Exam 3: Process Costing and Analysis

Exam 1: Managerial Accounting Concepts and Principles250 Questions

Exam 2: Job Order Costing and Analysis217 Questions

Exam 3: Process Costing and Analysis230 Questions

Exam 4: Activity Based Costing and Analysis220 Questions

Exam 5: Cost Behavior Cost-Volume-Profit Analysis247 Questions

Exam 6: Variable Costing and Analysis201 Questions

Exam 7: Master Budgets and Performance Planning213 Questions

Exam 8: Flexible Budgets and Standard Costs222 Questions

Exam 9: Performance Measurement and Responsibility Accounting208 Questions

Exam 10: Relevant Costing for Managerial Decisions117 Questions

Exam 11: Capital Budgeting and Investment Analysis159 Questions

Exam 12: Reporting Cash Flows239 Questions

Exam 13: Analysis of Financial Statements233 Questions

Exam 14: Time Value of Money84 Questions

Exam 15: Analyzing for Business Transactions250 Questions

Exam 16: Partnership Accounting179 Questions

Select questions type

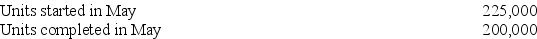

Pitt Enterprises manufactures jeans. All materials are introduced at the beginning of the manufacturing process in the Cutting Department. Conversion costs are incurred uniformly throughout the manufacturing process. As the cutting of material is completed, the pieces are immediately transferred to the Sewing Department. Information for the Cutting Department for the month of May follows. Work in Process, May 1 (50,000 units, 100% complete for direct materials, 40% complete with respect to conversion costs; includes $70,500 of direct material cost; $34,050 of conversion costs).

Work in Process, May 31 (75,000 units, 100% complete for direct materials; 20% complete for conversion costs).

Work in Process, May 31 (75,000 units, 100% complete for direct materials; 20% complete for conversion costs).

If Pitt Enterprises uses the weighted average method of process costing, compute the equivalent units for direct materials and conversion respectively for May.

If Pitt Enterprises uses the weighted average method of process costing, compute the equivalent units for direct materials and conversion respectively for May.

(Multiple Choice)

4.8/5  (31)

(31)

A production department's output for the most recent month consisted of 8,000 units completed and transferred to the next stage of production and 5,000 units in ending Work in Process inventory. The units in ending Work in Process inventory were 50% complete with respect to both direct materials and conversion costs. Calculate the equivalent units of production for the month, assuming the company uses the weighted average method.

(Multiple Choice)

4.7/5  (40)

(40)

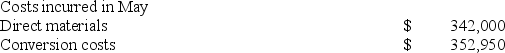

Dazzle, Inc. produces beads for jewelry making use. The following information summarizes production operations for June. The journal entry to record June production activities for overhead allocation is:

(Multiple Choice)

4.8/5  (35)

(35)

Sparky Corporation uses the FIFO method of process costing. The following information is available for February in its Molding Department: Units:

Beginning Inventory: 25,000 units, 100% complete as to materials and 55% complete as to conversion.

Units started and completed: 110,000.

Units completed and transferred out: 135,000.

Ending Inventory: 30,000 units, 100% complete as to materials and 30% complete as to conversion.

Costs:

Costs in beginning Work in Process - Direct Materials: $43,000.

Costs in beginning Work in Process - Conversion: $48,850.

Costs incurred in February - Direct Materials: $287,000.

Costs incurred in February - Conversion: $599,150.

Calculate the cost per equivalent unit of conversion.

(Multiple Choice)

4.8/5  (40)

(40)

The FIFO method of computing equivalent units excludes the beginning inventory costs in computing the cost per equivalent unit for the current period.

(True/False)

4.9/5  (38)

(38)

During March, the production department of a process operations system completed and transferred to finished goods 25,000 units that were in process at the beginning of March and 110,000 units that were started and completed in March. March's beginning inventory units were 100% complete with respect to materials and 55% complete with respect to conversion. At the end of March, 30,000 additional units were in process in the production department and were 100% complete with respect to materials and 30% complete with respect to conversion. Compute the number of equivalent units with respect to both materials and conversion respectively for March using the weighted-average method.

(Multiple Choice)

4.9/5  (36)

(36)

When raw materials are purchased on account for use in a process costing system, the corresponding journal entry that should be recorded will include:

(Multiple Choice)

4.9/5  (35)

(35)

Process costing systems are commonly used by companies that manufacture standardized products by passing them through a series of manufacturing steps.

