Exam 2: Job Order Costing and Analysis

Exam 1: Managerial Accounting Concepts and Principles250 Questions

Exam 2: Job Order Costing and Analysis217 Questions

Exam 3: Process Costing and Analysis230 Questions

Exam 4: Activity Based Costing and Analysis220 Questions

Exam 5: Cost Behavior Cost-Volume-Profit Analysis247 Questions

Exam 6: Variable Costing and Analysis201 Questions

Exam 7: Master Budgets and Performance Planning213 Questions

Exam 8: Flexible Budgets and Standard Costs222 Questions

Exam 9: Performance Measurement and Responsibility Accounting208 Questions

Exam 10: Relevant Costing for Managerial Decisions117 Questions

Exam 11: Capital Budgeting and Investment Analysis159 Questions

Exam 12: Reporting Cash Flows239 Questions

Exam 13: Analysis of Financial Statements233 Questions

Exam 14: Time Value of Money84 Questions

Exam 15: Analyzing for Business Transactions250 Questions

Exam 16: Partnership Accounting179 Questions

Select questions type

When materials are used as indirect materials, their cost is debited to the Factory Overhead account.

(True/False)

4.9/5  (36)

(36)

When actual overhead cost exceeds the overhead applied, overhead is said to be underapplied.

(True/False)

4.9/5  (44)

(44)

If overhead applied is less than actual overhead incurred, it is:

(Multiple Choice)

5.0/5  (35)

(35)

A company's predetermined overhead rate is applied at 150% of direct materials cost. How much overhead would be allocated to Job No. 325 if the total direct materials costs was $40,000?

(Short Answer)

4.8/5  (30)

(30)

Job A3B was ordered by a customer on September 25. During the month of September, Jaycee Corporation requisitioned $2,500 of direct materials and used $4,000 of direct labor. The job was not finished by the end of the month, but needed an additional $3,000 of direct materials and additional direct labor of $6,500 to finish the job in October. The company applies overhead at the end of each month at a rate of 200% of the direct labor cost incurred. What is the total cost of the job when it is completed in October?

(Multiple Choice)

5.0/5  (43)

(43)

Job A3B was ordered by a customer on September 25. During the month of September, Jaycee Corporation requisitioned $2,500 of direct materials and used $4,000 of direct labor. The job was not finished by the end of the month, but needed an additional $3,000 of direct materials and additional direct labor of $6,500 to finish the job in October. The company applies overhead at the end of each month at a rate of 200% of the direct labor cost incurred. What is the balance in the Work in Process account at the end of September relative to Job A3B?

(Multiple Choice)

4.8/5  (27)

(27)

A company's file of job cost sheets for jobs that are completed but not yet sold equals the balance in the Work in Process Inventory account.

(True/False)

4.8/5  (36)

(36)

The ending inventory of finished goods has a total cost of $9,000 and consists of 600 units. If the overhead applied to these goods is $3,000, and the overhead rate is 75% of direct labor, how much direct materials cost was incurred in producing these units?

(Multiple Choice)

4.8/5  (34)

(34)

Since a predetermined overhead rate is established before a period begins, this rate is revised many times during the period to compensate for inaccurate estimates previously made.

(True/False)

4.7/5  (38)

(38)

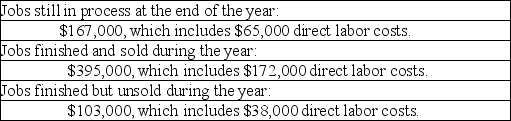

Oddley Corp. uses a job order costing system. The following is selected information pertaining to costs applied to jobs during the year:

Oddley Corp.'s predetermined overhead rate is 60% of direct labor cost. At the end of the year, the company's records show that $189,000 of factory overhead has been incurred.

(a) Determine the amount of overapplied or underapplied overhead.

(b) Prepare the necessary journal entry to close the Factory Overhead account assuming that any remaining balance is not material.

Oddley Corp.'s predetermined overhead rate is 60% of direct labor cost. At the end of the year, the company's records show that $189,000 of factory overhead has been incurred.

(a) Determine the amount of overapplied or underapplied overhead.

(b) Prepare the necessary journal entry to close the Factory Overhead account assuming that any remaining balance is not material.

(Essay)

4.8/5  (34)

(34)

Omega Contractors manufactures each house to customer specifications. It most likely would use:

(Multiple Choice)

4.9/5  (29)

(29)

Immaterial amounts of overapplied overhead should be ________ to the ________ account when closed.

(Short Answer)

4.8/5  (43)

(43)

Minstrel Manufacturing uses a job order costing system. During one month, Minstrel purchased $198,000 of raw materials on credit; issued materials to production of $195,000 of which $30,000 were indirect. Minstrel incurred a factory payroll of $150,000, of which $40,000 was indirect labor. Minstrel uses a predetermined overhead rate of 150% of direct labor cost. The journal entry to record the issuance of materials to production is:

(Multiple Choice)

4.8/5  (37)

(37)

Oxford Company uses a job order costing system. In the last month, the system accumulated labor time tickets total $24,600 for direct labor and $4,300 for indirect labor. How are these costs recorded?

(Multiple Choice)

4.8/5  (39)

(39)

Lowden Company has an overhead application rate of 160% and allocates overhead based on direct material cost. During the current period, direct labor cost is $50,000 and direct materials used cost $80,000. Determine the amount of overhead Lowden Company should record in the current period.

(Multiple Choice)

4.8/5  (42)

(42)

Dallas Company uses a job order costing system. The company's executives estimated that direct labor would be $2,000,000 (200,000 hours at $10/hour) and that factory overhead would be $1,500,000 for the current period. At the end of the period, the records show that there had been 180,000 hours of direct labor and $1,200,000 of actual overhead costs. Using direct labor hours as a base, what was the predetermined overhead rate?

(Multiple Choice)

4.8/5  (43)

(43)

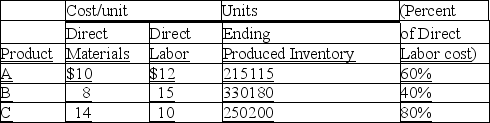

The following data relates to the Mass Company's first operating period. Calculate the total cost of goods sold for each product.

Overhead rate

(Essay)

4.7/5  (36)

(36)

The schedule of cost of goods manufactured for a job costing system includes total actual factory overhead.

(True/False)

4.9/5  (36)

(36)

Describe the purpose of a job cost sheet, and explain what information is found on the job cost sheet.

(Essay)

4.7/5  (39)

(39)

Showing 141 - 160 of 217

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)