Exam 5: Activity-Based Costing and Customer Profitability Analysis

Exam 1: Cost Management and Strategy67 Questions

Exam 2: Implementing Strategy: The Value Chain, the Balanced Scorecard, and the Strategy Map53 Questions

Exam 3: Basic Cost Management Concepts86 Questions

Exam 4: Job Costing103 Questions

Exam 5: Activity-Based Costing and Customer Profitability Analysis148 Questions

Exam 6: Process Costing90 Questions

Exam 7: Cost Allocation: Departments, Joint Products, and By-Products85 Questions

Exam 8: Cost Estimation110 Questions

Exam 9: Profit Planning: Cost-Volume-Profit Analysis98 Questions

Exam 10: Strategy and the Master Budget132 Questions

Exam 11: Decision Making With a Strategic Emphasis103 Questions

Exam 12: Strategy and the Analysis of Capital Investments150 Questions

Exam 13: Cost Planning for the Product Life Cycle: Target Costing,Theory of Constraints,and Strategic Pricing83 Questions

Exam 14: Operational Performance Measurement: Sales and Direct-Cost Variances, and the Role of Nonfinancial Performance Measures177 Questions

Exam 15: Operational Performance Measurement: Indirect-Cost Variances and Resource- Capacity Management166 Questions

Exam 16: Operational Performance Measurement: Further Analysis of Productivity and Sales124 Questions

Exam 17: The Management and Control of Quality118 Questions

Exam 18: Strategic Performance Measurement: Cost Centers, Profit Centers, and the Balanced Scorecard121 Questions

Exam 19: Strategic Performance Measurement: Investment Centers129 Questions

Exam 20: Management Compensation, Business Analysis, and Business Valuation87 Questions

Select questions type

An activity that is performed for each unit of production is a(n):

Free

(Multiple Choice)

4.9/5  (37)

(37)

Correct Answer:

C

Cost to process monthly statements is an example of a:

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

C

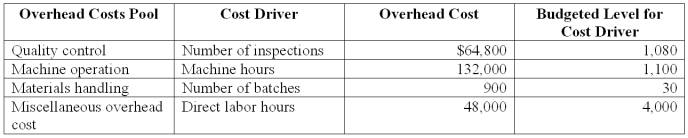

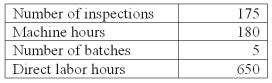

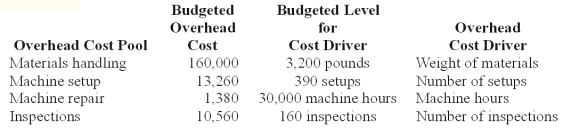

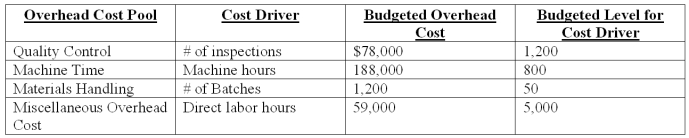

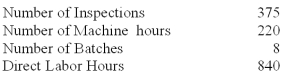

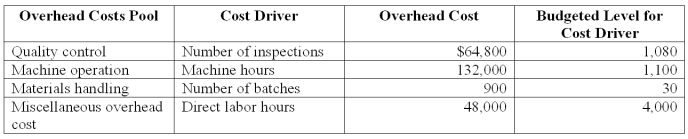

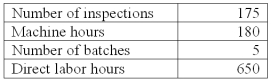

Sheen Co.manufacturers laser printers.It has outlined the following overhead cost drivers:  Sheen Co.has an order for 1,000 laser printers that has the following production requirements:

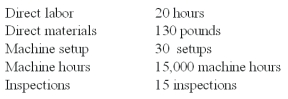

Sheen Co.has an order for 1,000 laser printers that has the following production requirements:  Using activity-based costing,applied miscellaneous factory overhead for the 1000 laser printer order based on direct labor hours is:

Using activity-based costing,applied miscellaneous factory overhead for the 1000 laser printer order based on direct labor hours is:

Free

(Multiple Choice)

4.8/5  (42)

(42)

Correct Answer:

A

In an organization that makes furniture,which of the following is a high value-added activity?

(Multiple Choice)

4.9/5  (40)

(40)

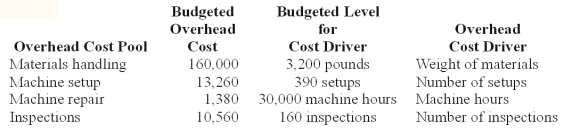

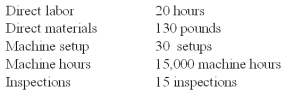

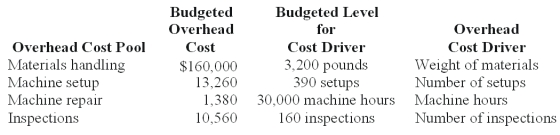

Wings Co.budgeted $555,600 manufacturing direct wages,2,315 direct labor hours and had the following manufacturing overhead:  Requirements for Job #971 which manufactured 4 units of product:

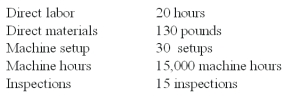

Requirements for Job #971 which manufactured 4 units of product:  If Wings uses a volume-based overhead rate based on direct labor hours,the manufacturing overhead for Job #971 is:

If Wings uses a volume-based overhead rate based on direct labor hours,the manufacturing overhead for Job #971 is:

(Multiple Choice)

4.7/5  (42)

(42)

Wings Co.budgeted $555,600 manufacturing direct wages,2,315 direct labor hours and had the following manufacturing overhead:  Requirements for Job #971 which manufactured 4 units of product:

Requirements for Job #971 which manufactured 4 units of product:  Using ABC,overhead cost assigned to Job #971 for machine repair is:

