Exam 14: Financial Statement Analysis

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Product Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting256 Questions

Exam 4: Activity-Based Costing230 Questions

Exam 5: Process Costing6 Cost-Volume-Profit Relationships139 Questions

Exam 6: Cost-Volume-Profit Relationships260 Questions

Exam 7: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 8: Master Budgeting236 Questions

Exam 10: Performance Measurement in Decentralized Organizations180 Questions

Exam 11: Differential Analysis: The Key to Decision Making203 Questions

Exam 12: Capital Budgeting Decisions179 Questions

Exam 9: Flexible Budgets Standard Costs and Variance Analysis461 Questions

Exam 13: Statement of Cash Flows132 Questions

Exam 14: Financial Statement Analysis289 Questions

Exam 15: Job-Order Costing: Cost Flows and External Reporting28 Questions

Exam 16: Process Costing6 Cost-Volume-Profit Relationships100 Questions

Exam 17: Cost-Volume-Profit Relationships82 Questions

Exam 18:Flexible Budgets, Standard Costs, and Variance Analysis177 Questions

Exam 19: Flexible Budgets, Standard Costs, and Variance Analysis140 Questions

Exam 20: A Capital Budgeting Decisions16 Questions

Exam 21: A Statement of Cash Flows56 Questions

Select questions type

When computing the return on equity, retained earnings should be excluded from the average total stockholders' equity.

(True/False)

4.8/5  (45)

(45)

The company's earnings per share for Year 2 is closest to:

(Multiple Choice)

4.8/5  (39)

(39)

The company's average collection period for Year 2 is closest to:

(Multiple Choice)

4.8/5  (42)

(42)

The times interest earned ratio of Whitney Corporation is 3.0.The interest expense for the year is $21,000, and the corporation's tax rate is 40%.The corporation's after-tax net income must be:

(Multiple Choice)

4.8/5  (43)

(43)

The company's book value per share at the end of Year 2 is closest to:

(Multiple Choice)

4.9/5  (49)

(49)

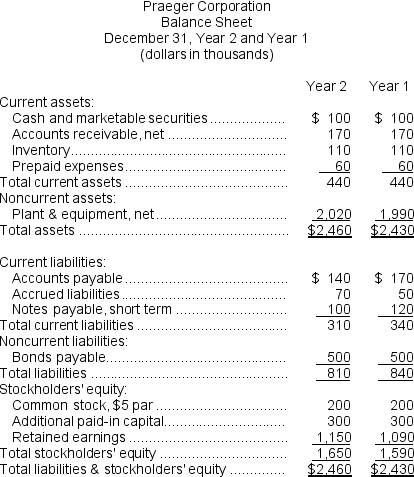

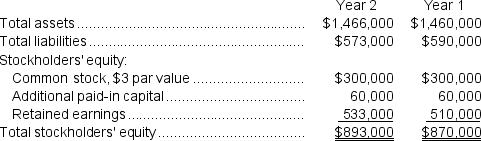

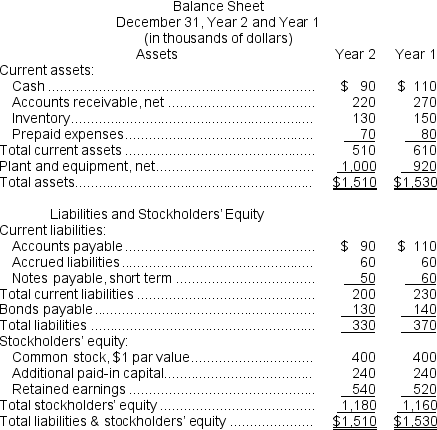

Financial statements for Praeger Corporation appear below:

Dividends during Year 2 totaled $45 thousand.The market price of a share of common stock on December 31, Year 2 was $30.

Required:

Compute the following for Year 2:

a.Return on total assets.

b.Working capital.

c.Current ratio.

d.Acid-test (quick)ratio.

e.Accounts receivable turnover.

f.Average collection period.

g.Inventory turnover.

h.Average sale period.

i.Times interest earned ratio.

j.Debt-to-equity ratio.

Dividends during Year 2 totaled $45 thousand.The market price of a share of common stock on December 31, Year 2 was $30.

