Exam 3: Governmental Operating Statement Accounts Budgetary Accounting

Exam 1: Introduction to Accounting and Financial Reporting for Governmental and Not-For-Profit Entities59 Questions

Exam 2: Principles of Accounting and Financial Reporting for State and Local Governments66 Questions

Exam 3: Governmental Operating Statement Accounts Budgetary Accounting80 Questions

Exam 4: Accounting for Governmental Operating Activitiesillustrative Transactions and Financial Statements86 Questions

Exam 5: Accounting for General Capital Assets and Capital Projects82 Questions

Exam 6: Accounting for General Long-Term Liabilities and Debt Service72 Questions

Exam 7: Accounting for the Business-Type Activities of State and Local Governments75 Questions

Exam 8: Accounting for Fiduciary Activitiesagency and Trust Funds63 Questions

Exam 9: Financial Reporting of State and Local Governments65 Questions

Exam 10: Analysis of Governmental Financial Performance59 Questions

Exam 11: Auditing of Governmental and Not-For-Profit Organizations65 Questions

Exam 12: Budgeting and Performance Measurement59 Questions

Exam 13: Accounting for Not-For-Profit Organizations74 Questions

Exam 14: Not-For-Profit Organizationsregulatory, Taxation, and Performance Issues54 Questions

Exam 15: Accounting for Colleges and Universities61 Questions

Exam 16: Accounting for Health Care Organizations59 Questions

Exam 17: Accounting and Reporting for the Federal Government Glossary65 Questions

Select questions type

Which of the following is not a category of program revenue reported on the statement of activities at the government-wide level?

(Multiple Choice)

4.7/5  (35)

(35)

The Expenditures control account of a government is debited when:

(Multiple Choice)

4.8/5  (28)

(28)

When equipment that is to be used by the General Fund is received,how should it be recorded?

(Multiple Choice)

4.9/5  (41)

(41)

The numerical difference between (1)current assets and deferred outflows and (2)current liabilities and deferred inflows recorded in governmental funds is denoted as net position.

(True/False)

4.8/5  (26)

(26)

The expenditure classification "Public Safety" is an example of which of the following types of classifications?

(Multiple Choice)

5.0/5  (39)

(39)

If supplies that were ordered by a department financed by the General Fund are received at an actual price that is less than the estimated price on the purchase order,the department's available balance of appropriations for supplies will be:

(Multiple Choice)

4.8/5  (41)

(41)

GASB standards suggest the following classification scheme for expenditures:

A.Function

B.Program

C.Organization unit

D.Activity

E.Character

F.Object

For each of the following expenditure items,indicate its correct classification by placing the appropriate letter in the blank space next to the item.

____ 1.Streetlight repair

____ 2.City clerk

____ 3.Salaries and wages

____ 4.Transportation

____ 5.Current operating expenditures

(Short Answer)

4.8/5  (39)

(39)

If a state law requires that local governments prepare General Fund and special revenue fund budgets on a basis that differs from the basis of accounting required by generally accepted accounting principles (GAAP):

(Multiple Choice)

4.7/5  (48)

(48)

Other financing sources increase fund balance in the same manner as revenues.

(True/False)

4.9/5  (44)

(44)

Fund balance may be classified as all of the following except:

(Multiple Choice)

4.8/5  (36)

(36)

The County Commission of Seminole County adopted its General Fund budget for the year ending June 30,comprising estimated revenues of $13,200,000 and appropriations of $12,900,000.Seminole County utilizes the budgetary accounts required by GASB standards.The journal entry to record budgeted appropriations will include:

(Multiple Choice)

5.0/5  (34)

(34)

Program revenues are distinguished from general revenues on the government-wide statement of activities under GASB standards.

(True/False)

4.7/5  (35)

(35)

An interim schedule comparing the detail of appropriations,expenditures,and encumbrances should be prepared on an appropriate periodic basis to determine whether appropriations are being expended at the expected rate for the period and for the budget year to date.

(True/False)

4.9/5  (39)

(39)

The expenditure classification "City Attorney" is an example of which of the following types of classification?

(Multiple Choice)

4.8/5  (46)

(46)

GASB standards require that all state and local governments present a statement of revenues,expenditures,and changes in fund balances-budget and actual for the General Fund and major special revenue funds for which annual budgets have been legally adopted.

(True/False)

4.7/5  (42)

(42)

The County Commission of Canyon County adopted its General Fund budget for the year ending June 30,comprising estimated revenues of $13,200,000 and appropriations of $12,900,000.The budgeted excess of estimated revenues over appropriations will be recorded as:

(Multiple Choice)

4.8/5  (39)

(39)

The Expenditures control account of a government is credited when:

(Multiple Choice)

4.9/5  (32)

(32)

Government-wide financial statements include financial information for all governmental,proprietary,and fiduciary funds.

(True/False)

4.9/5  (34)

(34)

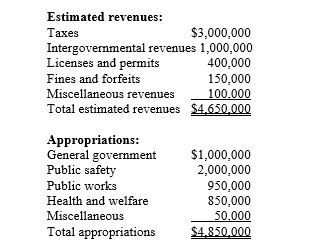

The City of Jackson Hole adopted the following General Fund budget for fiscal year 2017:

Estimated revenues:

Required

Prepare a summary general journal entry to record the adopted budget at the beginning of FY 2017.You may ignore entries in the subsidiary ledger accounts.

Required

Prepare a summary general journal entry to record the adopted budget at the beginning of FY 2017.You may ignore entries in the subsidiary ledger accounts.

(Short Answer)

4.8/5  (36)

(36)

Showing 41 - 60 of 80

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)