Using ABC,overhead cost assigned to Job #971 for machine repair is:

(Multiple Choice)

4.8/5  (40)

(40)

Wings Co.budgeted $555,600 manufacturing direct wages,2,315 direct labor hours,and had the following manufacturing overhead:  Requirements for Job #971 which manufactured 4 units of product:

Requirements for Job #971 which manufactured 4 units of product:  The total overhead of Job #971 under the ABC costing is:

The total overhead of Job #971 under the ABC costing is:

(Multiple Choice)

4.9/5  (32)

(32)

The major limitation of volume-based costing systems is the use of volume-based:

(Multiple Choice)

4.8/5  (40)

(40)

Diamond Cleats Co.manufactures cleats for baseball shoes.It has outlined the following overhead cost drivers:  Diamond Cleats Co.has an order for cleats that has the following production requirements:

Diamond Cleats Co.has an order for cleats that has the following production requirements:  Using activity-based costing,applied machine overhead for the baseball cleat order is:

Using activity-based costing,applied machine overhead for the baseball cleat order is:

(Multiple Choice)

4.8/5  (37)

(37)

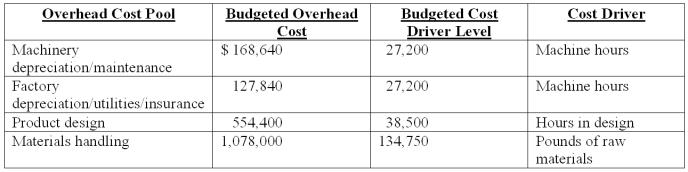

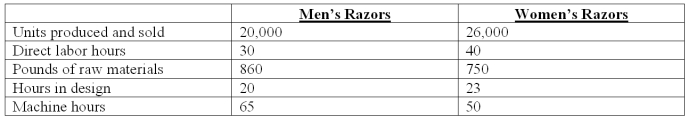

Shaver Co.manufactures a variety of electric razors for men and women.The company's plant is partially automated.Listed below is cost driver information used in the product-costing system:  In addition,Shaver expects to spend $514,368 for 8,037 direct labor-hours.Two current product orders had the following requirements:

In addition,Shaver expects to spend $514,368 for 8,037 direct labor-hours.Two current product orders had the following requirements:  What is the total manufacturing overhead assigned to the current order for Women's Razors if the firm uses a volume-based plantwide overhead rate based on the direct labor dollars?

What is the total manufacturing overhead assigned to the current order for Women's Razors if the firm uses a volume-based plantwide overhead rate based on the direct labor dollars?

(Multiple Choice)

4.7/5  (37)

(37)

Sheen Co.manufacturers laser printers.It has outlined the following overhead cost drivers:  Sheen Co.has an order for 1,000 laser printers that has the following production requirements:

Sheen Co.has an order for 1,000 laser printers that has the following production requirements:  Using activity-based costing,applied machine repetition overhead for the 1000 laser printer order is:

Using activity-based costing,applied machine repetition overhead for the 1000 laser printer order is:

(Multiple Choice)

4.8/5  (38)

(38)

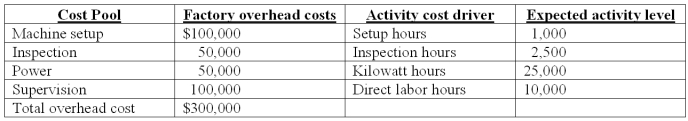

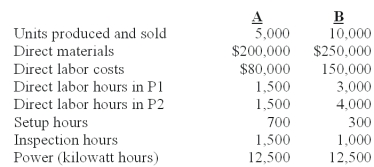

Demski Company has used a two-stage cost allocation system for many years.In the first stage,plant overhead costs are allocated to two production departments,P1 and P2,based on machine hours.In the second stage,Demski uses direct labor hours to assign overhead costs from the production departments to individual products A andB.

Budgeted factory overhead costs for the year are $300,000.Both the budgeted and actual machine hours in P1 and P2 are 12,000 and 28,000 hours,respectively.

After attending a seminar to learn the potential benefits of adopting an activity-based costing system (ABC),Ted Demski,the president of Demski Company,is considering implementing an ABC system.Upon his request,the controller at Demski Company has compiled the following information for analysis:

Demski manufactures two types of product,A and B,for which the following information is available:

Demski manufactures two types of product,A and B,for which the following information is available:

Required:

(1)Determine the unit cost for each of the two products using the traditional two-stage allocation method.Round calculations to 2 decimal places.

(2)Determine the unit cost for each of the two products using the proposed ABC system.

(3)(a)Compare the unit manufacturing costs for product A and product B computed in requirements 1 and 2.Why do two the cost systems differ in their total cost for each product?

(b)Why might these differences be important to the Demski Company?

Please see Feedback for answers.

Required:

(1)Determine the unit cost for each of the two products using the traditional two-stage allocation method.Round calculations to 2 decimal places.

(2)Determine the unit cost for each of the two products using the proposed ABC system.

(3)(a)Compare the unit manufacturing costs for product A and product B computed in requirements 1 and 2.Why do two the cost systems differ in their total cost for each product?

(b)Why might these differences be important to the Demski Company?

Please see Feedback for answers.

(Essay)

4.8/5  (34)

(34)

The controller for Alabama Cooking Oil Co.established the following overhead cost pools and cost drivers:

(Essay)

4.9/5  (33)

(33)

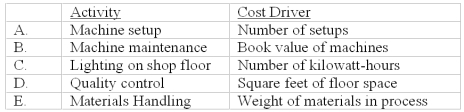

Which of the following has the weakest linkage between activity and cost driver?

(Multiple Choice)

4.9/5  (33)

(33)

Showing 1 - 20 of 148

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)