Exam 14: Financial Statement Analysis

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Product Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting256 Questions

Exam 4: Activity-Based Costing230 Questions

Exam 5: Process Costing6 Cost-Volume-Profit Relationships139 Questions

Exam 6: Cost-Volume-Profit Relationships260 Questions

Exam 7: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 8: Master Budgeting236 Questions

Exam 10: Performance Measurement in Decentralized Organizations180 Questions

Exam 11: Differential Analysis: The Key to Decision Making203 Questions

Exam 12: Capital Budgeting Decisions179 Questions

Exam 9: Flexible Budgets Standard Costs and Variance Analysis461 Questions

Exam 13: Statement of Cash Flows132 Questions

Exam 14: Financial Statement Analysis289 Questions

Exam 15: Job-Order Costing: Cost Flows and External Reporting28 Questions

Exam 16: Process Costing6 Cost-Volume-Profit Relationships100 Questions

Exam 17: Cost-Volume-Profit Relationships82 Questions

Exam 18:Flexible Budgets, Standard Costs, and Variance Analysis177 Questions

Exam 19: Flexible Budgets, Standard Costs, and Variance Analysis140 Questions

Exam 20: A Capital Budgeting Decisions16 Questions

Exam 21: A Statement of Cash Flows56 Questions

Select questions type

The accounts receivable for Note Corporation was $240,000 at the beginning of the year and $260,000 at the end of the year.If the accounts receivable turnover for the year was 8 and 20% of the total sales were cash sales, the total sales for the year were:

(Multiple Choice)

4.9/5  (47)

(47)

The price-earnings ratio is determined by dividing market price per share of stock by the earnings per share.

(True/False)

4.9/5  (33)

(33)

Accounts receivable turnover will normally decrease as a result of:

(Multiple Choice)

4.8/5  (32)

(32)

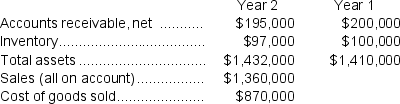

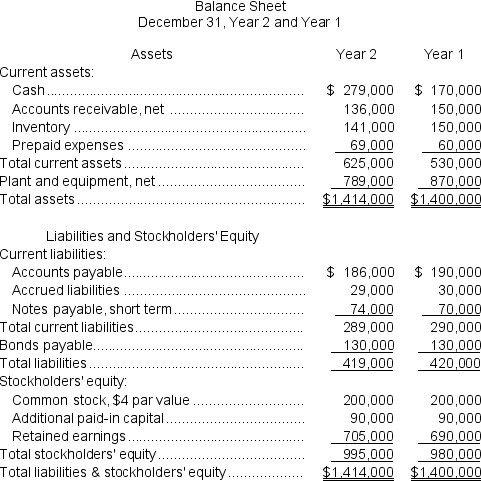

Kestner Corporation has provided the following financial data:  Required:

a.What is the company's accounts receivable turnover for Year 2?

b.What is the company's average collection period for Year 2?

c.What is the company's inventory turnover for Year 2?

d.What is the company's average sale period for Year 2?

e.What is the company's operating cycle for Year 2?

f.What is the company's total asset turnover for Year 2?

Required:

a.What is the company's accounts receivable turnover for Year 2?

b.What is the company's average collection period for Year 2?

c.What is the company's inventory turnover for Year 2?

d.What is the company's average sale period for Year 2?

e.What is the company's operating cycle for Year 2?

f.What is the company's total asset turnover for Year 2?

(Essay)

4.9/5  (34)

(34)

McRae Corporation's total current assets are $380,000, its noncurrent assets are $500,000, its total current liabilities are $340,000, its long-term liabilities are $250,000, and its stockholders' equity is $290,000.Working capital is:

(Multiple Choice)

4.8/5  (39)

(39)

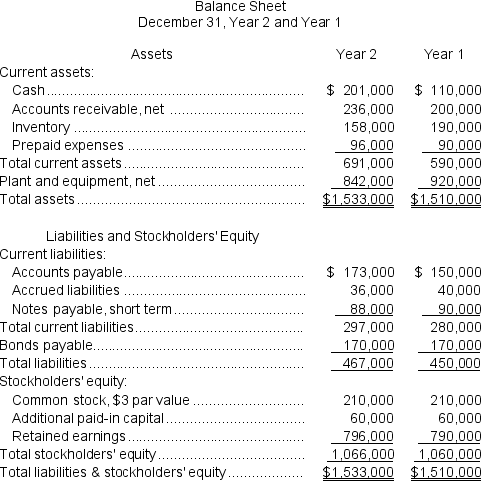

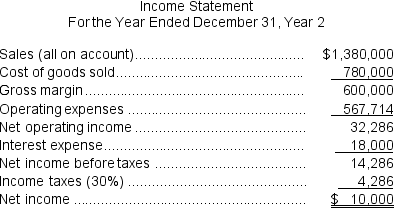

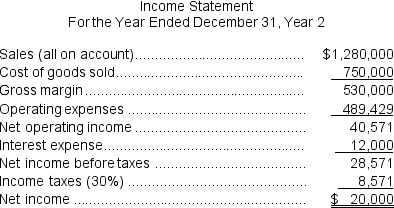

Tobia Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $6,300.The market price of common stock at the end of Year 2 was $1.78 per share.

Required:

a.What is the company's times interest earned ratio for Year 2?

b.What is the company's debt-to-equity ratio at the end of Year 2?

c.What is the company's equity multiplier at the end of Year 2?

d.What is the company's earnings per share for Year 2?

e.What is the company's price-earnings ratio for Year 2?

f.What is the company's dividend payout ratio for Year 2?

g.What is the company's dividend yield ratio for Year 2?

h.What is the company's book value per share at the end of Year 2?

