Exam 28: Time Value of Money

Exam 1: An Overview of Financial Management and the Financial Environment33 Questions

Exam 2: Risk and Return: Part I145 Questions

Exam 3: Risk and Return: Part Ii34 Questions

Exam 4: Bond Valuation99 Questions

Exam 5: Financial Options28 Questions

Exam 6: Accounting for Financial Management76 Questions

Exam 7: Analysis of Financial Statements104 Questions

Exam 8: Basic Stock Valuation91 Questions

Exam 9: Corporate Valuation and Financial Planning46 Questions

Exam 10: Corporate Governance6 Questions

Exam 11: Determining the Cost of Capital92 Questions

Exam 12: Capital Budgeting: Decision Rules107 Questions

Exam 13: Cash Flow Estimation and Risk Analysis78 Questions

Exam 14: Real Options19 Questions

Exam 16: Capital Structure Decisions72 Questions

Exam 17: Dynamic Capital Structures and Corporate Valuation31 Questions

Exam 18: Initial Public Offerings, investment Banking, and Financial Restructuring27 Questions

Exam 19: Lease Financing23 Questions

Exam 20: Hybrid Financing: Preferred Stock, Warrants, and Convertibles30 Questions

Exam 21: Supply Chains and Working Capital Management138 Questions

Exam 22: Providing and Obtaining Credit38 Questions

Exam 23: Advanced Issues in Cash Management and Inventory Control29 Questions

Exam 24: Enterprise Risk Management14 Questions

Exam 25: Bankruptcy, reorganization, and Liquidation12 Questions

Exam 26: Mergers and Corporate Control49 Questions

Exam 27: Multinational Financial Management49 Questions

Exam 28: Time Value of Money168 Questions

Exam 29: Basic Financial Tools: a Review247 Questions

Exam 30: Pension Plan Management10 Questions

Exam 31: Financial Management in Not-For-Profit Businesses10 Questions

Exam 32: a Values of the Areas Under the Standard Normal4 Questions

Select questions type

Your investment account pays 8.0%,compounded annually.If you invest $5,000 today,how many years will it take for your investment to grow to $9,140.20?

(Multiple Choice)

4.9/5  (32)

(32)

Midway through the life of an amortized loan,the percentage of the payment that represents interest could be equal to,less than,or greater than to the percentage that represents repayment of principal.The proportions depend on the original life of the loan and the interest rate.

(True/False)

4.9/5  (35)

(35)

Your girlfriend just won the Florida lottery.She has the choice of $15,000,000 today or a 20-year annuity of $1,050,000,with the first payment coming one year from today.What rate of return is built into the annuity?

(Multiple Choice)

4.8/5  (34)

(34)

A salt mine you inherited will pay you $25,000 per year for 25 years,with the first payment being made today.If you think a fair return on the mine is 7.5%,how much should you ask for it if you decide to sell it?

(Multiple Choice)

4.9/5  (35)

(35)

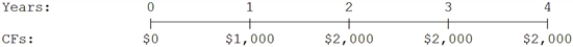

You sold your motorcycle and accepted a note with the following cash flow stream as your payment.What was the effective price you received for the car assuming an interest rate of 6.0%?

(Multiple Choice)

5.0/5  (39)

(39)

What's the future value of $1,500 after 5 years if the appropriate interest rate is 6%,compounded semiannually?

(Multiple Choice)

4.8/5  (43)

(43)

All other things held constant,the present value of a given annual annuity increases as the number of periods per year increases.

(True/False)

4.8/5  (35)

(35)

You plan to borrow $35,000 at a 7.5% annual interest rate.The terms require you to amortize the loan with 7 equal end-of-year payments.How much interest would you be paying in Year 2?

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following statements is CORRECT,assuming positive interest rates and holding other things constant?

(Multiple Choice)

4.9/5  (35)

(35)

Your investment advisor has recommended your invest in bonds that pay 6.0%,compounded annually.If you invest $10,000 today,how many years will it take for your investment to grow to $30,000?

(Multiple Choice)

4.8/5  (33)

(33)

You are in negotiations to make a 7-year loan of $25,000 to DeVille Corporation.To repay you,DeVille will pay $2,500 at the end of Year 1,$5,000 at the end of Year 2,and $7,500 at the end of Year 3,plus a fixed but currently unspecified cash flow,X,at the end of each year from Year 4 through Year 7.You are confident the payments will be made,since DeVille is essentially riskless.You regard 8% as an appropriate rate of return on a low risk but illiquid 7-year loan.What cash flow must the investment provide at the end of each of the final 4 years,that is,what is X?

(Multiple Choice)

4.7/5  (47)

(47)

Suppose you just won the state lottery,and you have a choice between receiving $2,550,000 today or a 20-year annuity of $250,000,with the first payment coming one year from today.What rate of return is built into the annuity? Disregard taxes.

(Multiple Choice)

4.9/5  (40)

(40)

Ten years ago,Kronan Corporation earned $0.50 per share.Its earnings this year were $2.20.What was the growth rate in earnings per share (EPS)over the 10-year period?

(Multiple Choice)

4.8/5  (37)

(37)

Starting to invest early for retirement increases the benefits of compound interest.

(True/False)

4.8/5  (40)

(40)

You are considering investing in a bank account that pays a nominal annual rate of 7%,compounded monthly.If you invest $3,000 at the end of each month,how many months will it take for your account to grow to $150,000?

(Multiple Choice)

4.9/5  (48)

(48)

Your bank offers to lend you $100,000 at an 8.5% annual interest rate to start your new business.The terms require you to amortize the loan with 10 equal end-of-year payments.How much interest would you be paying in Year 2?

(Multiple Choice)

4.9/5  (30)

(30)

Assume that you own an annuity that will pay you $15,000 per year for 12 years,with the first payment being made today.You need money today to open a new restaurant,and your uncle offers to give you $120,000 for the annuity.If you sell it,what rate of return would your uncle earn on his investment?

(Multiple Choice)

4.9/5  (43)

(43)

Showing 121 - 140 of 168

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)