Required:

Compute the following for Year 2:

a.Return on total assets.

b.Working capital.

c.Current ratio.

d.Acid-test (quick)ratio.

e.Accounts receivable turnover.

f.Average collection period.

g.Inventory turnover.

h.Average sale period.

i.Times interest earned ratio.

j.Debt-to-equity ratio.

(Essay)

4.8/5  (34)

(34)

All other things the same, purchasing inventory would decrease the inventory turnover ratio.

(True/False)

4.8/5  (33)

(33)

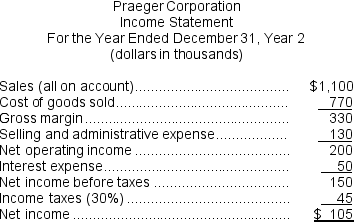

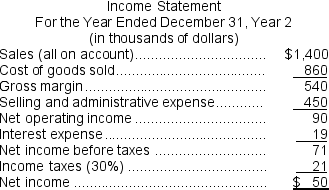

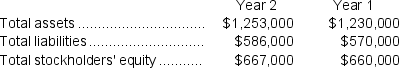

Neiger Corporation has provided the following financial data:

Required:

a.What is the company's working capital at the end of Year 2?

b.What is the company's current ratio at the end of Year 2?

c.What is the company's acid-test (quick)ratio at the end of Year 2?

d.What is the company's times interest earned ratio for Year 2?

e.What is the company's debt-to-equity ratio at the end of Year 2?

f.What is the company's equity multiplier at the end of Year 2?

Required:

a.What is the company's working capital at the end of Year 2?

b.What is the company's current ratio at the end of Year 2?

c.What is the company's acid-test (quick)ratio at the end of Year 2?

d.What is the company's times interest earned ratio for Year 2?

e.What is the company's debt-to-equity ratio at the end of Year 2?

f.What is the company's equity multiplier at the end of Year 2?

(Essay)

4.9/5  (35)

(35)

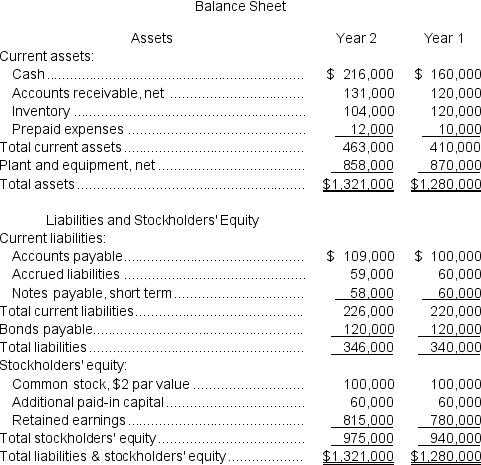

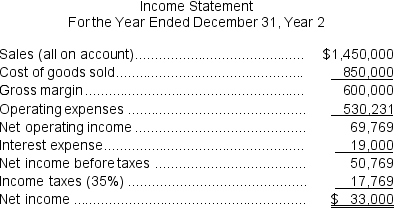

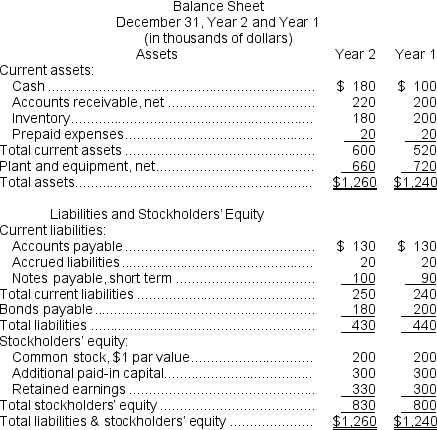

Jaquez Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $10,000.The market price of common stock at the end of Year 2 was $5.45 per share.

Required:

a.What is the company's times interest earned ratio for Year 2?

b.What is the company's debt-to-equity ratio at the end of Year 2?

c.What is the company's equity multiplier at the end of Year 2?

d.What is the company's net profit margin percentage for Year 2?

e.What is the company's gross margin percentage for Year 2?

f.What is the company's return on total assets for Year 2?

g.What is the company's return on equity for Year 2?

h.What is the company's earnings per share for Year 2?

i.What is the company's price-earnings ratio for Year 2?

j.What is the company's dividend payout ratio for Year 2?

k.What is the company's dividend yield ratio for Year 2?

l.What is the company's book value per share at the end of Year 2?

Dividends on common stock during Year 2 totaled $10,000.The market price of common stock at the end of Year 2 was $5.45 per share.

