Exam 3: Governmental Operating Statement Accounts Budgetary Accounting

Exam 1: Introduction to Accounting and Financial Reporting for Governmental and Not-For-Profit Entities59 Questions

Exam 2: Principles of Accounting and Financial Reporting for State and Local Governments66 Questions

Exam 3: Governmental Operating Statement Accounts Budgetary Accounting80 Questions

Exam 4: Accounting for Governmental Operating Activitiesillustrative Transactions and Financial Statements86 Questions

Exam 5: Accounting for General Capital Assets and Capital Projects82 Questions

Exam 6: Accounting for General Long-Term Liabilities and Debt Service72 Questions

Exam 7: Accounting for the Business-Type Activities of State and Local Governments75 Questions

Exam 8: Accounting for Fiduciary Activitiesagency and Trust Funds63 Questions

Exam 9: Financial Reporting of State and Local Governments65 Questions

Exam 10: Analysis of Governmental Financial Performance59 Questions

Exam 11: Auditing of Governmental and Not-For-Profit Organizations65 Questions

Exam 12: Budgeting and Performance Measurement59 Questions

Exam 13: Accounting for Not-For-Profit Organizations74 Questions

Exam 14: Not-For-Profit Organizationsregulatory, Taxation, and Performance Issues54 Questions

Exam 15: Accounting for Colleges and Universities61 Questions

Exam 16: Accounting for Health Care Organizations59 Questions

Exam 17: Accounting and Reporting for the Federal Government Glossary65 Questions

Select questions type

A statement of revenues,expenditures,and changes in fund balances-budget and actual is:

(Multiple Choice)

4.7/5  (47)

(47)

Which of the following best describes the recommended format for the government-wide statement of activities?

(Multiple Choice)

4.8/5  (43)

(43)

Which of the following is regarding other financing sources and other financing uses?

(Multiple Choice)

4.8/5  (35)

(35)

Define the term revenue and distinguish between revenue and other financing sources.

(Essay)

4.7/5  (45)

(45)

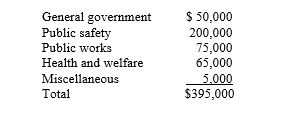

During July 2016,the first month of the 2017 fiscal year,the City of Jackson Hole issued the following purchase orders and contracts:

Show the summary general journal entry to record the issuance of the purchase orders and contracts.You may ignore entries in the subsidiary ledger accounts.

Show the summary general journal entry to record the issuance of the purchase orders and contracts.You may ignore entries in the subsidiary ledger accounts.

(Short Answer)

4.7/5  (39)

(39)

An encumbrance represents the estimated future liability for goods or services resulting from placing a purchase order or signing a contract.

(True/False)

4.9/5  (46)

(46)

Indicate whether the following revenues should be classified as program revenues or general revenues on the government-wide statement of activities.

(Essay)

4.7/5  (36)

(36)

When supplies ordered for use in an activity accounted for in the General Fund are received at an actual price that is more than the estimated price on the purchase order,the Encumbrance account is:

(Multiple Choice)

4.8/5  (32)

(32)

How might a citizen become involved in the local government budgeting process?

(Essay)

5.0/5  (42)

(42)

Under the modified accrual basis of accounting,expenditures generally are not recognized until:

(Multiple Choice)

4.8/5  (39)

(39)

The account "Interfund Transfers In" would be classified in a General Fund statement of revenues,expenditures,and changes in fund balance as a(an):

(Multiple Choice)

4.9/5  (30)

(30)

The revenue classifications recommended by GASB standards are listed below:

A.Taxes

B.Licenses and permits

C.Intergovernmental revenue

D.Charges for services

E.Fines and forfeits

F.Miscellaneous

For each revenue source listed below indicate its correct classification by placing the appropriate letter in the blank space next to the item.

____ 1.Capital grant received by a city from a state

____ 2.Property tax levied by city

____ 3.Library use fees

____ 4.Building permit

____ 5.Speeding ticket

(Short Answer)

4.8/5  (38)

(38)

Which of the following neither increases nor decreases fund balance of the General Fund during the current period?

(Multiple Choice)

4.7/5  (31)

(31)

Encumbrance accounting is required in the accounting for payroll of governmental funds.

(True/False)

4.9/5  (39)

(39)

Extraordinary items and special items are reported on the government-wide statement of activities

(Multiple Choice)

4.9/5  (36)

(36)

Three categories of program revenues are reported in the statement of activities: charges for services,operating grants and contributions,and capital grants and contributions.

(True/False)

4.7/5  (44)

(44)

The journal entry to record budgeted revenues will include:

(Multiple Choice)

4.9/5  (37)

(37)

Fund-based financial statements are intended to provide detailed financial information about the governmental,proprietary,and fiduciary activities of the primary government.

(True/False)

4.9/5  (38)

(38)

Showing 21 - 40 of 80

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)