Exam 28: Time Value of Money

Exam 1: An Overview of Financial Management and the Financial Environment33 Questions

Exam 2: Risk and Return: Part I145 Questions

Exam 3: Risk and Return: Part Ii34 Questions

Exam 4: Bond Valuation99 Questions

Exam 5: Financial Options28 Questions

Exam 6: Accounting for Financial Management76 Questions

Exam 7: Analysis of Financial Statements104 Questions

Exam 8: Basic Stock Valuation91 Questions

Exam 9: Corporate Valuation and Financial Planning46 Questions

Exam 10: Corporate Governance6 Questions

Exam 11: Determining the Cost of Capital92 Questions

Exam 12: Capital Budgeting: Decision Rules107 Questions

Exam 13: Cash Flow Estimation and Risk Analysis78 Questions

Exam 14: Real Options19 Questions

Exam 16: Capital Structure Decisions72 Questions

Exam 17: Dynamic Capital Structures and Corporate Valuation31 Questions

Exam 18: Initial Public Offerings, investment Banking, and Financial Restructuring27 Questions

Exam 19: Lease Financing23 Questions

Exam 20: Hybrid Financing: Preferred Stock, Warrants, and Convertibles30 Questions

Exam 21: Supply Chains and Working Capital Management138 Questions

Exam 22: Providing and Obtaining Credit38 Questions

Exam 23: Advanced Issues in Cash Management and Inventory Control29 Questions

Exam 24: Enterprise Risk Management14 Questions

Exam 25: Bankruptcy, reorganization, and Liquidation12 Questions

Exam 26: Mergers and Corporate Control49 Questions

Exam 27: Multinational Financial Management49 Questions

Exam 28: Time Value of Money168 Questions

Exam 29: Basic Financial Tools: a Review247 Questions

Exam 30: Pension Plan Management10 Questions

Exam 31: Financial Management in Not-For-Profit Businesses10 Questions

Exam 32: a Values of the Areas Under the Standard Normal4 Questions

Select questions type

Your bank offers a 10-year certificate of deposit (CD)that pays 6.5% interest,compounded annually.If you invest $2,000 in the CD,how much will you have when it matures?

(Multiple Choice)

4.9/5  (38)

(38)

The going rate of interest on a 5-year treasury bond is 4.25%.You have one that will pay $2,500 five years from now.How much is the bond worth today?

(Multiple Choice)

4.8/5  (43)

(43)

Suppose a State of North Carolina bond will pay $1,000 ten years from now.If the going interest rate on these 10-year bonds is 5.5%,how much is the bond worth today?

(Multiple Choice)

4.8/5  (38)

(38)

How much would $100,growing at 5% per year,be worth after 75 years?

(Multiple Choice)

4.9/5  (34)

(34)

A time line is meaningful even if all cash flows do not occur annually.

(True/False)

4.8/5  (37)

(37)

When a loan is amortized,a relatively low percentage of the payment goes to reduce the outstanding principal in the early years,and the principal repayment's percentage increases in the loan's later years.

(True/False)

4.9/5  (31)

(31)

Your aunt wants to retire and has $375,000.She expects to live for another 25 years,and she also expects to earn 7.5% on her invested funds.How much could she withdraw at the beginning of each of the next 25 years and end up with zero in the account?

(Multiple Choice)

4.8/5  (44)

(44)

If we are given a periodic interest rate,say a monthly rate,we can find the nominal annual rate by multiplying the periodic rate by the number of periods per year.

(True/False)

4.8/5  (37)

(37)

Which of the following bank accounts has the highest effective annual return?

(Multiple Choice)

4.9/5  (35)

(35)

The store where you bought new home furnishings offers you two alternative payment plans.The first plan requires a $4,000 immediate up-front payment.The second plan requires you to make monthly payments of $137.41,payable at the end of each month for 3 years.What nominal annual interest rate is built into the monthly payment plan?

(Multiple Choice)

4.8/5  (38)

(38)

A U.S.Treasury bond will pay a lump sum of $1,000 exactly 3 years from today.The nominal interest rate is 6%,semiannual compounding.Which of the following statements is CORRECT?

(Multiple Choice)

4.9/5  (33)

(33)

Your bank offers a savings account that pays 3.5% interest,compounded annually.How much will $500 invested today be worth at the end of 25 years?

(Multiple Choice)

4.9/5  (40)

(40)

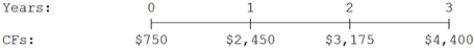

What is the present value of the following cash flow stream at a rate of 8.0%?

(Multiple Choice)

4.8/5  (38)

(38)

The payment made each period on an amortized loan is constant,and it consists of some interest and some principal.The closer we are to the end of the loan's life,the smaller the percentage of the payment that will be a repayment of principal.

(True/False)

4.8/5  (41)

(41)

All other things held constant,the present value of a given annual annuity decreases as the number of periods per year increases.

(True/False)

4.9/5  (40)

(40)

You are hoping to buy a new boat 3 years from now,and you plan to save $4,200 per year,beginning one year from today.You will deposit your savings in an account that pays 5.2% interest.How much will you have just after you make the 3rd deposit,3 years from now?

(Multiple Choice)

4.8/5  (37)

(37)

A $150,000 loan is to be amortized over 6 years,with annual end-of-year payments.Which of these statements is CORRECT?

(Multiple Choice)

4.7/5  (42)

(42)

Showing 61 - 80 of 168

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)