Exam 4: Accounting for Governmental Operating Activities-Illustrative Transactions and Financial Statements

Exam 1: Introduction to Accounting and Financial Reporting for Governmental and Not-For-Profit Entities 46 Questions

Exam 2: Principles of Accounting and Financial Reporting for State and Local Governments 50 Questions

Exam 3: Governmental Operating Statement Accounts; Budgetary Accounting 76 Questions

Exam 4: Accounting for Governmental Operating Activities-Illustrative Transactions and Financial Statements 87 Questions

Exam 5: Accounting for General Capital Assets and Capital Projects 88 Questions

Exam 6: Accounting for General Long-Term Liabilities and Debt Service81 Questions

Exam 7: Accounting for the Business-Type Activities of State and Local Governments94 Questions

Exam 8: Accounting for Fiduciary Activities-Agency and Trust Funds61 Questions

Exam 9: Financial Reporting of State and Local Governments58 Questions

Exam 10: Analysis of Governmental Financial Performance46 Questions

Exam 11: Auditing of Governmental and Not-For-Profit Organizations66 Questions

Exam 12: Budgeting and Performance Measurement62 Questions

Exam 13: Accounting for Not-For-Profit Organizations57 Questions

Exam 14: Not-For-Profit Organizations-Regulatory, Taxation, and Performance Issues43 Questions

Exam 15: Accounting for Colleges and Universities45 Questions

Exam 16: Accounting for Health Care Organizations52 Questions

Exam 17: Accounting and Reporting for the Federal Government49 Questions

Select questions type

If state law requires that local governments prepare General Fund and special revenue fund budgets on a basis that differs from the basis of accounting required by GAAP,then the budgetary comparison schedule or statements should

(Multiple Choice)

4.8/5  (40)

(40)

The Town of Ashland levied property taxes in the amount of $800,000.The town estimates that 1 percent will be uncollectible.The journal entry to record the tax levy will include

(Multiple Choice)

4.8/5  (30)

(30)

During January 2014 General Fund supplies ordered in the previous fiscal year and encumbered at an estimated amount of $2,000 were received at an actual cost of $2,200.The entry to record this transaction will require a debit to

(Multiple Choice)

4.9/5  (41)

(41)

Fines and forfeits are reported as charges for services on the government-wide statement of activities.

(True/False)

4.8/5  (40)

(40)

A payment made by the General Fund to a debt service fund would not be recorded in the governmental activities journal.

(True/False)

4.8/5  (44)

(44)

A payment made by a city-owned utility to the General Fund of the city in lieu of taxes is an example of an "internal exchange transaction."

(True/False)

4.8/5  (52)

(52)

Which of the following should not be reported on the balance sheet of the General Fund?

(Multiple Choice)

4.9/5  (45)

(45)

An interim schedule comparing the detail of appropriations,expenditures,and encumbrances should be prepared on an appropriate periodic basis to determine whether appropriations are being expended at the expected rate for the period and for the budget year to date.

(True/False)

4.9/5  (48)

(48)

If a government issues debt to finance capital acquisition,how should the related long-term debt be reported by the governmental fund that receives the proceeds of the debt?

(Multiple Choice)

4.9/5  (41)

(41)

The voters of the city passed an ordinance to increase their sales tax by ¼ percent.The proceeds of the sales tax are to be used for culture and recreation.In the governmental activities journal,how would the ¼ percent sales tax revenue be recorded?

(Multiple Choice)

4.8/5  (40)

(40)

Under the dual-track accounting approach used in the text,which of the following transactions or events would be recorded in the general journal for governmental activities at the government-wide level?

(Multiple Choice)

4.7/5  (42)

(42)

As a general rule,revenues,expenditures,and expenses should be reported as such only once in the funds of a government.

(True/False)

4.8/5  (34)

(34)

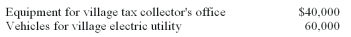

Cartier Village's capital expenditures during the year ended December 31 included:  What amounts should have been recorded in the General Fund and enterprise fund for the increase in equipment during the year ended December 31,assuming the electric utility is considered an enterprise fund?

What amounts should have been recorded in the General Fund and enterprise fund for the increase in equipment during the year ended December 31,assuming the electric utility is considered an enterprise fund?

(Multiple Choice)

4.8/5  (42)

(42)

When a fire truck purchased from General Fund revenues is received,what account,if any,should have been debited in the General Fund?

(Multiple Choice)

4.8/5  (34)

(34)

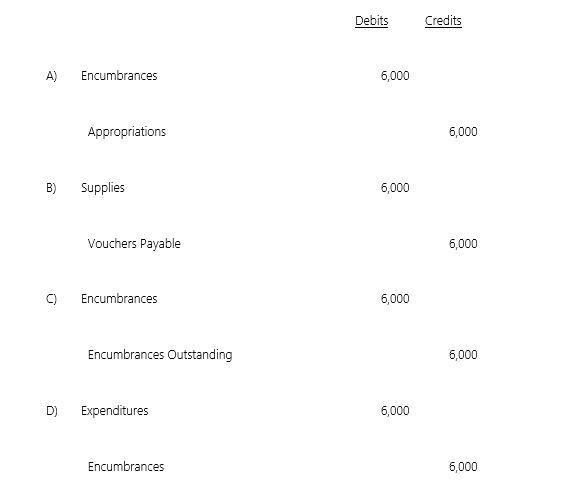

The City of Grand Marais' fiscal year ends on June 30.Grand Marais uses encumbrance accounting.On May 6,a purchase order was approved and issued for supplies in the amount of $6,000.Grand Marais received these supplies on June 2,and the $6,000 invoice was approved for payment.What General Fund journal entry should Grand Marais make on May 6,to record the approved purchase order?

(Multiple Choice)

4.8/5  (36)

(36)

On July 1,the first day of its fiscal year,the Town of Eldon levied a $1,000,000 property tax which is payable in full on December 1 of the same year.On September 15,the town decided to borrow $200,000 in 90-day tax anticipation notes to cover operating expenditures until the tax revenues are collected.The journal entry on September 15 to record the issuance of tax anticipation notes will include

(Multiple Choice)

4.9/5  (43)

(43)

The City of Tipton received 100 acres of land located in the city limits as a gift from a local property owner for use as a city park.The debit for the entry to record this event in the General Fund should be to

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following accounts would not be closed at the end of each fiscal year?

(Multiple Choice)

4.8/5  (31)

(31)

Under current GASB standards the revenue from property taxes should be recorded in the amounts collected during the current period.

(True/False)

4.7/5  (39)

(39)

Whenever a significant revenue source is restricted for a specific operating purpose,a special revenue fund should be established.

(True/False)

4.8/5  (38)

(38)

Showing 61 - 80 of 87

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)