Exam 9: Net Present Value and Other Investment Criteria

Exam 1: Introduction to Corporate Finance61 Questions

Exam 2: Financial Statements, Taxes, and Cash Flow99 Questions

Exam 3: Working With Financial Statements111 Questions

Exam 4: Long-Term Financial Planning and Growth103 Questions

Exam 5: Introduction to Valuation: The Time Value of Money68 Questions

Exam 6: Discounted Cash Flow Valuation132 Questions

Exam 7: Interest Rates and Bond Valuation128 Questions

Exam 8: Stock Valuation119 Questions

Exam 9: Net Present Value and Other Investment Criteria112 Questions

Exam 10: Making Capital Investment Decisions108 Questions

Exam 11: Project Analysis and Evaluation106 Questions

Exam 12: Some Lessons From Capital Market History98 Questions

Exam 13: Return, Risk, and the Security Market Line108 Questions

Exam 14: Cost of Capital101 Questions

Exam 15: Raising Capital91 Questions

Exam 16: Financial Leverage and Capital Structure Policy98 Questions

Exam 17: Dividends and Dividend Policy104 Questions

Exam 18: Short-Term Finance and Planning110 Questions

Exam 19: Cash and Liquidity Management101 Questions

Exam 20: Credit and Inventory Management97 Questions

Exam 21: International Corporate Finance99 Questions

Exam 22: Behavioral Finance: Implications for Financial Management45 Questions

Exam 23: Risk Management: An Introduction to Financial Engineering71 Questions

Exam 24: Options and Corporate Finance106 Questions

Exam 25: Option Valuation86 Questions

Exam 26: Mergers and Acquisitions79 Questions

Exam 27: Leasing72 Questions

Select questions type

A project has an initial cost of $18,400 and produces cash inflows of $7,200, $8,900, and $7,500 over three years, respectively. What is the discounted payback period if the required rate of return is 16 percent?

Free

(Multiple Choice)

4.8/5  (37)

(37)

Correct Answer:

E

Mutually exclusive projects are best defined as competing projects which:

Free

(Multiple Choice)

4.9/5  (33)

(33)

Correct Answer:

C

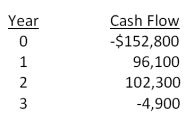

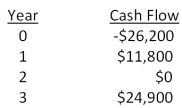

You are considering an investment with the following cash flows. If the required rate of return for this investment is 15.5 percent, should you accept the investment based solely on the internal rate of return rule? Why or why not?

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

E

The Square Box is considering two projects, both of which have an initial cost of $35,000 and total cash inflows of $50,000. The cash inflows of project A are $5,000, $10,000, $15,000, and $20,000 over the next four years, respectively. The cash inflows for project B are $20,000, $15,000, $10,000, and $5,000 over the next four years, respectively. Which one of the following statements is correct if The Square Box requires a 12 percent rate of return and has a required discounted payback period of 3.5 years?

(Multiple Choice)

4.7/5  (37)

(37)

A project has a discounted payback period that is equal to the required payback period. Given this, which of the following statements must be true?

I. The project must also be acceptable under the payback rule.

II. The project must have a profitability index that is equal to or greater than 1.0.

III. The project must have a zero net present value.

IV. The project's internal rate of return must equal the required return.

(Multiple Choice)

4.8/5  (39)

(39)

The length of time a firm must wait to recoup the money it has invested in a project is called the:

(Multiple Choice)

4.8/5  (38)

(38)

A project has a required payback period of three years. Which one of the following statements is correct concerning the payback analysis of this project?

(Multiple Choice)

4.9/5  (41)

(41)

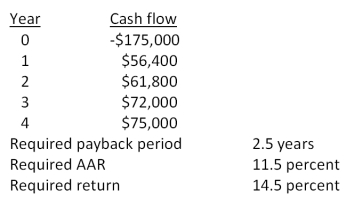

You are analyzing a project and have gathered the following data:  Based on the internal rate of return of _____ percent for this project, you should _____ the project.

Based on the internal rate of return of _____ percent for this project, you should _____ the project.

(Multiple Choice)

4.8/5  (41)

(41)

A firm evaluates all of its projects by applying the IRR rule. The required return for the following project is 21 percent. The IRR is _____ percent and the firm should ______ the project.

(Multiple Choice)

4.7/5  (33)

(33)

You are considering two independent projects with the following cash flows. The required return for both projects is 16 percent. Given this information, which one of the following statements is correct?

(Multiple Choice)

4.8/5  (40)

(40)

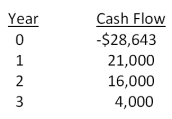

Based on the profitability index rule, should a project with the following cash flows be accepted if the discount rate is 14 percent? Why or why not?

(Multiple Choice)

4.7/5  (42)

(42)

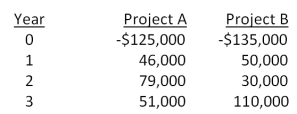

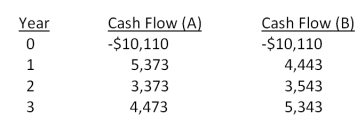

Consider the following two mutually exclusive projects:  What is the crossover rate for these two projects?

What is the crossover rate for these two projects?

(Multiple Choice)

4.9/5  (44)

(44)

An investment project costs $21,500 and has annual cash flows of $4,200 for 6 years. If the discount rate is 20 percent, what is the discounted payback period?

(Multiple Choice)

4.8/5  (39)

(39)

A project with financing type cash flows is typified by a project that has which one of the following characteristics?

(Multiple Choice)

4.8/5  (38)

(38)

The Chandler Group wants to set up a private cemetery business. According to the CFO, Barry M. Deep, business is "looking up". As a result, the cemetery project will provide a net cash inflow of $57,000 for the firm during the first year, and the cash flows are projected to grow at a rate of 7 percent per year forever. The project requires an initial investment of $759,000. The firm requires a 14 percent return on such undertakings. The company is somewhat unsure about the assumption of a 7 percent growth rate in its cash flows. At what constant rate of growth would the company just break even?

(Multiple Choice)

4.8/5  (40)

(40)

The present value of an investment's future cash flows divided by the initial cost of the investment is called the:

(Multiple Choice)

4.8/5  (34)

(34)

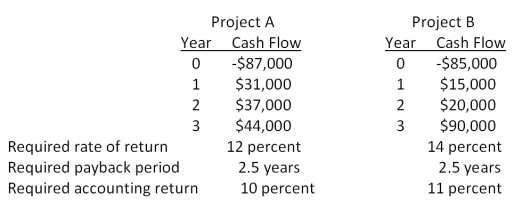

You are considering the following two mutually exclusive projects. Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project. Neither project has any salvage value.  Should you accept or reject these projects based on the profitability index?

Should you accept or reject these projects based on the profitability index?

(Multiple Choice)

4.8/5  (38)

(38)

Which one of the following is the best example of two mutually exclusive projects?

(Multiple Choice)

4.9/5  (36)

(36)

Which one of the following increases the net present value of a project?

(Multiple Choice)

4.9/5  (43)

(43)

Showing 1 - 20 of 112

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)