Exam 16: Option Valuation

Exam 1: A Brief History of Risk and Return100 Questions

Exam 2: The Investment Process98 Questions

Exam 3: Overview of Security Types94 Questions

Exam 4: Mutual Funds and Other Investment Companies101 Questions

Exam 5: The Stock Market104 Questions

Exam 6: Common Stock Valuation102 Questions

Exam 7: Stock Price Behavior and Market Efficiency82 Questions

Exam 8: Behavioral Finance and the Psychology of Investing84 Questions

Exam 9: Interest Rates100 Questions

Exam 10: Bond Prices and Yields95 Questions

Exam 11: Diversification and Risky Asset Allocation84 Questions

Exam 12: Return, Risk, and the Security Market Line84 Questions

Exam 13: Performance Evaluation and Risk Management91 Questions

Exam 14: Futures Contracts97 Questions

Exam 15: Stock Options100 Questions

Exam 16: Option Valuation72 Questions

Exam 17: Projecting Cash Flow and Earnings100 Questions

Exam 18: Corporate and Government Bonds107 Questions

Exam 19: Global Economic Activity and Industry Analysis70 Questions

Exam 20: Mortgage-Backed Securities92 Questions

Select questions type

Given a set of variables,the Black-Scholes option pricing formula has a call option delta of .496.What is the put delta given these same variables?

Free

(Multiple Choice)

4.8/5  (32)

(32)

Correct Answer:

B

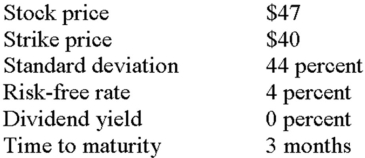

What is the call option premium given the following information?

Free

(Multiple Choice)

4.9/5  (42)

(42)

Correct Answer:

C

You own 1,500 shares of ABC stock that is currently priced at $27 a share.Given this price,the option delta for a $25 call option on this stock is .724.How many $25 call options do you need to hedge against a -$1 change in the price of the stock?

Free

(Multiple Choice)

4.8/5  (42)

(42)

Correct Answer:

D

You own 7,500 shares of GO stock which is currently valued at $47 a share.The $50 put has a premium of $2.50 and a put delta of -.60.What position should you take in $50 put contracts to hedge your stock against a $1 decrease in price?

(Multiple Choice)

4.8/5  (29)

(29)

A stock is currently priced at $44 a share while the $45 call option is priced at $1.22.The call option delta is .86.What is the approximate call price if the stock increases in value to $45?

(Multiple Choice)

4.9/5  (32)

(32)

Which one of the following statements concerning the relationship between the volatility of the underlying stock price,as measured by sigma,and call and put prices is correct?

(Multiple Choice)

4.7/5  (37)

(37)

Which one of the following statements concerning option prices is correct?

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following statements related to employee stock options (ESO)are generally correct?

I.ESO vesting encourages long-term employment.

II.Most ESOs are issued at-the-money.

III.ESOs cannot be resold.

IV.ESOs that are in-the-money are frequently repriced.

(Multiple Choice)

4.9/5  (47)

(47)

Which option price(s)will increase when the dividend yield increases?

(Multiple Choice)

4.9/5  (39)

(39)

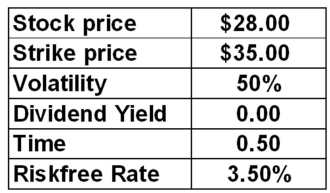

What is the put option premium given the following information?

(Multiple Choice)

4.7/5  (33)

(33)

All else constant,which one of the following situations will produce the highest call price given a strike price of $27.50?

(Multiple Choice)

4.9/5  (45)

(45)

Repricing an employee stock option involves which one of the following?

(Multiple Choice)

4.9/5  (36)

(36)

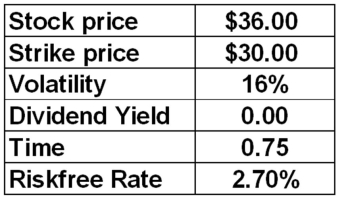

What is the call option premium given the following information?

(Multiple Choice)

4.7/5  (52)

(52)

Draw a graph with the option price on the vertical axis and the time to expiration on the horizontal axis.Illustrate how put and call option prices vary as the time to expiration increases.

(Essay)

4.8/5  (40)

(40)

Which one of the following situations will produce the highest call price,all else constant?

(Multiple Choice)

4.9/5  (32)

(32)

Which one of the following inputs is included in the Black-Scholes-Merton model but not in the Black-Scholes model?

(Multiple Choice)

4.8/5  (40)

(40)

Which one of the following terms is used as a shortcut means of saying "time to maturity"?

(Multiple Choice)

4.8/5  (39)

(39)

Showing 1 - 20 of 72

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)