Exam 9: Nontaxable Exchanges

Exam 1: Taxes and Taxing Jurisdictions87 Questions

Exam 2: Policy Standards for a Good Tax85 Questions

Exam 3: Taxes As Transaction Costs82 Questions

Exam 4: Maxims of Income Tax Planning92 Questions

Exam 5: Tax Research82 Questions

Exam 6: Taxable Income From Business Operations116 Questions

Exam 7: Property Acquisitions and Cost Recovery Deductions116 Questions

Exam 8: Property Dispositions122 Questions

Exam 9: Nontaxable Exchanges107 Questions

Exam 10: Sole Proprietorships, Partnerships, llcs, and S Corporations97 Questions

Exam 11: The Corporate Taxpayer103 Questions

Exam 12: The Choice of Business Entity102 Questions

Exam 13: Jurisdictional Issues in Business Taxation107 Questions

Exam 14: The Individual Tax Formula113 Questions

Exam 15: Compensation and Retirement Planning107 Questions

Exam 16: Investment and Personal Financial Planning109 Questions

Exam 17: Tax Consequences of Personal Activities93 Questions

Exam 18: The Tax Compliance Process86 Questions

Select questions type

Ms.Ellis sold 889 shares of publicly traded Omer stock (tax basis $161,400)for $125,000 cash on July 2.She paid $136,200 cash to purchase 900 Omer shares on August 8.Compute Ms.Ellis' loss recognized on the July 2 sale and determine her tax basis in the 1,000 shares.

(Multiple Choice)

4.9/5  (31)

(31)

G&G Inc.transferred an old asset with a $110,300 adjusted tax basis plus $20,000 cash in exchange for a new asset worth $150,000.Which of the following statements is false?

(Multiple Choice)

4.8/5  (29)

(29)

The goodwill of one business is never of a like-kind to the goodwill of a different business.

(True/False)

5.0/5  (38)

(38)

A taxpayer who realizes a loss on the sale of marketable securities and reacquires substantially the same securities within the 30 day period before the sale cannot recognize the loss.

(True/False)

4.9/5  (41)

(41)

In April,vandals completely destroyed outdoor signage owned by Renfru Inc.Renfru's adjusted tax basis in the signage was $31,300.Renfru received a $50,000 reimbursement from its property insurance company,and on August 8,it paid $60,000 to replace the signage.Compute Renfru's recognized gain on loss on the involuntary conversion and its tax basis in the new signage.

(Multiple Choice)

4.8/5  (31)

(31)

Kornek Inc.transferred an old asset with a $200,000 adjusted tax basis plus $12,000 cash in exchange for a new asset worth $260,000.Which of the following statements is false?

(Multiple Choice)

4.9/5  (40)

(40)

Qualifying property received in a nontaxable exchange has a cost basis for tax purposes.

(True/False)

4.7/5  (36)

(36)

IPM Inc.and Zeta Company formed IPeta Inc.by transferring business assets in exchange for 1,000 shares of IPeta common stock.IPM transferred assets with a $675,000 FMV and a $283,000 adjusted tax basis and received 600 shares.Zeta transferred assets with a $450,000 FMV and a $98,000 adjusted tax basis and received 400 shares.Determine IPM and Zeta's tax basis in their IPeta stock and IPeta's aggregate tax basis in the transferred assets.

(Multiple Choice)

4.9/5  (46)

(46)

Denali,Inc.exchanged equipment with a $230,000 adjusted basis for like-kind equipment with a $200,000 FMV and $5,000 cash.How much loss may Denali recognize?

(Multiple Choice)

5.0/5  (33)

(33)

A taxpayer who realizes a loss on the exchange of like-kind property can elect to recognize the loss.

(True/False)

4.8/5  (37)

(37)

Mrs.Brinkley transferred business property (FMV $340,200; adjusted tax basis $111,700)to M&W Inc.in exchange for 4,200 shares of M&W stock.Immediately after the exchange,M&W had 7,800 shares of outstanding stock.Compute M&W's recognized gain on its exchange of stock for property and determine M&W's tax basis in the property received from Mrs.Brinkley.

(Multiple Choice)

4.7/5  (46)

(46)

IPM Inc.and Zeta Company formed IPeta Inc.by transferring business assets in exchange for 1,000 shares of IPeta common stock.IPM transferred assets with a $675,000 FMV and a $283,000 adjusted tax basis and received 600 shares.Zeta transferred assets with a $450,000 FMV and a $98,000 adjusted tax basis and received 400 shares.Which of the following statements is false?

(Multiple Choice)

4.8/5  (38)

(38)

Acme Inc.and Beamer Company exchanged like-kind production assets.Acme's asset had a $240,000 FMV and $117,300 adjusted tax basis,and Beamer's asset had a $225,000 FMV and a $168,200 adjusted tax basis.Beamer paid $15,000 cash to Acme as part of the exchange.Which of the following statements is true?

(Multiple Choice)

4.7/5  (42)

(42)

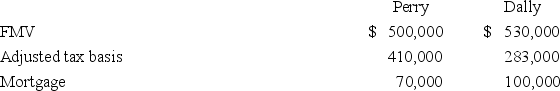

Perry Inc.and Dally Company entered into an exchange of real property.Here is the information for the properties to be exchanged.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

Pursuant to the exchange,Perry assumed the mortgage on the Dally property,and Dally assumed the mortgage on the Perry property.Compute Perry's gain recognized on the exchange and its tax basis in the property received from Dally.

(Multiple Choice)

4.8/5  (30)

(30)

On July 2,2017,a tornado destroyed an asset owned by Leigh Inc.,a calendar year taxpayer.Leigh's adjusted tax basis in the asset was $22,700,and the reimbursement from its property insurance company was $35,000.If Leigh wants to defer recognizing its $12,300 realized gain,it must replace the asset no later than December 31,2018.

(True/False)

4.9/5  (33)

(33)

Vincent Company transferred business realty (FMV $2.3 million; adjusted tax basis $973,000)to Massur Inc.in exchange for Massur common stock.Which of the following statements is false?

(Multiple Choice)

4.7/5  (45)

(45)

Loonis Inc.and Rhea Company formed LooNR Inc.by transferring business assets in exchange for 1,000 shares of LooNR common stock.Loonis transferred assets with a $820,000 FMV and a $444,000 adjusted tax basis and received 820 shares.Rhea transferred assets with a $180,000 FMV and a $75,000 adjusted tax basis and received 180 shares.Compute Loonis and Rhea's realized and recognized gain on the exchange.

(Multiple Choice)

4.8/5  (38)

(38)

All types of business and investment real properties are like-kind.

(True/False)

4.9/5  (34)

(34)

Luce Company exchanged the copyright on a software application for a copyright on a different software application.Luce's gain on the exchange was nontaxable (because the copyrights were like-kind)but was included in financial statement income.Which of the following statements is false?

(Multiple Choice)

4.9/5  (36)

(36)

IPM Inc.and Zeta Company formed IPeta Inc.by transferring business assets in exchange for 1,000 shares of IPeta common stock.IPM transferred assets with a $675,000 FMV and a $283,000 adjusted tax basis and received 600 shares.Zeta transferred assets with a $450,000 FMV and a $98,000 adjusted tax basis and received 400 shares.Compute IPM and Zeta's realized and recognized gain on the exchange.

(Multiple Choice)

4.9/5  (32)

(32)

Showing 21 - 40 of 107

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)