Exam 9: Net Present Value and Other Investment Criteria

Exam 1: Introduction to Corporate Finance71 Questions

Exam 2: Financial Statements,Taxes,and Cash Flow81 Questions

Exam 3: Working With Financial Statements96 Questions

Exam 4: Long-Term Financial Planning and Growth80 Questions

Exam 5: Introduction to Valuation: The Time Value of Money68 Questions

Exam 6: Discounted Cash Flow Valuation132 Questions

Exam 7: Interest Rates and Bond Valuation129 Questions

Exam 8: Stock Valuation119 Questions

Exam 9: Net Present Value and Other Investment Criteria115 Questions

Exam 10: Making Capital Investment Decisions108 Questions

Exam 11: Project Analysis and Evaluation106 Questions

Exam 12: Some Lessons From Capital Market History98 Questions

Exam 13: Return,Risk,and the Security Market Line109 Questions

Exam 14: Cost of Capital100 Questions

Exam 15: Raising Capital93 Questions

Exam 16: Financial Leverage and Capital Structure Policy98 Questions

Exam 17: Dividends and Payout Policy103 Questions

Exam 18: Short-Term Finance and Planning109 Questions

Exam 19: Cash and Liquidity Management101 Questions

Exam 20: Credit and Inventory Management97 Questions

Exam 21: International Corporate Finance99 Questions

Exam 22: Behavioral Finance: Implications for Financial Management45 Questions

Exam 23: Enterprise Risk Management68 Questions

Exam 24: Options and Corporate Finance106 Questions

Exam 25: Option Valuation79 Questions

Exam 26: Mergers and Acquisitions89 Questions

Exam 27: Leasing72 Questions

Select questions type

Southern Chicken is considering two projects.Project A consists of creating an outdoor eating area on the unused portion of the restaurant's property.Project B would use that outdoor space for creating a drive-thru service window.When trying to decide which project to accept,the firm should rely most heavily on which one of the following analytical methods?

(Multiple Choice)

4.7/5  (28)

(28)

You are considering a project with conventional cash flows and the following characteristics: Internal rate of return 11.63 percent Profitability ratio 1.04 Net present value \ 987 Payback period 2.98 years Which of the following statements is correct given this information?

I.The discount rate used in computing the net present value was less than 11.63 percent.

II.The discounted payback period must be more than 2.98 years.

III.The discount rate used in the computation of the profitability ratio was 11.63 percent.

IV.This project should be accepted as the internal rate of return exceeds the required return.

(Multiple Choice)

4.9/5  (45)

(45)

Which one of the following statements related to payback and discounted payback is correct?

(Multiple Choice)

4.8/5  (43)

(43)

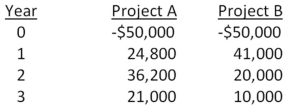

You are considering the following two mutually exclusive projects.The required rate of return is 14.6 percent for project A and 13.8 percent for project B.Which project should you accept and why?

(Multiple Choice)

4.8/5  (37)

(37)

Which one of the following methods determines the amount of the change a proposed project will have on the value of a firm?

(Multiple Choice)

4.8/5  (45)

(45)

A project produces annual net income of $46,200,$51,800,and $62,900 over its 3-year life,respectively.The initial cost of the project is $675,000.This cost is depreciated straight-line to a zero book value over three years.What is the average accounting rate of return if the required discount rate is 14.5 percent?

(Multiple Choice)

4.9/5  (41)

(41)

An investment project costs $21,500 and has annual cash flows of $6,500 for 6 years.If the discount rate is 15 percent,what is the discounted payback period?

(Multiple Choice)

4.8/5  (31)

(31)

A project has an initial cost of $6,500.The cash inflows are $900,$2,200,$3,600,and $4,100 over the next four years,respectively.What is the payback period?

(Multiple Choice)

4.9/5  (37)

(37)

It will cost $6,000 to acquire an ice cream cart.Cart sales are expected to be $3,600 a year for three years.After the three years,the cart is expected to be worthless as the expected life of the refrigeration unit is only three years.What is the payback period?

(Multiple Choice)

4.9/5  (31)

(31)

Blue Water Systems is analyzing a project with the following cash flows.Should this project be accepted based on the discounting approach to the modified internal rate of return if the discount rate is 14 percent? Why or why not? 1 137,400 2 189,300 3 -25,000

(Multiple Choice)

4.8/5  (34)

(34)

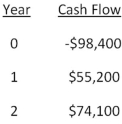

You would like to invest in the following project.  Sis,your boss,insists that only projects returning at least $1.06 in today's dollars for every $1 invested can be accepted.She also insists on applying a 14 percent discount rate to all cash flows.Based on these criteria,you should:

Sis,your boss,insists that only projects returning at least $1.06 in today's dollars for every $1 invested can be accepted.She also insists on applying a 14 percent discount rate to all cash flows.Based on these criteria,you should:

(Multiple Choice)

4.9/5  (29)

(29)

A project has a discounted payback period that is equal to the required payback period.Given this,which of the following statements must be true?

I.The project must also be acceptable under the payback rule.

II.The project must have a profitability index that is equal to or greater than 1.0.

III.The project must have a zero net present value.

IV.The project's internal rate of return must equal the required return.

(Multiple Choice)

4.9/5  (41)

(41)

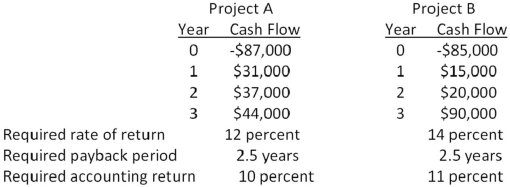

You are considering the following two mutually exclusive projects.Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.Neither project has any salvage value.  Should you accept or reject these projects based on IRR analysis?

Should you accept or reject these projects based on IRR analysis?

(Multiple Choice)

4.7/5  (37)

(37)

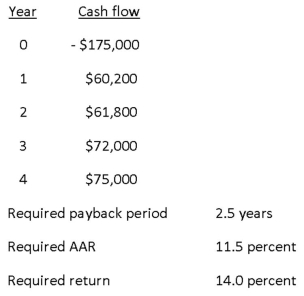

You are analyzing a project and have gathered the following data:  Based on the profitability index of _____ for this project,you should _____ the project.

Based on the profitability index of _____ for this project,you should _____ the project.

(Multiple Choice)

4.8/5  (37)

(37)

Showing 101 - 115 of 115

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)