Exam 18: Macroeconomics in an Open Economy

Exam 1: Economics: Foundations and Models219 Questions

Exam 2: Trade-Offs, Comparative Advantage, and the Market System236 Questions

Exam 3: Where Prices Come From: The Interaction of Demand and Supply234 Questions

Exam 4: Economic Efficiency, Government Price Setting, and Taxes212 Questions

Exam 5: The Economics of Health Care166 Questions

Exam 6: Firms, the Stock Market, and Corporate Governance251 Questions

Exam 7: Comparative Advantage and the Gains From International Trade188 Questions

Exam 8: GDP: Measuring Total Production and Income260 Questions

Exam 9: Unemployment and Inflation289 Questions

Exam 10: Economic Growth, the Financial System, and Business Cycles251 Questions

Exam 11: Long-Run Economic Growth: Sources and Policies261 Questions

Exam 12: Aggregate Expenditure and Output in the Short Run304 Questions

Exam 13: Aggregate Demand and Aggregate Supply Analysis284 Questions

Exam 14: Money,Banks,and the Federal Reserve System276 Questions

Exam 15: Monetary Policy278 Questions

Exam 16: Fiscal Policy313 Questions

Exam 17: Inflation, Unemployment, and Federal Reserve Policy257 Questions

Exam 18: Macroeconomics in an Open Economy277 Questions

Exam 19: The International Financial System256 Questions

Select questions type

Which of the following would decrease net exports in the United States?

(Multiple Choice)

4.8/5  (27)

(27)

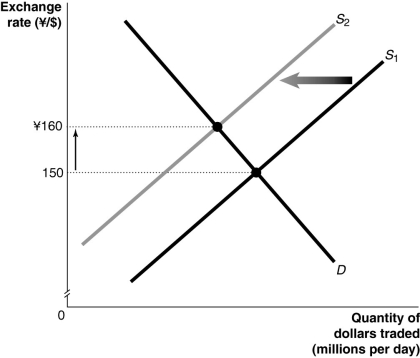

Figure 18-3  -Refer to Figure 18-3.Consider the market for U.S.dollars against the Japanese yen shown above.An event which could have caused the changes shown in the graph would be

-Refer to Figure 18-3.Consider the market for U.S.dollars against the Japanese yen shown above.An event which could have caused the changes shown in the graph would be

(Multiple Choice)

4.7/5  (35)

(35)

Ceteris paribus,a rise in interest rates in the United States will cause the yen price of the dollar in international exchange markets to ________; i.e.,the dollar ________ in value against the yen.

(Multiple Choice)

4.8/5  (31)

(31)

If the United States is a "net lender" abroad,________.(Assume that the capital account is zero and net transfers are zero.)

(Multiple Choice)

4.7/5  (44)

(44)

The difference between the value of the goods a country exports and the value of the goods a country imports is the country's

(Multiple Choice)

4.8/5  (41)

(41)

A country which incurs a current account deficit will most likely have a financial or capital account surplus.

(True/False)

4.9/5  (37)

(37)

Expansionary monetary policy lowers interest rates and forces a real appreciation of the dollar in international currency markets.

(True/False)

4.9/5  (28)

(28)

Which of the following would decrease the balance on the current account?

(Multiple Choice)

4.8/5  (31)

(31)

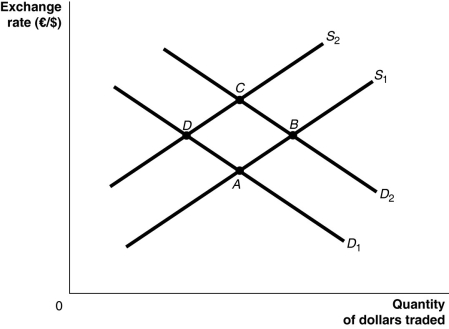

Figure 18-1  -Refer to Figure 18-1.Suppose that the U.S.government deficit causes interest rates in the United States to rise relative to those in the European Union.Assuming all else remains constant,how would this be represented?

-Refer to Figure 18-1.Suppose that the U.S.government deficit causes interest rates in the United States to rise relative to those in the European Union.Assuming all else remains constant,how would this be represented?

(Multiple Choice)

5.0/5  (32)

(32)

How will an interest rate decrease in the United States affect equilibrium in the foreign exchange market?

(Multiple Choice)

4.8/5  (27)

(27)

The current account deficits incurred by the United States in the 1980s were caused,in the opinion of many economists,by

(Multiple Choice)

4.9/5  (28)

(28)

Saving exceeds domestic investment in Japan,which generates a financial account deficit in Japan's balance of payments.

(True/False)

4.9/5  (29)

(29)

Holding all else constant,an economic expansion in Mexico should decrease the demand for U.S.dollars.

(True/False)

4.9/5  (31)

(31)

The United States has a trade ________ with all its major trading partners and a trade ________ with every region of the world except for Latin America.

(Multiple Choice)

4.9/5  (33)

(33)

The saving and investment equation holds only when the federal budget is balanced.

(True/False)

4.9/5  (39)

(39)

How will an increase in federal government spending without an increase in taxes affect real GDP and the price level in the short run in a closed economy and in an open economy?

(Essay)

4.8/5  (30)

(30)

Showing 141 - 160 of 277

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)