Exam 1: Managerial Accounting and Cost Concepts

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Product Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting256 Questions

Exam 4: Activity-Based Costing230 Questions

Exam 5: Process Costing6 Cost-Volume-Profit Relationships139 Questions

Exam 6: Cost-Volume-Profit Relationships260 Questions

Exam 7: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 8: Master Budgeting236 Questions

Exam 10: Performance Measurement in Decentralized Organizations180 Questions

Exam 11: Differential Analysis: The Key to Decision Making203 Questions

Exam 12: Capital Budgeting Decisions179 Questions

Exam 9: Flexible Budgets Standard Costs and Variance Analysis461 Questions

Exam 13: Statement of Cash Flows132 Questions

Exam 14: Financial Statement Analysis289 Questions

Exam 15: Job-Order Costing: Cost Flows and External Reporting28 Questions

Exam 16: Process Costing6 Cost-Volume-Profit Relationships100 Questions

Exam 17: Cost-Volume-Profit Relationships82 Questions

Exam 18:Flexible Budgets, Standard Costs, and Variance Analysis177 Questions

Exam 19: Flexible Budgets, Standard Costs, and Variance Analysis140 Questions

Exam 20: A Capital Budgeting Decisions16 Questions

Exam 21: A Statement of Cash Flows56 Questions

Select questions type

Haack Inc.is a merchandising company.Last month the company's cost of goods sold was $84,000.The company's beginning merchandise inventory was $20,000 and its ending merchandise inventory was $18,000.What was the total amount of the company's merchandise purchases for the month?

(Multiple Choice)

4.8/5  (28)

(28)

The incremental manufacturing cost that the company will incur if it increases production from 5,000 to 5,001 units is closest to:

(Multiple Choice)

4.8/5  (35)

(35)

Depreciation on a personal computer used in the marketing department of a manufacturing company would be classified as:

(Multiple Choice)

4.7/5  (38)

(38)

During the month of May, direct labor cost totaled $10,000 and direct labor cost was 40% of prime cost.If total manufacturing costs during May were $86,000, the manufacturing overhead was:

(Multiple Choice)

4.8/5  (32)

(32)

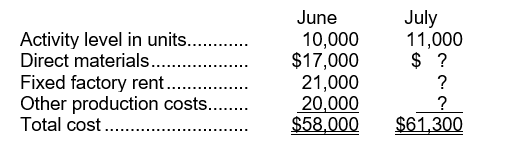

The following data pertains to activity and costs for two months:  Assuming that these activity levels are within the relevant range, the other production costs for July were:

Assuming that these activity levels are within the relevant range, the other production costs for July were:

(Multiple Choice)

4.9/5  (37)

(37)

What would be the average fixed cost per unit at an activity level of 5,200 units? Assume that this level of activity is within the relevant range.

(Multiple Choice)

4.9/5  (37)

(37)

To the nearest whole cent, what should be the average cost of operating the helpline per call at a volume of 25,300 calls in a month? (Assume that this call volume is within the relevant range.)

(Multiple Choice)

4.9/5  (33)

(33)

The total of the manufacturing overhead costs listed above for September is:

(Multiple Choice)

4.9/5  (36)

(36)

A contribution format income statement separates costs into fixed and variable categories, first deducting variable expenses from sales to obtain the contribution margin.

(True/False)

4.9/5  (42)

(42)

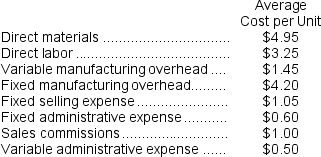

Macy Corporation's relevant range of activity is 4,000 units to 8,000 units.When it produces and sells 6,000 units, its average costs per unit are as follows:  If the selling price is $23.50 per unit, the contribution margin per unit sold is closest to:

If the selling price is $23.50 per unit, the contribution margin per unit sold is closest to:

(Multiple Choice)

4.8/5  (38)

(38)

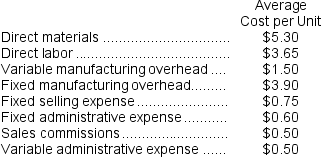

Saxbury Corporation's relevant range of activity is 3,000 units to 7,000 units.When it produces and sells 5,000 units, its average costs per unit are as follows:  Required:

a.For financial reporting purposes, what is the total amount of product costs incurred to make 5,000 units?

