Exam 2: Job Order Costing and Analysis

Exam 1: Managerial Accounting Concepts and Principles250 Questions

Exam 2: Job Order Costing and Analysis217 Questions

Exam 3: Process Costing and Analysis230 Questions

Exam 4: Activity Based Costing and Analysis220 Questions

Exam 5: Cost Behavior Cost-Volume-Profit Analysis247 Questions

Exam 6: Variable Costing and Analysis201 Questions

Exam 7: Master Budgets and Performance Planning213 Questions

Exam 8: Flexible Budgets and Standard Costs222 Questions

Exam 9: Performance Measurement and Responsibility Accounting208 Questions

Exam 10: Relevant Costing for Managerial Decisions117 Questions

Exam 11: Capital Budgeting and Investment Analysis159 Questions

Exam 12: Reporting Cash Flows239 Questions

Exam 13: Analysis of Financial Statements233 Questions

Exam 14: Time Value of Money84 Questions

Exam 15: Analyzing for Business Transactions250 Questions

Exam 16: Partnership Accounting179 Questions

Select questions type

A company that makes which of the following types of products would best be suited for a job costing system?

(Multiple Choice)

4.8/5  (34)

(34)

The collection of job cost sheets for all jobs in process makes up the subsidiary ledger controlled by the ________ Inventory.

(Short Answer)

4.8/5  (35)

(35)

A company that uses a job order costing system incurred $10,000 of factory payroll during May. Present the May 31 entry assuming $8,000 is direct labor and $2,000 is indirect labor.

(Essay)

4.9/5  (40)

(40)

Taylor Corp. uses a job order costing system and worked only on Job 101 during the current period. Job 101 was sold for $460,000. The following information pertains to costs incurred for Job 101.

Direct Materials \ 90,000 Indirect Materials \ 30,000 Direct Labor \ 130,000 Indirect Labor \ 75,000 Depreciation of Machinery \ 10,000 Factory Supplies \ 8,000 Overhead Application Rate 90\% of direct labor After adjusting for the amount of over or underapplied overhead, determine the amount of gross profit earned on Job 101.

(Essay)

4.9/5  (36)

(36)

A company's file of job cost sheets for jobs that are completed but not yet sold equals the balance in the Finished Goods Inventory account.

(True/False)

4.7/5  (32)

(32)

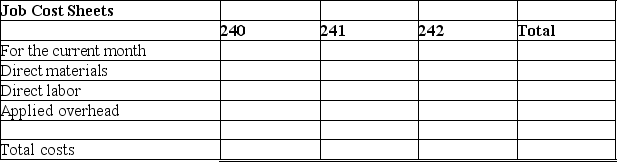

Drop Anchor takes special orders to manufacture sail boats for high end customers. Complete the job cost sheets for Drop Anchor for September based on the following information. Prepare journal entries to record the transactions as well as post to the job cost sheets.

a. Purchased raw materials on credit, $145,000.

b. Materials requisitions: Job 240, $48,000; Job 241, $36,000; Job 242, $42,000; indirect materials were $12,000.

c. Time tickets used to charge labor to jobs: Job 240, $40,000; Job 241, $30,000; Job 242, $35,000, indirect labor is $25,000.

d. The company incurred the following additional overhead costs: depreciation of factory building, $70,000; depreciation of factory equipment, $60,000; expired factory insurance, $10,000; utilities and maintenance cost of $20,000 were paid in cash.

e. Applied overhead to all three jobs. The predetermined overhead rate is 190% of direct labor cost.

f. Transferred jobs 240 and 242 to Finished Goods Inventory.

g. Sold job 240 for $300,000 for cash.

h. Closed the under- or over-applied overhead account balance.

(Essay)

4.9/5  (43)

(43)

A company that uses a cost accounting system normally has only two inventory accounts: Finished Goods Inventory and Work in Process Inventory.

(True/False)

4.7/5  (31)

(31)

The production of one unit of Product BJM used $27.50 of direct materials and $21.00 of direct labor. The unit sold for $76.00 and was assigned overhead at a rate of 30% of labor costs. What is the gross profit per unit on its sale?

(Essay)

4.8/5  (32)

(32)

Andrew Industries purchased $165,000 of raw materials on account during the month of March. The beginning Raw Materials Inventory balance was $22,000, and the materials used to complete jobs during the month were $141,000 of direct materials and $13,000 of indirect materials. What amount will Andrew debit to Work in Process Inventory for the month of March?

(Multiple Choice)

4.8/5  (46)

(46)

The journal entry to record the purchase of materials includes a debit to Work in Process Inventory.

(True/False)

4.8/5  (37)

(37)

A type of production that yields customized products or services for each customer is called:

(Multiple Choice)

4.9/5  (35)

(35)

The amount by which the overhead applied to jobs during a period exceeds the overhead incurred during the period is known as:

(Multiple Choice)

4.9/5  (35)

(35)

In nearly all job order cost systems, materials ledger cards are perpetual records that are updated each time materials are purchased or issued for use in production.

(True/False)

4.8/5  (35)

(35)

Actual factory overhead incurred in a job costing system is debited to a Factory Overhead general ledger account and credited to various other accounts.

(True/False)

4.9/5  (48)

(48)

Factory overhead is often collected and summarized in a subsidiary factory overhead ledger.

(True/False)

4.9/5  (32)

(32)

Features of a job costing system include all but which of the following:

(Multiple Choice)

4.7/5  (34)

(34)

A job order costing system would be appropriate for a manufacturer of automobile tires.

(True/False)

4.9/5  (26)

(26)

Minstrel Manufacturing uses a job order costing system. During one month, Minstrel purchased $198,000 of raw materials on credit; issued materials to production of $195,000 of which $30,000 were indirect. Minstrel incurred a factory payroll of $150,000, of which $40,000 was indirect labor. Minstrel uses a predetermined overhead application rate of 150% of direct labor cost. If Minstrel incurred total overhead costs of $167,800 during the month, compute the amount of under- or overapplied overhead:

(Multiple Choice)

5.0/5  (30)

(30)

The amount by which overhead incurred during a period exceeds the overhead applied to jobs is:

(Multiple Choice)

4.8/5  (44)

(44)

Adams Manufacturing allocates overhead to production on the basis of direct labor costs. At the beginning of the year, Adams estimated total overhead of $396,000; materials of $410,000 and direct labor of $220,000. During the year Adams incurred $418,000 in materials costs, $413,200 in overhead costs and $224,000 in direct labor costs. Compute the overhead application rate.

(Multiple Choice)

4.8/5  (34)

(34)

Showing 81 - 100 of 217

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)