Required:

a.What is the company's times interest earned ratio for Year 2?

b.What is the company's debt-to-equity ratio at the end of Year 2?

c.What is the company's equity multiplier at the end of Year 2?

d.What is the company's net profit margin percentage for Year 2?

e.What is the company's gross margin percentage for Year 2?

f.What is the company's return on total assets for Year 2?

g.What is the company's return on equity for Year 2?

h.What is the company's earnings per share for Year 2?

i.What is the company's price-earnings ratio for Year 2?

j.What is the company's dividend payout ratio for Year 2?

k.What is the company's dividend yield ratio for Year 2?

l.What is the company's book value per share at the end of Year 2?

(Essay)

4.9/5  (44)

(44)

The company's total asset turnover for Year 2 is closest to:

(Multiple Choice)

4.9/5  (28)

(28)

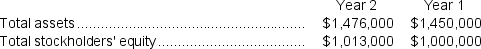

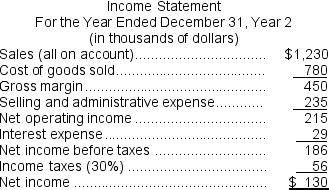

Pribyl Corporation has provided the following financial data:

Required:

a.What is the company's net profit margin percentage for Year 2?

b.What is the company's gross margin percentage for Year 2?

c.What is the company's return on total assets for Year 2?

d.What is the company's return on equity for Year 2?

Required:

a.What is the company's net profit margin percentage for Year 2?

b.What is the company's gross margin percentage for Year 2?

c.What is the company's return on total assets for Year 2?

d.What is the company's return on equity for Year 2?

(Essay)

4.9/5  (43)

(43)

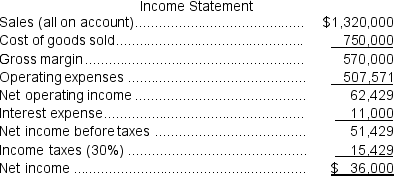

Wegener Corporation's most recent balance sheet and income statement appear below:

Required:

Compute the following for Year 2:

a.Working capital.

b.Current ratio.

c.Acid-test (quick)ratio.

d.Accounts receivable turnover.

e.Average collection period.

f.Inventory turnover.

g.Average sale period.

Required:

Compute the following for Year 2:

a.Working capital.

b.Current ratio.

c.Acid-test (quick)ratio.

d.Accounts receivable turnover.

e.Average collection period.

f.Inventory turnover.

g.Average sale period.

(Essay)

4.9/5  (41)

(41)

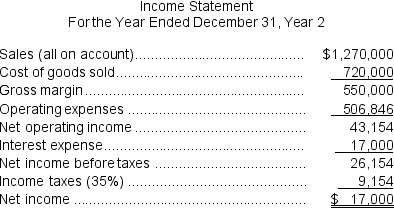

Sidell Corporation's most recent balance sheet and income statement appear below:

Required:

Compute the following for Year 2:

a.Times interest earned ratio.

b.Debt-to-equity ratio.

Required:

Compute the following for Year 2:

a.Times interest earned ratio.

b.Debt-to-equity ratio.

(Essay)

4.8/5  (35)

(35)

Spomer Corporation's inventory at the end of Year 2 was $114,000 and its inventory at the end of Year 1 was $120,000.Cost of goods sold amounted to $710,000 in Year 2.The company's inventory turnover for Year 2 is closest to:

(Multiple Choice)

4.9/5  (39)

(39)

Rough Corporation's total assets at the end of Year 2 were $1,247,000 and at the end of Year 1 were $1,270,000.The company's total liabilities at the end of Year 2 were $512,000 and at the end of Year 1 were $550,000.The company's total stockholders' equity at the end of Year 2 was $735,000 and at the end of Year 1 was $720,000.The company's equity multiplier is closest to:

(Multiple Choice)

4.9/5  (29)

(29)

Wittels Corporation has provided the following data:  In Year 2, the company's net operating income was $42,571, its net income before taxes was $21,571, and its net income was $15,100.The company's equity multiplier is closest to:

In Year 2, the company's net operating income was $42,571, its net income before taxes was $21,571, and its net income was $15,100.The company's equity multiplier is closest to:

(Multiple Choice)

4.8/5  (36)

(36)

Showing 201 - 220 of 289

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)