b.For financial reporting purposes, what is the total amount of period costs incurred to sell 5,000 units?

c.If 6,000 units are sold, what is the variable cost per unit sold?

d.If 6,000 units are sold, what is the total amount of variable costs related to the units sold?

e.If 6,000 units are produced, what is the average fixed manufacturing cost per unit produced?

f.If 6,000 units are produced, what is the total amount of fixed manufacturing cost incurred?

g.If 6,000 units are produced, what is the total amount of manufacturing overhead cost incurred? What is this total amount expressed on a per unit basis?

h.If the selling price is $22.90 per unit, what is the contribution margin per unit sold?

i.If 4,000 units are produced, what is the total amount of direct manufacturing cost incurred?

j.If 4,000 units are produced, what is the total amount of indirect manufacturing cost incurred?

k.What incremental manufacturing cost will the company incur if it increases production from 5,000 to 5,001 units?

Required:

a.For financial reporting purposes, what is the total amount of product costs incurred to make 5,000 units?

b.For financial reporting purposes, what is the total amount of period costs incurred to sell 5,000 units?

c.If 6,000 units are sold, what is the variable cost per unit sold?

d.If 6,000 units are sold, what is the total amount of variable costs related to the units sold?

e.If 6,000 units are produced, what is the average fixed manufacturing cost per unit produced?

f.If 6,000 units are produced, what is the total amount of fixed manufacturing cost incurred?

g.If 6,000 units are produced, what is the total amount of manufacturing overhead cost incurred? What is this total amount expressed on a per unit basis?

h.If the selling price is $22.90 per unit, what is the contribution margin per unit sold?

i.If 4,000 units are produced, what is the total amount of direct manufacturing cost incurred?

j.If 4,000 units are produced, what is the total amount of indirect manufacturing cost incurred?

k.What incremental manufacturing cost will the company incur if it increases production from 5,000 to 5,001 units?

(Essay)

4.8/5  (45)

(45)

Within the relevant range, a change in activity results in a change in variable cost per unit and total fixed cost.

(True/False)

4.8/5  (41)

(41)

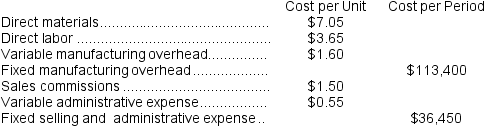

Dobosh Corporation has provided the following information:  Required:

a.For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units?

b.For financial reporting purposes, what is the total amount of period costs incurred to sell 9,000 units?

c.If 10,000 units are sold, what is the variable cost per unit sold?

d.If 10,000 units are sold, what is the total amount of variable costs related to the units sold?

e.If 10,000 units are produced, what is the total amount of manufacturing overhead cost incurred?

f.If the selling price is $21.60 per unit, what is the contribution margin per unit sold?

g.If 8,000 units are produced, what is the total amount of direct manufacturing cost incurred?

h.If 8,000 units are produced, what is the total amount of indirect manufacturing costs incurred?

i.What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units?

Required:

a.For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units?

b.For financial reporting purposes, what is the total amount of period costs incurred to sell 9,000 units?

c.If 10,000 units are sold, what is the variable cost per unit sold?

d.If 10,000 units are sold, what is the total amount of variable costs related to the units sold?

e.If 10,000 units are produced, what is the total amount of manufacturing overhead cost incurred?

f.If the selling price is $21.60 per unit, what is the contribution margin per unit sold?

g.If 8,000 units are produced, what is the total amount of direct manufacturing cost incurred?

h.If 8,000 units are produced, what is the total amount of indirect manufacturing costs incurred?

i.What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units?

(Essay)

4.8/5  (39)

(39)

To the nearest whole dollar, what should be the total property taxes at a sales volume of 37,200 units? (Assume that this sales volume is within the relevant range.)

(Multiple Choice)

4.9/5  (39)

(39)

If 6,000 units are produced, the total amount of direct manufacturing cost incurred is closest to:

(Multiple Choice)

5.0/5  (38)

(38)

If 4,000 units are sold, the variable cost per unit sold is closest to:

(Multiple Choice)

4.9/5  (39)

(39)

The total of the period costs listed above for September is:

(Multiple Choice)

4.9/5  (38)

(38)

Showing 61 - 80 of 299

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)