Exam 3: Process Costing and Analysis

Exam 1: Managerial Accounting Concepts and Principles250 Questions

Exam 2: Job Order Costing and Analysis217 Questions

Exam 3: Process Costing and Analysis230 Questions

Exam 4: Activity Based Costing and Analysis220 Questions

Exam 5: Cost Behavior Cost-Volume-Profit Analysis247 Questions

Exam 6: Variable Costing and Analysis201 Questions

Exam 7: Master Budgets and Performance Planning213 Questions

Exam 8: Flexible Budgets and Standard Costs222 Questions

Exam 9: Performance Measurement and Responsibility Accounting208 Questions

Exam 10: Relevant Costing for Managerial Decisions117 Questions

Exam 11: Capital Budgeting and Investment Analysis159 Questions

Exam 12: Reporting Cash Flows239 Questions

Exam 13: Analysis of Financial Statements233 Questions

Exam 14: Time Value of Money84 Questions

Exam 15: Analyzing for Business Transactions250 Questions

Exam 16: Partnership Accounting179 Questions

Select questions type

A process costing system records all factory overhead costs directly in the Work in Process Inventory accounts.

(True/False)

4.8/5  (37)

(37)

Clarksen Company uses a process costing system. The company requisitioned $93,000 of materials for Department A and $67,000 of materials for Department D. The entry to record the use of the direct materials by these two departments is:

(Multiple Choice)

4.9/5  (45)

(45)

Sparky Corporation uses the weighted-average method of process costing. The following information is available for February in its Molding Department: Units:

Beginning Inventory: 25,000 units, 100% complete as to materials and 55% complete as to conversion.

Units started and completed: 110,000.

Units completed and transferred out: 135,000.

Ending Inventory: 30,000 units, 100% complete as to materials and 30% complete as to conversion.

Costs:

Costs in beginning Work in Process - Direct Materials: $43,000.

Costs in beginning Work in Process - Conversion: $48,850.

Costs incurred in February - Direct Materials: $287,000.

Costs incurred in February - Conversion: $599,150.

Calculate the equivalent units of materials.

(Multiple Choice)

4.7/5  (47)

(47)

Williams Company computed its cost per equivalent unit for direct materials to be $2.60 and its cost per equivalent unit for conversion to be $3.75. A total of 250,000 units of product were completed and transferred out as finished goods during the month. The ending Work in Process inventory consists of 36,000 equivalent units of direct materials and 36,000 equivalent units of conversion costs. The amount that should be reported in ending Work in Process Inventory is:

(Multiple Choice)

4.9/5  (36)

(36)

In a process costing system, companies typically end each period with only Finished Goods Inventory.

(True/False)

4.9/5  (31)

(31)

During November, the production department of a process operations system completed and transferred to finished goods 35,000 units that were in process at the beginning of November and 110,000 that were started and completed in November. November's beginning inventory units were 100% complete with respect to materials and 55% complete with respect to conversion. At the end of November, 40,000 additional units were in process in the production department and were 100% complete with respect to materials and 30% complete with respect to conversion. Compute the number of equivalent units with respect to conversion for November using the weighted-average method.

(Multiple Choice)

4.8/5  (31)

(31)

If a department that applies process costing starts the reporting period with 50,000 physical units that were 25% complete with respect to direct materials and 40% complete with respect to direct labor, it must add 12,500 equivalent units of direct materials and 20,000 equivalent units of direct labor to complete them.

(True/False)

4.9/5  (32)

(32)

Manufacturers that utilize process operations produce large quantities of identical products.

(True/False)

4.8/5  (40)

(40)

Describe the flow of materials in a process costing system, including accounts used.

(Essay)

4.9/5  (31)

(31)

A company uses a process costing system and the weighted average method for inventory costs. The following information is available regarding direct labor for the current year:

Work in Process, January 1 5,500 units, 80% complete

Work in Process, December 31 8,800 units, 40% complete

Units completed and transferred to

finished goods 46,900 units

Direct labor costs during the year $266,300

(a) Calculate the equivalent units of production for direct labor for the year.

(b) Calculate the average cost per equivalent unit for direct labor (round to the nearest cent).

(Essay)

4.9/5  (39)

(39)

Wilturner Company incurs $74,000 of labor related directly to the product in the Assembly Department, $23,000 of labor not directly related to the product but related to the Assembly Department as a whole, and $10,000 of labor for services that help production in both the Assembly and Finishing departments. The journal entries to record the labor would include:

(Multiple Choice)

4.8/5  (30)

(30)

Equivalent units of production are always the same as the total number of physical units finished during the period.

(True/False)

4.9/5  (32)

(32)

Conversion cost per equivalent unit is the combined cost of direct materials, direct labor, and factory overhead per equivalent unit.

(True/False)

4.9/5  (47)

(47)

In process costing, all indirect materials are charged directly to Work in Process Inventory.

(True/False)

4.9/5  (30)

(30)

Wang Company provides the following data for the current year:

Estimated Factory Overhead $7,800

Factory Overhead Incurred $11,400

Factory Overhead Applied ?

Estimated Direct Labor Cost $12,000

Direct Labor Cost Incurred $11,800

Required:

a. Calculate the predetermined overhead allocation rate based on direct labor.

b. Determine the amount of overhead applied to production.

c. Prepare the journal entry to apply factory overhead to Work in Process.

(Essay)

4.8/5  (41)

(41)

The fourth step in accounting for production activity in a period is to prepare a cost reconciliation, which reconciles ________ with the ________.

(Short Answer)

4.8/5  (41)

(41)

During January, the production department of a process operations system completed and transferred to finished goods a total of 78,000 units. At the end of January, 9,000 additional units were in process in the production department and were 65% complete with respect to labor. The beginning inventory included labor cost of $37,100 and the production department incurred direct labor cost of $294,300 during January. Compute the direct labor cost per equivalent unit for the department using the weighted-average method.

(Multiple Choice)

4.8/5  (40)

(40)

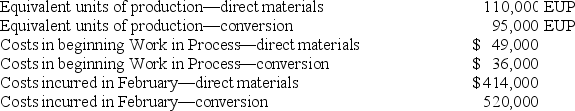

Andrews Corporation uses the weighted-average method of process costing. The following information is available for February in its Polishing Department:  The cost per equivalent unit of production for direct materials is:

The cost per equivalent unit of production for direct materials is:

(Multiple Choice)

4.7/5  (38)

(38)

At the beginning of the month, the Forming Department of Martin Manufacturing had 10,000 units in inventory, 30% complete as to materials, and 10% complete as to conversion. During the month the department started 60,000 units and transferred 62,000 units to the next manufacturing department. At the end of the month, the department had 8,000 units in inventory, 80% complete as to materials and 60% complete as to conversion. How many units did the Forming Department start and complete in the current month?

(Multiple Choice)

4.8/5  (29)

(29)

Conversion cost per equivalent unit is the combined costs of direct materials and factory overhead.

(True/False)

4.7/5  (38)

(38)

Showing 181 - 200 of 230

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)