Exam 8: Absorption and Variable Costing

Exam 1: The Changing Role of Managerial Accounting in a Dynamic Business Environment68 Questions

Exam 2: Basic Cost Management Concepts and Accounting for Mass Customization Operations88 Questions

Exam 3: Product Costing and Cost Accumulation in a Batch Production Environment75 Questions

Exam 4: Process Costing and Hybrid Product-Costing Systems78 Questions

Exam 5: Activity-Based Costing and Management102 Questions

Exam 6: Activity Analysis,cost Behavior,and Cost Estimation84 Questions

Exam 18: Appendix I: The Sarbanes-Oxley Act, Internal Controls, and Management Accounting14 Questions

Exam 7: Cost-Volume-Profit Analysis91 Questions

Exam 8: Absorption and Variable Costing58 Questions

Exam 9: Profit Planning and Activity-Based Budgeting91 Questions

Exam 10: Standard Costing,Operational Performance Measures,and the Balanced Scorecard97 Questions

Exam 11: Flexible Budgeting and the Management of Overhead and Support Activity Costs85 Questions

Exam 12: Responsibility Accounting, Quality Control, and Environmental Cost Management91 Questions

Exam 13: Investment Centers and Transfer Pricing85 Questions

Exam 14: Decision Making: Relevant Costs and Benefits85 Questions

Exam 15: Target Costing and Cost Analysis for Pricing Decisions88 Questions

Exam 16: Capital Expenditure Decisions114 Questions

Exam 17: Allocation of Support Activity Costs and Joint Costs77 Questions

Exam 19: compound Interest and the Concept of Present Value24 Questions

Exam 20: Inventory Management14 Questions

Select questions type

Under absorption costing,each unit of the company's inventory would be carried at:

(Multiple Choice)

4.8/5  (31)

(31)

For external-reporting purposes,generally accepted accounting principles require that net income be based on:

(Multiple Choice)

4.9/5  (32)

(32)

If Indiana uses absorption costing,the total inventoriable costs for the year would be:

(Multiple Choice)

4.9/5  (36)

(36)

The table that follows denotes selected characteristics of absorption costing and/or variable costing.

(Essay)

4.9/5  (32)

(32)

Which of the following statements pertain to variable costing?

(Multiple Choice)

4.8/5  (40)

(40)

Carter reported $106,000 of income for the year by using variable costing.The company had no beginning inventory,planned and actual production of 50,000 units,and sales of 47,000 units.Standard variable manufacturing costs were $15 per unit,and total budgeted fixed manufacturing overhead was $150,000.If there were no variances,income under absorption costing would be:

(Multiple Choice)

4.7/5  (36)

(36)

Variable manufacturing overhead becomes part of a unit's cost when variable costing is used.

(True/False)

4.9/5  (34)

(34)

Fixed manufacturing overhead is not inventoried under absorption costing.

(True/False)

4.9/5  (32)

(32)

Which of the following methods defines product cost as the unit-level cost incurred each time a unit is manufactured?

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following conditions would cause absorption-costing income to be higher than variable-costing income?

(Multiple Choice)

4.9/5  (40)

(40)

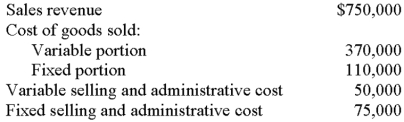

Under absorption costing,each unit of the company's inventory would be carried at:

(Multiple Choice)

4.9/5  (37)

(37)

All of the following are inventoried under variable costing except:

(Multiple Choice)

4.9/5  (36)

(36)

Under variable costing,each unit of the company's inventory would be carried at:

(Multiple Choice)

4.9/5  (33)

(33)

The following data relate to Lebeaux Corporation for the year just ended:  Which of the following statements is correct?

Which of the following statements is correct?

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following product-costing systems is/are required for tax purposes?

(Multiple Choice)

4.8/5  (40)

(40)

Consider the following statements about absorption costing and variable costing:

I.Variable costing is consistent with contribution reporting and cost-volume-profit analysis.

II.Absorption costing must be used for external financial reporting.

III.A number of companies use both absorption costing and variable costing.

Which of the above statements is (are)true?

(Multiple Choice)

4.9/5  (40)

(40)

Moneka reported $65,000 of income for the year by using absorption costing.The company had no beginning inventory,planned and actual production of 20,000 units,and sales of 18,000 units.Standard variable manufacturing costs were $20 per unit,and total budgeted fixed manufacturing overhead was $100,000.If there were no variances,income under variable costing would be:

(Multiple Choice)

4.8/5  (35)

(35)

Consider the following comments about absorption- and variable-costing income statements:

I.A variable-costing income statement discloses a firm's contribution margin.

II.Cost of goods sold on an absorption-costing income statement includes fixed costs.

III.The amount of variable selling and administrative cost is the same on absorption- and variable-costing income statements.

Which of the above statements is (are)true?

(Multiple Choice)

4.8/5  (28)

(28)

Showing 41 - 58 of 58

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)