Dividends on common stock during Year 2 totaled $6,300.The market price of common stock at the end of Year 2 was $1.78 per share.

Required:

a.What is the company's times interest earned ratio for Year 2?

b.What is the company's debt-to-equity ratio at the end of Year 2?

c.What is the company's equity multiplier at the end of Year 2?

d.What is the company's earnings per share for Year 2?

e.What is the company's price-earnings ratio for Year 2?

f.What is the company's dividend payout ratio for Year 2?

g.What is the company's dividend yield ratio for Year 2?

h.What is the company's book value per share at the end of Year 2?

(Essay)

4.8/5  (27)

(27)

The company's total asset turnover for Year 2 is closest to:

(Multiple Choice)

4.8/5  (36)

(36)

The company's debt-to-equity ratio at the end of Year 2 is closest to:

(Multiple Choice)

4.8/5  (41)

(41)

Purchasing marketable securities with cash will have no effect on a company's acid-test ratio.

(True/False)

4.9/5  (35)

(35)

The acid-test (quick)ratio at the end of Year 2 is closest to:

(Multiple Choice)

4.8/5  (32)

(32)

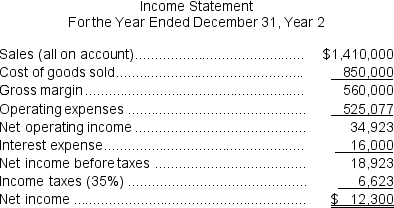

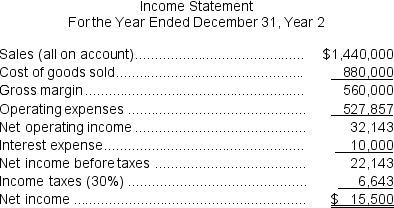

Schepp Corporation has provided the following financial data:

Required:

a.What is the company's times interest earned ratio for Year 2?

b.What is the company's debt-to-equity ratio at the end of Year 2?

c.What is the company's equity multiplier at the end of Year 2?

d.What is the company's net profit margin percentage for Year 2?

e.What is the company's gross margin percentage for Year 2?

f.What is the company's return on total assets for Year 2?

g.What is the company's return on equity for Year 2?

Required:

a.What is the company's times interest earned ratio for Year 2?

b.What is the company's debt-to-equity ratio at the end of Year 2?

c.What is the company's equity multiplier at the end of Year 2?

d.What is the company's net profit margin percentage for Year 2?

e.What is the company's gross margin percentage for Year 2?

f.What is the company's return on total assets for Year 2?

g.What is the company's return on equity for Year 2?

(Essay)

4.9/5  (38)

(38)

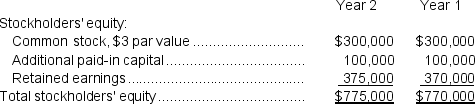

Mihok Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $5,000.The market price of common stock at the end of Year 2 was $0.97 per share.

Required:

a.What is the company's earnings per share for Year 2?

b.What is the company's price-earnings ratio for Year 2?

c.What is the company's dividend payout ratio for Year 2?

d.What is the company's dividend yield ratio for Year 2?

e.What is the company's book value per share at the end of Year 2?

Dividends on common stock during Year 2 totaled $5,000.The market price of common stock at the end of Year 2 was $0.97 per share.

Required:

a.What is the company's earnings per share for Year 2?

b.What is the company's price-earnings ratio for Year 2?

c.What is the company's dividend payout ratio for Year 2?

d.What is the company's dividend yield ratio for Year 2?

e.What is the company's book value per share at the end of Year 2?

(Essay)

4.9/5  (42)

(42)

The company's net profit margin percentage for Year 2 is closest to:

(Multiple Choice)

4.9/5  (34)

(34)

Harris Corporation, a retailer, had cost of goods sold of $290,000 last year.The beginning inventory balance was $26,000 and the ending inventory balance was $24,000.The corporation's inventory turnover was closest to:

(Multiple Choice)

4.9/5  (40)

(40)

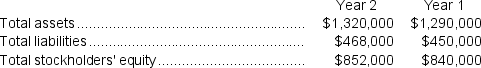

Hagle Corporation has provided the following financial data:

Required:

a.What is the company's accounts receivable turnover for Year 2?

b.What is the company's average collection period for Year 2?

c.What is the company's inventory turnover for Year 2?

d.What is the company's average sale period for Year 2?

e.What is the company's operating cycle for Year 2?

f.What is the company's total asset turnover for Year 2?

Required:

a.What is the company's accounts receivable turnover for Year 2?

b.What is the company's average collection period for Year 2?

c.What is the company's inventory turnover for Year 2?

d.What is the company's average sale period for Year 2?

e.What is the company's operating cycle for Year 2?

f.What is the company's total asset turnover for Year 2?

(Essay)

4.9/5  (39)

(39)

Maraby Corporation's average collection period for Year 2 was closest to:

(Multiple Choice)

4.7/5  (39)

(39)

Keyton Corporation's net operating income in Year 2 was $43,714, net income before taxes was $30,714, and the net income was $21,500.Total common stock was $200,000 at the end of both Year 2 and Year 1.The par value of common stock is $4 per share.The company's total stockholders' equity at the end of Year 2 amounted to $1,148,000 and at the end of Year 1 to $1,130,000.The company declared and paid $3,500 dividends on common stock in Year 2.The market price per share was $8.43 at the end of Year 2.The company's dividend payout ratio for Year 2 is closest to:

(Multiple Choice)

4.8/5  (40)

(40)

A common-size financial statement is a vertical analysis in which each financial statement account is expressed as a percentage.

(True/False)

4.9/5  (32)

(32)

Showing 141 - 160 of 289

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)