Exam 9: Accounting for Special-Purpose Entities, Including Public Colleges and Universities

Exam 1: Introduction to Accounting and Financial Reporting for Governmental and Not-For-Profit Organizations134 Questions

Exam 2: Overview of Financial Reporting for State and Local Governments135 Questions

Exam 3: Modified Accrual Accounting: Including the Role of Fund Balances and Budgetary Authority143 Questions

Exam 4: Accounting for the General and Special Revenue Funds125 Questions

Exam 5: Accounting for Other Governmental Fund Types: Capital Projects, Debt Service, and Permanent152 Questions

Exam 6: Proprietary Funds130 Questions

Exam 7: Fiduciary Trustfunds154 Questions

Exam 8: Government-Wide Statements, Capital Assets, Long-Term Debt143 Questions

Exam 9: Accounting for Special-Purpose Entities, Including Public Colleges and Universities105 Questions

Exam 10: Accounting for Private Not-For-Profit Organizations151 Questions

Exam 11: College and University Accounting Private Institutions125 Questions

Exam 12: Accounting for Hospitals and Other Health Care Providers100 Questions

Exam 13: Auditing, Tax-Exempt Organizations, and Evaluating Performance151 Questions

Exam 14: Financial Reporting by the Federal Government66 Questions

Select questions type

Which of the following is true regarding the Statement of Cash Flows for a public college?

(Multiple Choice)

5.0/5  (38)

(38)

Southeastern State University has chosen to report as a public university reporting as a special-purpose entity engaged only in business-type activities.Deferred Revenues were reported as of July 1,2013 in the amount of $4,800,000.Record the following transactions related to revenue recognition for the year ended June 30,2014.Include in the account titles the proper revenue classification (operating revenues,nonoperating revenues,etc.):

1.Deferred revenues related to unearned revenues for the summer session,which ended in August 2013.

2.During the fiscal year ended June 30,2014,student tuition and fees were assessed in the amount of $68,000,000.Of that amount,$61,000,000 was collected in cash.Also,of that amount,$4,200,000 pertained to that portion of the 2014 summer session that took place after June 30,2014.

3.Student scholarships,for which no services were required,amounted to $3,500,000.Students applied these scholarships to their tuition bills at the beginning of the fall and spring semesters.

4.Student scholarships and fellowships,for which services were required,such as graduate assistantships,amounted to $2,200,000.These students also applied their scholarship and fellowship awards to their tuition bills at the beginning of each semester.

5.Auxiliary enterprise revenues amounted to $8,300,000.

6.The state appropriation for operations amounted to $33,000,000.

7.The state appropriation for capital outlay amounted to $12,700,000.

8.Gifts for endowment purposes amounted to $4,000,000.Gifts for unrestricted purposes amounted to $6,000,000.Interest income,all unrestricted,amounted to $600,000.

(Essay)

4.8/5  (37)

(37)

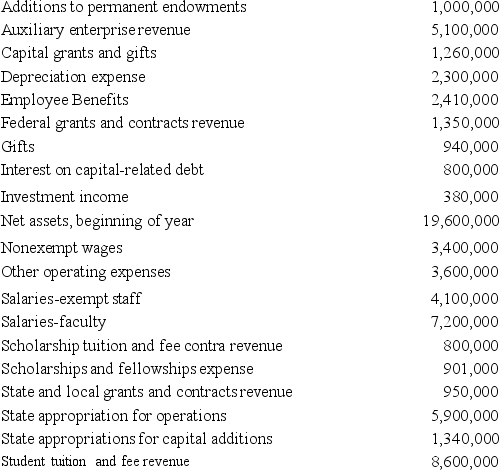

Northern State University had the following account balances for the year ended and as of June 30,2014.Debits are not distinguished from credits,so assume all accounts have a "normal" balance.

Required:

Prepare,in good form,a Statement of Revenues,Expenses,and Changes in Net Assets for Northern State University for the year ended June 30,2014.

Required:

Prepare,in good form,a Statement of Revenues,Expenses,and Changes in Net Assets for Northern State University for the year ended June 30,2014.

(Essay)

4.9/5  (33)

(33)

Public colleges and universities follow __________ guidelines while private colleges and universities follow ________ guidelines

(Multiple Choice)

4.9/5  (41)

(41)

Special-purpose governmental entities that are engaged in a single business activity are not required to prepare government-wide financial statements,but may issue only enterprise fund statements.

(True/False)

4.8/5  (38)

(38)

A County could be either a general-purpose or a special purpose government.

(True/False)

4.7/5  (37)

(37)

Which of the following is true regarding the Statement of Revenues,Expenses,and Changes in Net Assets for a public college?

(Multiple Choice)

4.8/5  (33)

(33)

Fire districts are examples of general-purpose state or local governments:

(True/False)

4.7/5  (50)

(50)

The following data applies to the next two questions.

•Northern University has a fiscal year end of June 30.

•In June 2014, tuition and fees of $1,200,000 was assessed for the summer term that runs from June 1, 2014 through August 31, 2014. $1,200,000 was collected on June 1, 2014.

-What is the journal entry on June 1 for Northern?

(Multiple Choice)

4.7/5  (37)

(37)

What are the criteria outlined in GASB Statement 39:

Determining Whether Certain Organizations Are Component Units for requiring public college foundations to be reported as discretely presented components in the college's financial reports?

(Essay)

4.8/5  (30)

(30)

Which of the following statements is true of a special-purpose government?

(Multiple Choice)

4.7/5  (39)

(39)

Public colleges must depreciate infrastructure and may not use the modified approach.

(True/False)

4.8/5  (29)

(29)

Which of the following is true regarding the financial statements for special-purpose entities?

(Multiple Choice)

4.9/5  (36)

(36)

Public higher education institutions typically report as special-purpose entities engaged in governmental and business-type activities or in governmental-type activities only.

(True/False)

4.9/5  (24)

(24)

Special purpose governments engaged only in fiduciary-type activities are required to prepare all of the following except:

(Multiple Choice)

4.9/5  (31)

(31)

GASB Statement 35 extends the provisions of GASB Statement 34 to both public and private colleges and universities.

(True/False)

4.9/5  (38)

(38)

Which of the following groups would not be considered a component unit of a special-purpose government,for the purposes of applying GASB Statement 39: Determining Whether Certain Organizations Are Component Units?

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following statements is (are)true regarding public colleges and universities choosing to report as special-purpose entities engaged in business-type activities only?

(Multiple Choice)

4.7/5  (34)

(34)

The implementation guide for GASB Statement 34 provides a distinction by indicating that "general purpose governments are thought to be those that offer more than one type of basic governmental service.

(True/False)

4.7/5  (37)

(37)

Public colleges who waive fees for graduate assistants must report tuition at the gross amount and expense the fees waived.

(True/False)

4.9/5  (35)

(35)

Showing 21 - 40 of 105

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)