Exam 15: Public Finance and Public Choice

Exam 1: Economics: The Study of Choice145 Questions

Exam 2: Confronting Scarcity: Choices in Production198 Questions

Exam 3: Demand and Supply251 Questions

Exam 4: Applications of Supply and Demand113 Questions

Exam 5: Elasticity: a Measure of Response255 Questions

Exam 6: Markets, Maximizers, and Efficiency239 Questions

Exam 7: The Analysis of Consumer Choice244 Questions

Exam 8: Production and Cost227 Questions

Exam 9: Competitive Markets for Goods and Services265 Questions

Exam 10: Monopoly234 Questions

Exam 11: The World of Imperfect Competition237 Questions

Exam 12: Wages and Employment in Perfect Competition189 Questions

Exam 13: Interest Rates and the Markets for Capital and Natural Resources170 Questions

Exam 14: Imperfectly Competitive Markets for Factors of Production183 Questions

Exam 15: Public Finance and Public Choice188 Questions

Exam 16: Antitrust Policy and Business Regulation137 Questions

Exam 17: International Trade186 Questions

Exam 18: The Economics of the Environment148 Questions

Exam 19: Inequality, Poverty, and Discrimination140 Questions

Select questions type

A charge levied on consumers of government-provided services is a(n):

(Multiple Choice)

5.0/5  (37)

(37)

If the purpose of taxation is to raise revenue, would it be better for the government to levy taxes on products whose demand is elastic or inelastic? Explain.Are there any other reasons why governments levy taxes? Explain.

(Essay)

4.9/5  (34)

(34)

The presence of external benefits may result in government action because the external benefits are not included in the market price of a good.

(True/False)

4.8/5  (25)

(25)

If the marginal benefit received from a good is less than the marginal opportunity cost of production, then:

(Multiple Choice)

4.8/5  (40)

(40)

A ______ transfer payment is one for which the recipient qualifies on the basis of ________.

(Multiple Choice)

4.8/5  (36)

(36)

Taxes paid on the purchase of specific items such as gasoline, cigarettes, or alcoholic beverages would fall into the category of:

(Multiple Choice)

4.8/5  (37)

(37)

Taxation according to the benefits-received principle is best illustrated by the:

(Multiple Choice)

4.8/5  (40)

(40)

The primary source of the difference between government purchases and government expenditures is:

(Multiple Choice)

4.8/5  (30)

(30)

According to public choice theory, special-interest groups are not a problem for efficient government.

(True/False)

4.8/5  (35)

(35)

A tax that takes a fixed percentage of income, regardless of the level of income, is a(n):

(Multiple Choice)

4.8/5  (42)

(42)

The rate that would apply to an additional $1 of taxable income received by a taxpayer is the:

(Multiple Choice)

4.8/5  (45)

(45)

Public goods are distinguished from private goods in that nonpayers cannot be excluded from benefiting from public goods.

(True/False)

4.8/5  (40)

(40)

A tax that takes a higher percentage of income as income rises is a(n):

(Multiple Choice)

4.7/5  (37)

(37)

The theory that assumes that the role of government is to maximize welfare by seeking an efficient allocation of resources is called public choice theory.

(True/False)

4.8/5  (33)

(33)

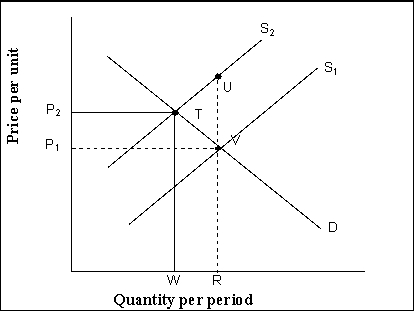

Use the following to answer question(s): Correcting for Market Failure: External Cost

-(Exhibit: Correcting for Market Failure: External Cost) Assume that there is an external cost involved, as illustrated in the exhibit.If the government intervenes to correct for the external cost, the new _______ will now reflect _______ and _______ cost.

-(Exhibit: Correcting for Market Failure: External Cost) Assume that there is an external cost involved, as illustrated in the exhibit.If the government intervenes to correct for the external cost, the new _______ will now reflect _______ and _______ cost.

(Multiple Choice)

4.8/5  (39)

(39)

For a public good, nonpayers _______ excluded from obtaining the benefits of the good.

(Multiple Choice)

4.7/5  (37)

(37)

Showing 61 - 80 of 188

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)