Exam 13: Advanced Topics in Business Strategy

Exam 1: The Fundamentals of Managerial Economics145 Questions

Exam 2: Market Forces: Demand and Supply149 Questions

Exam 3: Quantitative Demand Analysis167 Questions

Exam 4: The Theory of Individual Behavior183 Questions

Exam 5: The Production Process and Costs186 Questions

Exam 6: The Organization of the Firm157 Questions

Exam 7: The Nature of Industry124 Questions

Exam 8: Managing in Competitive, Monopolistic, and Monopolistically Competitive Markets147 Questions

Exam 9: Basic Oligopoly Models135 Questions

Exam 10: Game Theory: Inside Oligopoly142 Questions

Exam 11: Pricing Strategies for Firms With Market Power140 Questions

Exam 12: The Economics of Information147 Questions

Exam 13: Advanced Topics in Business Strategy90 Questions

Exam 14: A Managers Guide to Government in the Marketplace112 Questions

Select questions type

Under limit pricing,the incumbent will produce:

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

C

Firms 1 and 2 compete in a Cournot duopoly.If firm 1 adopts a strategy that raises firm 2's marginal cost:

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

C

Firms 1 and 2 compete in a Cournot duopoly.If firm 2 adopts a strategy that raises firm 1's marginal cost:

(Multiple Choice)

4.9/5  (32)

(32)

Firms 1 and 2 compete in a Cournot duopoly.If firm 2 adopts a strategy that raises firm 1's marginal cost:

(Multiple Choice)

4.9/5  (32)

(32)

A two-way network linking 15 users creates how many potential network connections?

(Multiple Choice)

5.0/5  (32)

(32)

Refer to the following payoff matrix:

Player 2 Player 1 a b A Q \ 50,\ 5 \ 25,\ 30 B Q \ 40,\ 2 \ 20,\ 1 The Nash equilibrium for the simultaneous-move game depicted in the payoff matrix is:

(Multiple Choice)

4.7/5  (30)

(30)

A potential entrant knows that it faces a (inverse)residual demand curve given by P = 50 − 4Q.While the entrant does not know the inverse market demand,it does know that the incumbent committed to producing 150 units.Using this information,which of the following equations best summarizes the inverse market demand curve?

(Multiple Choice)

4.8/5  (40)

(40)

A single firm that charges the monopoly price in the market earns $500.If another firm successfully enters the market,the incumbent's profits fall to $325 and the entrant earns $250.If the incumbent engages in limit pricing,its profits are $400.For what interest rate,i,is limit pricing a profitable strategy for the incumbent?

(Multiple Choice)

4.8/5  (31)

(31)

Refer to the following payoff matrix:

Player 2 Player 1 Low Q High Q Low Q \ 50,\ 5 \ 15,\ 30 High Q \ 40,\ 2 \ 2,\ 1 Suppose the production game depicted in the payoff matrix is a sequential-move game.Identify the strategy leading to a first-mover advantage for player 2.

(Multiple Choice)

4.8/5  (31)

(31)

Smyth Industries operated as a monopolist for the past several years,earning annual profits amounting to $50 million,which it could have maintained if Jones Incorporated did not enter the market.The result of this increased competition is lower prices and lower profits; Smyth Industries now earns $10 million annually.The managers of Smyth Industries are trying to devise a plan to drive Jones Incorporated out of the market so Smyth can regain its monopoly position (and profit).One of Smyth's managers suggests pricing its product 50 percent below marginal cost for exactly one year.The estimated impact of such a move is a loss of $1 billion.Ignoring antitrust concerns,compute the present value of Smyth Industries' profits if it remains a duopolist in this market when the interest rate is 5 percent.

(Multiple Choice)

4.9/5  (36)

(36)

Smyth Industries operated as a monopolist for the past several years,earning annual profits amounting to $50 million,which it could have maintained if Jones Incorporated did not enter the market.The result of this increased competition is lower prices and lower profits; Smyth Industries now earns $10 million annually.The managers of Smyth Industries are trying to devise a plan to drive Jones Incorporated out of the market so Smyth can regain its monopoly position (and profit).One of Smyth's managers suggests pricing its product 50 percent below marginal cost for exactly one year.The estimated impact of such a move is a loss of $1 billion.Ignoring antitrust concerns,compute the present value of Smyth Industries' profits,if it could have remained a monopoly when the interest rate was 5 percent.

(Multiple Choice)

4.8/5  (27)

(27)

A monopolist earns $50 million annually and will maintain that level of profit indefinitely,provided no other firm enters the market.If another firm successfully enters the market,the incumbent's profits remain at $50 million the first period,but fall to $25 million annually thereafter.The opportunity cost of funds is 10 percent,and profits in each period are realized at the beginning of each period.If the monopolist can earn $27 million indefinitely by limit pricing,should it do so?

(Multiple Choice)

4.8/5  (33)

(33)

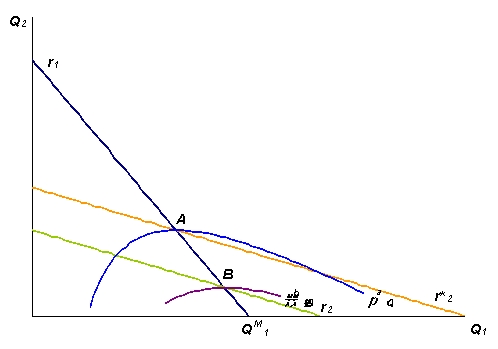

Use figure below to answer the following questions.  a.Would firm 1's profit increase or decrease if the equilibrium moved from point A to point B?

b.Would firm 2's profit increase or decrease if the equilibrium moved from point A to point B?

c.As the manager of firm 1,propose a strategy that would increase both the market share and the profits of firm 1-that is,a strategy that moves the market equilibrium from point A to point B.

a.Would firm 1's profit increase or decrease if the equilibrium moved from point A to point B?

b.Would firm 2's profit increase or decrease if the equilibrium moved from point A to point B?

c.As the manager of firm 1,propose a strategy that would increase both the market share and the profits of firm 1-that is,a strategy that moves the market equilibrium from point A to point B.

(Essay)

4.8/5  (36)

(36)

Firms 1 and 2 compete in a Cournot duopoly.If firm 2 adopts a strategy that,inadvertently,lowers firm 1's marginal cost:

(Multiple Choice)

4.8/5  (30)

(30)

Firms 1 and 2 compete in a Cournot duopoly.If firm 2 adopts a strategy that raises firm 1's marginal cost:

(Multiple Choice)

4.9/5  (32)

(32)

Refer to the following payoff matrix:

Player 2 Player 1 Low Q High Q Low Q \ 50,\ 5 \ 15,\ 30 High Q \ 40,\ 2 \ 2,\ 1 If the payoff matrix is a simultaneous-move production game,the Nash equilibrium is for:

(Multiple Choice)

4.8/5  (37)

(37)

Showing 1 - 20 of 90

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)