(True/False)

4.8/5  (32)

(32)

A process cost summary is an accounting report that describes the costs charged to each department, the equivalent units of production by each department, and determining the costs assigned to each department's output.

(True/False)

4.9/5  (41)

(41)

In a manufacturing operation with two process departments (1 and 2), the flow of costs would proceed from Work in Process, Department #1 to ________.

(Short Answer)

4.8/5  (44)

(44)

A company uses the FIFO method for inventory costing. At the start of the period the production department had 20,000 units in beginning Work in Process inventory which were 40% complete; the department completed and transferred 165,000 units. At the end of the period, 22,000 units were in the ending Work in Process inventory and are 75% complete. The production department had labor costs in the beginning goods is process inventory of $99,000 and total labor costs added during the period are $726,825. Compute the equivalent cost per unit for labor.

(Multiple Choice)

4.9/5  (34)

(34)

One section of the process cost summary describes the equivalent units of production for the department during the reporting period and presents the calculations of the direct materials and conversion costs per equivalent unit.

(True/False)

4.9/5  (41)

(41)

The managers of process operations focus on the series of repetitive processes, or steps, resulting in a noncustomized product or service.

(True/False)

4.8/5  (39)

(39)

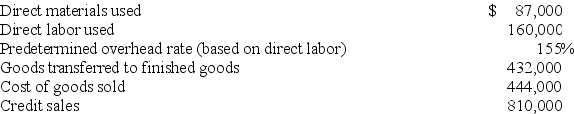

Prepare journal entries to record the following production activities for Oaks Manufacturing.

a. Used $93,900 of direct labor in the production department.

b. Used $11,200 of indirect labor.

(Essay)

4.7/5  (36)

(36)

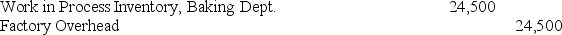

If the predetermined overhead allocation rate is 245% of direct labor cost, and the Baking Department's direct labor cost for the reporting period is $10,000, the following entry would be made to record the allocation of overhead to the products processed in this department:

(True/False)

4.9/5  (41)

(41)

During November, the production department of a process operations system completed and transferred to finished goods 35,000 units that were in process at the beginning of November and 110,000 units that were started and completed in November. November's beginning inventory units were 100% complete with respect to materials and 55% complete with respect to conversion. At the end of November, 40,000 additional units were in process in the production department and were 100% complete with respect to materials and 30% complete with respect to conversion. Compute the number of equivalent units with respect to materials for November using the weighted-average method.

(Multiple Choice)

4.9/5  (25)

(25)

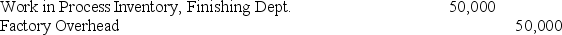

If the predetermined overhead allocation rate is 250% of direct labor cost and the Finishing Department's direct labor cost for the reporting period is $20,000, the following entry would record the allocation of overhead to the products processed in this department:

(True/False)

5.0/5  (41)

(41)

When direct labor and overhead enter the production process at the same rates, it is appropriate to use a conversion cost per equivalent unit.

(True/False)

4.9/5  (48)

(48)

Port Manufacturing Company uses a process costing system. Materials are added at the beginning of the process. Direct labor and overhead are added evenly throughout the process. The company uses monthly reporting periods for its weighted-average process costing. The following are the operating and cost data information for October.

The October 1 beginning Work in Process Inventory consisted of 20,000 units. The costs for this inventory are $82,500 of direct materials, $24,400 of direct labor, and $48,800 of factory overhead. Factory overhead is applied at 200% of direct labor cost.

In addition to the beginning inventory costs, the company issued the following costs into Work in Process Inventory; direct materials, $240,000; direct labor, $68,000; factory overhead, $136,000.

During October, the company completed and transferred 60,000 units of its product to finished goods. At the end of the month, the Work in Process inventory consisted of 15,000 units that were 40% complete with respect to direct labor and factory overhead and 100% complete with respect to materials.

Prepare the company's process cost summary for October using the weighted average method.

(Essay)

4.9/5  (39)

(39)

In a process costing accounting system, factory wages are debited to ________, when direct labor is used. When indirect labor is used, the ________ account is debited. In both cases the ________ is credited.

(Essay)

4.8/5  (38)

(38)

Showing 81 - 100 of 230

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)