Exam 5: Activity-Based Costing and Customer Profitability Analysis

Exam 9: Short-Term Profit Planning: Cost-Volume-Profit CVP Analysis79 Questions

Exam 2: Implementing Strategy: The Value Chain, the Balanced Scorecard, and the Strategy Map70 Questions

Exam 3: Basic Cost Management Concepts98 Questions

Exam 4: Job Costing118 Questions

Exam 5: Activity-Based Costing and Customer Profitability Analysis149 Questions

Exam 6: Process Costing106 Questions

Exam 7: Cost Allocation: Departments, Joint Products, and By-Products96 Questions

Exam 8: Cost Estimation120 Questions

Exam 9: Short-Term Profit Planning: Cost-Volume-Profit Cvp Analysis105 Questions

Exam 10: Strategy and the Master Budget146 Questions

Exam 11: Decision Making With a Strategic Emphasis137 Questions

Exam 12: Strategy and the Analysis of Capital Investments167 Questions

Exam 13: Cost Planning for the Product Life Cycle: Target Costing, Theory of Constraints, and Strategic Pricing94 Questions

Exam 14: Operational Performance Measurement: Sales, Direct-Cost Variances, and the Role of Nonfinancial Performance Measures178 Questions

Exam 15: Operational Performance Measurement: Indirect-Cost Variances and Resource-Capacity Management167 Questions

Exam 16: Operational Performance Measurement: Further Analysis of Productivity and Sales134 Questions

Exam 17: The Management and Control of Quality147 Questions

Exam 18: Strategic Performance Measurement: Cost Centers, Profit Centers, and the Balanced Scorecard133 Questions

Exam 19: Strategic Performance Measurement: Investment Centers and Transfer Pricing151 Questions

Exam 20: Management Compensation, Business Analysis, and Business Valuation108 Questions

Select questions type

All of the following statements regarding activity-based costing systems are true except they:

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following would be the most appropriate cost driver to allocate factory electricity costs to products?

(Multiple Choice)

5.0/5  (38)

(38)

Using a volume-based overhead rate based on machine hours to assign manufacturing overhead to a product line that uses relatively few machine hours is likely to:

(Multiple Choice)

5.0/5  (31)

(31)

Which of the following would likely be the most appropriate cost driver to allocate machine set-up costs to products?

(Multiple Choice)

5.0/5  (35)

(35)

An activity that is performed for each unit of production is a(n):

(Multiple Choice)

4.8/5  (40)

(40)

Moss Manufacturing has just completed a major change in its quality control (QC) process. Previously, products had been reviewed by QC inspectors at the end of each major process, and the company's ten QC inspectors were charged as direct labor to the operation or job. In an effort to improve efficiency and quality, a computerized video QC system was purchased for $250,000. The system consists of a minicomputer, 15 video cameras, other peripheral hardware, and software.

The new system used cameras stationed by QC engineers at key points in the production process. Each time an operation changes or there is a new operation, the cameras are moved, and a new master picture is loaded into the computer by a QC engineer. The camera takes pictures of the units in process, and the computer compares them to the picture of a "good" unit. Any differences are sent to a QC engineer who removes the bad units and discusses the flaws with the production supervisors. The new system has replaced the ten QC inspectors with two QC engineers.

The operating costs of the new QC system, including the salaries of the QC engineers, have been included as factory overhead in calculating the company's volume-based factory overhead rate which is based on direct labor dollars.

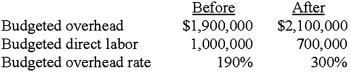

The company's president is confused. His vice president of production has told him how efficient the new system is, yet there is a large increase in the factory overhead rate. The computation of the rate before and after automation is shown below.  "Three hundred percent," lamented the president, "How can we compete with such a high factory overhead rate?"

Required:

1. a. Define factory overhead, and cite three examples of typical costs that would be included in factory overhead.

b. Explain why companies develop factory overhead rates.

2. Explain why the increase in the overhead rate should not have a negative financial impact on Moss Manufacturing.

3. Explain, in the greatest detail possible, how Moss Manufacturing could change its overhead accounting system to eliminate confusion over product costs.

"Three hundred percent," lamented the president, "How can we compete with such a high factory overhead rate?"

Required:

1. a. Define factory overhead, and cite three examples of typical costs that would be included in factory overhead.

b. Explain why companies develop factory overhead rates.

2. Explain why the increase in the overhead rate should not have a negative financial impact on Moss Manufacturing.

3. Explain, in the greatest detail possible, how Moss Manufacturing could change its overhead accounting system to eliminate confusion over product costs.

(Essay)

4.9/5  (42)

(42)

Using ABC, how much facility-level overhead is assigned to the current order for Men's Razors?

(Multiple Choice)

4.7/5  (36)

(36)

A measure of the quantity of resources consumed by an activity is:

(Multiple Choice)

4.8/5  (37)

(37)

Procurement costs such as costs of placing orders for materials and paying suppliers are usually classified as:

(Multiple Choice)

4.8/5  (43)

(43)

Which of the following is most likely to be the cost driver for the packaging and shipping activity?

(Multiple Choice)

4.8/5  (29)

(29)

Which of the following is a benefit of activity-based costing?

(Multiple Choice)

4.9/5  (35)

(35)

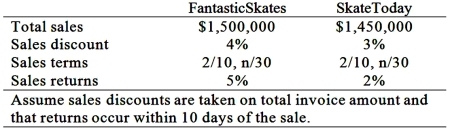

Skateline Inc. designs and manufactures roller skates. The following data pertain to two of its major

customers: FantasticSkates and SkateToday.  Required: Compare the net proceeds from each customer to Skateline Inc. 30 days after sale. (rounded to nearest dollar for each step where applicable).

Required: Compare the net proceeds from each customer to Skateline Inc. 30 days after sale. (rounded to nearest dollar for each step where applicable).

(Essay)

4.8/5  (33)

(33)

Using activity-based costing, applied quality control factory overhead for the 1,000 laser printers order is:

(Multiple Choice)

4.8/5  (37)

(37)

Using ABC, how much total overhead is assigned to the order?

(Multiple Choice)

4.9/5  (31)

(31)

Showing 41 - 60 of 149

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)