appropriately be reported on the governmental funds balance sheet?

(Multiple Choice)

4.8/5  (29)

(29)

Under the modified accrual basis of accounting,revenues should be recognized when

(Multiple Choice)

4.8/5  (37)

(37)

Equipment acquired several years ago by a capital projects fund and reported in the governmental activities statement of net position at a net book value of $2,000 was sold for $1,000 cash.Journal entries are necessary in the general journals of the

(Multiple Choice)

4.8/5  (39)

(39)

Beach City received a gift of corporate stock valued at $1,200,000 on the date of the gift.The donor specified that the principal amount of the gift be maintained in perpetuity,but that earnings can be used to acquire works of art to improve the appearance of public buildings.All changes in fair value are to increase or decrease the principal amount of the gift.Assuming that Beach City uses a permanent fund to account for the endowment and a special revenue fund to account for the earmarked earnings from the endowment,explain the accounting process for (1)receipt of the original gift, (2)receipt of quarterly dividends, (3)notification that fair value of the original stock increased by $3,000 during the year,and (4)the effect on fund balances of closing temporary accounts at year-end.(Note: Ignore the effects of the transactions at the government-wide level).

(Not Answered)

This question doesn't have any answer yet

Under GASB standards,Revenues must be credited for the total amount of the property tax levy.

(True/False)

4.7/5  (38)

(38)

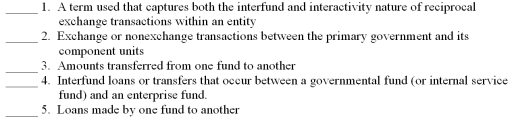

The following are key terms in Chapter 4 that relate to governmental operating activities and transfers:

A.Inter-activity transactions

B.Internal exchange transactions

C.Interfund loans

D.Intra-entity transactions

E.Interfund transfers

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

(Not Answered)

This question doesn't have any answer yet

Which of the following would be reported on the operating statement of a governmental fund?

(Multiple Choice)

4.9/5  (41)

(41)

Which of the following would be considered an internal exchange transaction?

(Multiple Choice)

4.8/5  (27)

(27)

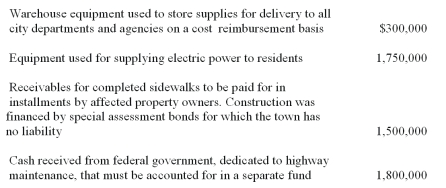

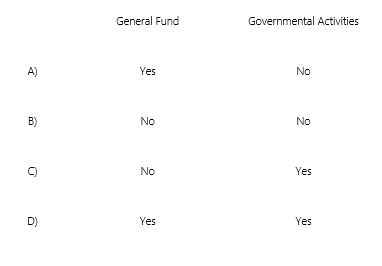

Using the information below,what amount should be accounted for in a special revenue fund or funds?

(Multiple Choice)

4.8/5  (34)

(34)

Under the modified accrual basis of accounting applicable to governmental fund types,revenue from sources such as fines and forfeits is accrued and recorded at net realizable value.

(True/False)

4.7/5  (33)

(33)

Describe the difference between exchange and nonexchange transactions and discuss the rules for recognition of revenues and expenses/expenditures for each type of transaction.

(Essay)

4.7/5  (32)

(32)

The liabilities for accrued payroll (pay owed employees but not paid at year-end)would be recorded in which journal?

(Multiple Choice)

4.7/5  (27)

(27)

Vehicles used by the Parks and Recreation Department should be accounted for in the General Fund.

(True/False)

4.8/5  (36)

(36)

Showing 21 - 40 of 87

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)