Exam 4: The Time Value of Money

Exam 1: An Overview of Managerial Finance51 Questions

Exam 2: Analysis of Financial Statements86 Questions

Exam 3: The Financial Environment: Markets, institutions, and Investment Banking40 Questions

Exam 4: The Time Value of Money95 Questions

Exam 5: The Cost of Money45 Questions

Exam 6: Bonds Debt-Characteristics and Valuation104 Questions

Exam 7: Stocks Equity-Characteristics and Valuation68 Questions

Exam 8: Risk and Rates of Return68 Questions

Exam 9: Capital Budgeting Techniques94 Questions

Exam 10: Project Cash Flows and Risk103 Questions

Exam 11: The Cost of Capital86 Questions

Exam 12: Capital Structure86 Questions

Exam 13: Distribution of Retained Earnings: Dividends and Stock Repurchases40 Questions

Exam 14: Working Capital Policy31 Questions

Exam 15: Managing Short-Term Assets108 Questions

Exam 16: Managing Short-Term Liabilities Financing101 Questions

Exam 17: Financial Planning and Control91 Questions

Exam 18: project Cash Flows and Risk5 Questions

Select questions type

Cash flow time lines are used primarily for decisions involving paying off debt or investing in financial securities.They cannot be used when making decisions about investments in physical assets.

(True/False)

4.9/5  (29)

(29)

Assume that you can invest to earn a stated annual rate of return of 12 percent,but where interest is compounded semiannually.If you make 20 consecutive semiannual deposits of $500 each,with the first deposit being made today,what will your balance be at the end of Year 20?

(Multiple Choice)

4.7/5  (38)

(38)

Assume that you just had a child,and you are now planning for her college education.You would like to make 43 equal payments over the next 21 years (the first payment to be made immediately,all other payments to be made at 6-month intervals,with the final payment to be made at her 21st birthday)so that you will be able to cover her expected expenses while in school.You expect to pay expenses on her 18th,19th,20th,and 21st birthdays.Assume that the current (time period 0)annual cost of college is $6,000,that you expect annual inflation to be 8 percent for the next 5 years,and then 5 percent thereafter.If you expect to be able to earn a return of 4 percent every 6 months on your investments (a simple rate of 8 percent with semiannual compounding),what will be the amount of each of the 43 payments?

(Multiple Choice)

4.9/5  (42)

(42)

You deposited $1,000 in a savings account that pays 8 percent interest,compounded quarterly,planning to use it to finish your last year in college.Eighteen months later,you decide to go to the Rocky Mountains to become a ski instructor rather than continue in school,so you close out your account.How much money will you receive?

(Multiple Choice)

4.8/5  (37)

(37)

The difference between the PV of an annuity due and the PV of an ordinary annuity is that each of the payments of the annuity due is discounted by one more year.

(True/False)

5.0/5  (49)

(49)

In 1958 the average tuition for one year at an Ivy League school was $1,800.Thirty years later,in 1988,the average cost was $13,700.What was the growth rate in tuition over the 30-year period?

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following payments (receipts)would probably not be considered an annuity due? Based on your knowledge and using logic,think about the timing of the payments.

(Multiple Choice)

4.9/5  (46)

(46)

In its first year of operations,1999,the Gourmet Cheese Shoppe had earnings per share (EPS)of $0.26.Four years later,in 2003,EPS was up to $0.38,and 7 years after that,in 2010,EPS was up to $0.535.It appears that the first 4 years represented a supernormal growth situation and since then a more normal growth rate has been sustained.What are the rates of growth for the earlier period and for the later period?

(Multiple Choice)

4.8/5  (40)

(40)

You have determined the profitability of a planned project by finding the present value of all the cash flows form that project.Which of the following would cause the project to look more appealing in terms of the present value of those cash flows?

(Multiple Choice)

4.9/5  (42)

(42)

Assume that you inherited some money.A friend of yours is working as an unpaid intern at a local brokerage firm,and her boss is selling some securities which call for four payments,$50 at the end of each of the next 3 years,plus a payment of $1,050 at the end of Year 4.Your friend says she can get you some of these securities at a cost of $900 each.Your money is now invested in a bank that pays an 8 percent simple (quoted)interest rate,but with quarterly compounding.You regard the securities as being just as safe,and as liquid,as your bank deposit,so your required effective annual rate of return on the securities is the same as that on your bank deposit.You must calculate the value of the securities to decide whether they are a good investment.What is their present value to you?

(Multiple Choice)

4.8/5  (41)

(41)

You have some money on deposit in a bank account which pays a simple (or quoted)rate of 8.0944 percent,but with interest compounded daily (using a 365-day year).Your friend owns a security which calls for the payment of $10,000 after 27 months.The security is just as safe as your bank deposit,and your friend offers to sell it to you for $8,000.If you buy the security,by how much will the effective annual rate of return on your investment change?

(Multiple Choice)

4.9/5  (39)

(39)

At an effective annual interest rate of 20 percent,how many years will it take a given amount to triple in value? (Round to the closest year.)

(Multiple Choice)

4.9/5  (43)

(43)

A recent advertisement in the financial section of a magazine carried the following claim: "Invest your money with us at 14 percent,compounded annually,and we guarantee to double your money sooner than you imagine." Ignoring taxes,how long would it take to double your money at a simple rate of 14 percent,compounded annually?

(Multiple Choice)

4.7/5  (42)

(42)

You plan to invest an amount of money in five-year certificate of deposit (CD)at your bank.The stated interest rate applied to the CD is 12 percent,compounded monthly.How much must you invest if you want the balance in the CD account to be $8,500 in five years?

(Multiple Choice)

4.7/5  (39)

(39)

Compounding is the process of converting today's values,which are termed present value,to future value.

(True/False)

4.9/5  (37)

(37)

You expect to receive $1,000 at the end of each of the next 3 years.You will deposit these payments into an account which pays 10 percent compounded semiannually.What is the future value of these payments,that is,the value at the end of the third year?

(Multiple Choice)

5.0/5  (33)

(33)

Because we usually assume positive interest rates in time value analyses,the present value of a three-year annuity will always be less than the future value of a single lump sum,if the annuity payment equals the original lump sum investment.

(True/False)

4.9/5  (42)

(42)

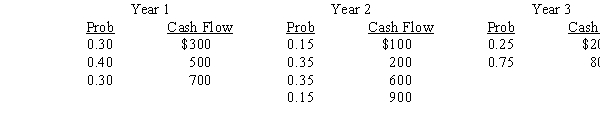

A project with a 3-year life has the following probability distributions for possible end of year cash flows in each of the next three years:  Using an interest rate of 8 percent,find the expected present value of these uncertain cash flows.(Hint: Find the expected cash flow in each year,then evaluate those cash flows.)

Using an interest rate of 8 percent,find the expected present value of these uncertain cash flows.(Hint: Find the expected cash flow in each year,then evaluate those cash flows.)

(Multiple Choice)

4.9/5  (37)

(37)

Showing 61 - 80 of 95

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)