Exam 3: Financial Statement Analysis and Long-Term Planning

Exam 1: Introduction to Corporate Finance45 Questions

Exam 2: Corporate Governance18 Questions

Exam 3: Financial Statement Analysis and Long-Term Planning89 Questions

Exam 4: Discounted Cash Flow Valuation125 Questions

Exam 6: Net Present Value and Other Investment Rules100 Questions

Exam 7: Making Capital Investment Decisions84 Questions

Exam 8: Risk Analysis, Real Options, and Capital Budgeting80 Questions

Exam 9: Risk and Return: Lessons From Market History71 Questions

Exam 10: Return and Risk: The Capital Asset Pricing Model Capm117 Questions

Exam 11: Factor Models and the Arbitrage Pricing Theory36 Questions

Exam 12: Risk, cost of Capital, and Capital Budgeting46 Questions

Exam 13: Corporate Financing Decisions and Efficient Capital Markets38 Questions

Exam 14: Long-Term Financing: An Introduction35 Questions

Exam 15: Capital Structure: Basic Concepts81 Questions

Exam 16: Capital Structure: Limits to the Use of Debt53 Questions

Exam 17: Valuation and Capital Budgeting for the Levered Firm42 Questions

Exam 18: Dividend and Other Payouts78 Questions

Exam 19: Equity Financing54 Questions

Exam 20: Debt Financing51 Questions

Exam 21: Leasing and Off-Balance-Sheet Financing35 Questions

Exam 22: Options and Corporate Finance84 Questions

Exam 23: Options and Corporate Finance: Extensions and Applications32 Questions

Exam 24: Warrants and Convertibles44 Questions

Exam 25: Financial Risk Management With Derivatives49 Questions

Exam 26: Short-Term Finance and Planning115 Questions

Exam 27: Cash Management58 Questions

Exam 28: Credit Management42 Questions

Exam 29: Mergers and Acquisitions65 Questions

Exam 30: Financial Distress19 Questions

Exam 31: International Corporate Finance83 Questions

Select questions type

Your _____ tax rate is the amount of tax payable on the next taxable euro you earn.

Free

(Multiple Choice)

4.7/5  (30)

(30)

Correct Answer:

E

The cash flow of the firm must be equal to:

Free

(Multiple Choice)

4.8/5  (28)

(28)

Correct Answer:

D

Which of the following statements concerning the income statement is true?

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

E

The financial statement showing a firm's accounting value on a particular date is the:

(Multiple Choice)

4.8/5  (35)

(35)

Thompson's Jet Skis has operating cash flow of €218.Depreciation is €45 and interest paid is €35.A net total of €69 was paid on non-current liabilities.The firm spent €180 on non-current assets and increased net working capital by €38.What is the amount of the cash flow to shareholders?

(Multiple Choice)

5.0/5  (38)

(38)

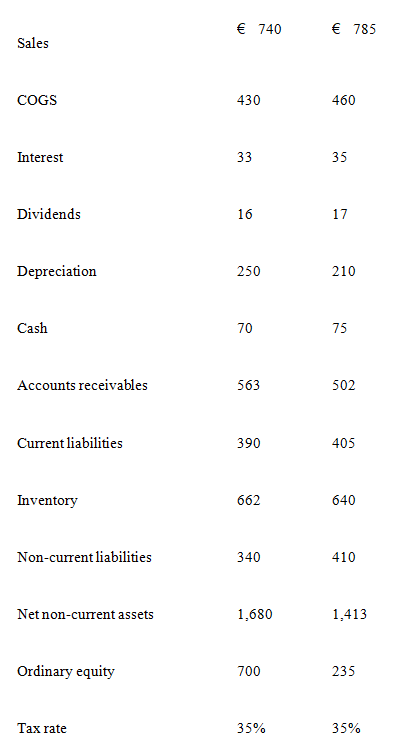

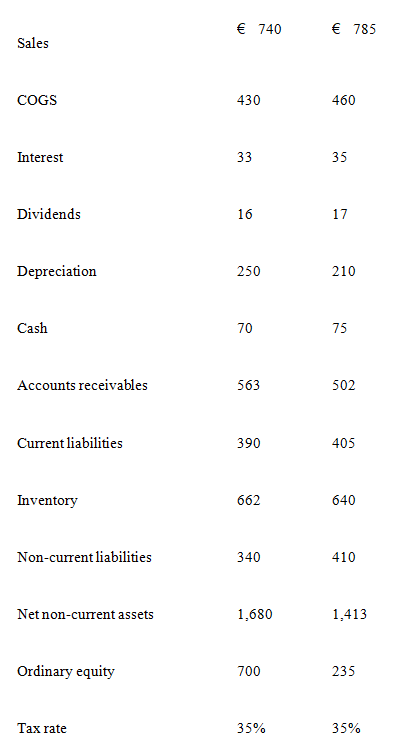

Cost of goods sold

Interest

Dividends

Depreciation

Change in retained earnings

Tax rate

-What is the taxable income for 2010?

(Multiple Choice)

4.8/5  (39)

(39)

Knickerdoodles NV.

-What is the change in net working capital from 2009 to 2010?

-What is the change in net working capital from 2009 to 2010?

(Multiple Choice)

4.8/5  (39)

(39)

Which of the following is not included in the computation of operating cash flow?

(Multiple Choice)

4.8/5  (32)

(32)

Teddy's Pillows has beginning net non-current assets of £480 and ending net non-current assets of £530.Assets valued at £300 were sold during the year.Depreciation was £40.What is the amount of capital spending?

(Multiple Choice)

4.9/5  (46)

(46)

_____ is calculated by adding back non-cash expenses to net income and adjusting for changes in current assets and liabilities.

(Multiple Choice)

4.7/5  (34)

(34)

When you are making a financial decision,the most relevant tax rate is the _____ rate.

(Multiple Choice)

4.9/5  (47)

(47)

Nabors plc

2010 Income Statement

( in millions)

Net sales £9,610 Less: Cost of goods sold 6,310 Less: Depreciation 1,370 Eamings before interest and taxes 1,930 Less: Interest paid 630 Taxable Income £1,300 Less: Taxes 455 Net income £845

Nabors ple

2009 and 2010 Statement of financial positions

( in millions)

2009 2010 2009 2010 Cash £,310 £405 Trade payables £2,720 £2,570 Accounts rec. 2,640 3,055 Notes payable 100 0 Inventory 3,275 Total £2,820 £2,570 Total £6,225 £7,310 Non-current liabilities 7,875 8,100 Net non-current assets 10,960 10,670 Ordinary equity 5,000 5,250 Retained eamings 2,060 Total Assets £17,185 £17,980 Total liab.\& equity £17,185 £17,890

-What is the operating cash flow for 2010?

(Multiple Choice)

4.7/5  (40)

(40)

What is a liquid asset and why is it necessary for a firm to maintain a reasonable level of liquid assets?

(Essay)

4.7/5  (35)

(35)

Knickerdoodles NV.

-What is the operating cash flow for 2010?

-What is the operating cash flow for 2010?

(Multiple Choice)

4.8/5  (29)

(29)

An increase in which one of the following will cause the operating cash flow to increase?

(Multiple Choice)

4.9/5  (45)

(45)

Calculate net income based on the following information.Sales are £250,cost of goods sold is £160,depreciation expense is £35,interest paid is £20,and the tax rate is 34%.

(Multiple Choice)

4.7/5  (29)

(29)

Cost of goods sold

Interest

Dividends

Depreciation

Change in retained earnings

Tax rate

-What are the sales for 2010?

(Multiple Choice)

4.8/5  (32)

(32)

Showing 1 - 20 of 89

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)