Exam 9: The Instruments of Trade Policy

Exam 1: Introduction41 Questions

Exam 2: World Trade: An Overview25 Questions

Exam 3: Labor Productivity and Comparative Advantage: The Ricardian Model70 Questions

Exam 4: Specific Factors and Income Distribution70 Questions

Exam 5: Resources and Trade: the Heckscher-Ohlin Model66 Questions

Exam 6: The Standard Trade Model48 Questions

Exam 7: External Economies of Scale and the International Location of Production37 Questions

Exam 8: Firms in the Global Economy: Export Decisions, Outsourcing, and Multinational Enterprises69 Questions

Exam 9: The Instruments of Trade Policy74 Questions

Exam 10: The Political Economy of Trade Policy63 Questions

Exam 11: Trade Policy in Developing Countries43 Questions

Exam 12: Controversies in Trade Policy47 Questions

Exam 13: National Income Accounting and the Balance of Payments78 Questions

Exam 14: Exchange Rates and the Foreign Exchange Market: An Asset Approach76 Questions

Exam 15: Money,Interest Rates, and Exchange Rates65 Questions

Exam 16: Price Levels and the Exchange Rate in the Long Run80 Questions

Exam 17: Output and the Exchange Rate in the Short Run116 Questions

Exam 18: Fixed Exchange Rates and Foreign Exchange Intervention81 Questions

Exam 19: International Monetary Systems: An Historical Overview171 Questions

Exam 20: Financial Globalization: Opportunity and Crisis131 Questions

Exam 21: Optimum Currency Areas and the Euro104 Questions

Exam 22: Developing Countries: Growth, Crisis, and Reform116 Questions

Select questions type

The effective rate of protection is a weighted average of nominal tariffs and tariffs on imported inputs.It has been noted that in most industrialized countries,the nominal tariffs on raw materials or intermediate components or products are lower than on final-stage products meant for final markets.Why would countries design their tariff structures in this manner? Who tends to be helped,and who is harmed by this cascading tariff structure?

(Essay)

4.8/5  (40)

(40)

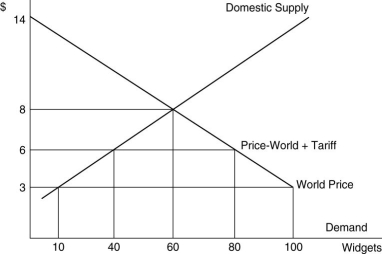

The two deadweight triangles are the Consumption distortion and Production distortion losses.It is easy to understand why the Consumption distortion constitutes a loss for society.After all it raises the prices of goods to consumers,and even causes some consumers to drop out of the market altogether.It seems paradoxical that the Production distortion is considered an equivalent burden on society.After all,in this case,profits increase,and additional production (with its associated employment)comes on line.This would seem to be an offset rather than an addition to the burden or loss borne by society.Explain why the Production distortion is indeed a loss to society,and what is wrong with the logic that leads to the apparent paradox.

(Essay)

4.9/5  (42)

(42)

-Refer to above figure.With free trade and no tariffs,what is the quantity of Widgets imported?

-Refer to above figure.With free trade and no tariffs,what is the quantity of Widgets imported?

(Essay)

4.8/5  (43)

(43)

The most vocal political pressure for tariffs is generally made by

(Multiple Choice)

4.9/5  (38)

(38)

The fact that industrialized countries levy very low or no tariff on raw materials and semi processed goods

(Multiple Choice)

4.8/5  (42)

(42)

If an import-competing firm is imperfectly competitive,then under free trade an export tariff will ________ domestic market price,________ producer surplus,________ consumer surplus,________ government revenue,and ________ overall domestic national welfare.

(Multiple Choice)

4.8/5  (39)

(39)

Should the home country be "large" relative to its trade partners,its imposition of a tariff on imports would lead to an increase in domestic welfare if the terms of the trade rectangle exceed the sum of the

(Multiple Choice)

4.8/5  (38)

(38)

Which type of tariff is forbidden in the United States on Constitutional grounds?

(Multiple Choice)

4.9/5  (30)

(30)

If an import-competing firm is imperfectly competitive,than under free trade an import quota will ________ domestic market price,________ producer surplus,________ consumer surplus,________ government revenue,and ________ overall domestic national welfare.

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following are examples of goods that have been subject to voluntary export restraints?

(Multiple Choice)

4.9/5  (25)

(25)

The imposition of tariffs on imports results in deadweight (triangle)losses.These are

(Multiple Choice)

4.9/5  (43)

(43)

Suppose an import-competing firm is imperfectly competitive.Replacement of an export tariff with an import quota that yields the same level of imports will ________ market price,________ producer surplus,________ consumer surplus,________ government revenue,and ________ overall domestic national welfare.

(Multiple Choice)

4.8/5  (31)

(31)

What is a TRUE statement concerning the imposition in the U.S.of a tariff on cheese?

(Multiple Choice)

4.8/5  (48)

(48)

Economic theory in general,and trade theory in particular are replete with equivalencies.For example,it is argued that for any specific tariff one can find an equivalent ad valorem tariff;and that for any quota one can calculate a tariff equivalent.Discuss conditions or situations under which a specific and an ad valorem tariff are not equivalent.Discuss conditions or situations when a tariff and a quota are not equivalent.

(Essay)

4.8/5  (38)

(38)

If a good is imported into (small)country H from country F,then the imposition of a tariff In country H

(Multiple Choice)

4.9/5  (45)

(45)

Showing 41 - 60 of 74

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)