Exam 12: Cash Flow Estimation and Risk Analysis

Exam 1: An Overview of Financial Management65 Questions

Exam 2: Financial Markets and Institutions33 Questions

Exam 3: Financial Statements, cash Flow, and Taxes130 Questions

Exam 4: Analysis of Financial Statements133 Questions

Exam 5: Time Value of Money163 Questions

Exam 6: Interest Rates82 Questions

Exam 7: Bonds and Their Valuation92 Questions

Exam 8: Risk and Rates of Return146 Questions

Exam 9: Stocks and Their Valuation89 Questions

Exam 10: The Cost of Capital94 Questions

Exam 11: The Basics of Capital Budgeting108 Questions

Exam 12: Cash Flow Estimation and Risk Analysis81 Questions

Exam 13: Real Options and Other Topics in Capital Budgeting41 Questions

Exam 14: Capital Structure and Leverage88 Questions

Exam 16: Working Capital Management126 Questions

Exam 17: Financial Planning and Forecasting39 Questions

Exam 18: Derivatives and Risk Management35 Questions

Exam 19: Multinational Financial Management50 Questions

Exam 20: Hybrid Financing: Preferred Stock, leasing, warrants, and Convertibles60 Questions

Exam 21: Mergers and Acquisitions39 Questions

Exam 22: Continuous Compounding and Discounting8 Questions

Exam 23: Zero Coupon Bonds18 Questions

Exam 24: Bankruptcy and Reorganization4 Questions

Exam 25: Calculating Beta Coefficients8 Questions

Exam 26: Using the Capm to Estimate the Risk-Adjusted Cost of Capital5 Questions

Exam 27: Techniques for Measuring Beta Risk3 Questions

Exam 28: Degree of Leverage23 Questions

Select questions type

We can identify the cash costs and cash inflows to a company that will result from a project.These could be called "direct inflows and outflows," and the net difference is the direct net cash flow.If there are other costs and benefits that do not flow from or to the firm,but to other parties,these are called externalities,and they need not be considered as a part of the capital budgeting analysis.

(True/False)

4.9/5  (36)

(36)

Wilson Co.is considering two mutually exclusive projects.Both require an initial investment of $10,000 at t = 0.Project X has an expected life of 2 years with after-tax cash inflows of $6,000 and $8,500 at the end of Years 1 and 2,respectively.In addition,Project X can be repeated at the end of Year 2 with no changes in its cash flows.Project Y has an expected life of 4 years with after-tax cash inflows of $4,600 at the end of each of the next 4 years.Each project has a WACC of 11%.What is the equivalent annual annuity of the most profitable project?

(Multiple Choice)

4.9/5  (35)

(35)

Carlyle Inc.is considering two mutually exclusive projects.Both require an initial investment of $15,000 at t = 0.Project S has an expected life of 2 years with after-tax cash inflows of $7,000 and $12,000 at the end of Years 1 and 2,respectively.In addition,Project S can be repeated at the end of Year 2 with no changes in its cash flows.Project L has an expected life of 4 years.Each project has a WACC of 9%.What is the equivalent annual annuity of the most profitable project?

(Multiple Choice)

5.0/5  (38)

(38)

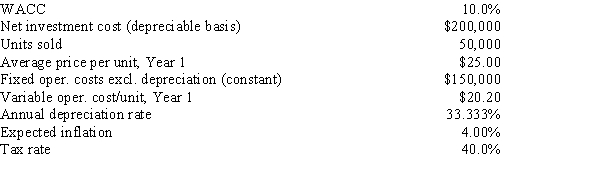

Poulsen Industries is analyzing an average-risk project,and the following data have been developed.Unit sales will be constant,but the sales price should increase with inflation.Fixed costs will also be constant,but variable costs should rise with inflation.The project should last for 3 years,it will be depreciated on a straight-line basis,and there will be no salvage value.No change in net operating working capital would be required.This is just one of many projects for the firm,so any losses on this project can be used to offset gains on other firm projects.The marketing manager does not think it is necessary to adjust for inflation since both the sales price and the variable costs will rise at the same rate,but the CFO thinks an inflation adjustment is required.What is the difference in the expected NPV if the inflation adjustment is made versus if it is not made?

(Multiple Choice)

4.7/5  (34)

(34)

A firm is considering a new project whose risk is greater than the risk of the firm's average project,based on all methods for assessing risk.In evaluating this project,it would be reasonable for management to do which of the following?

(Multiple Choice)

4.8/5  (32)

(32)

The two methods discussed in the text for dealing with unequal project lives are (1)the replacement chain approach and (2)the present value approach.

(True/False)

4.7/5  (33)

(33)

Dalrymple Inc.is considering production of a new product.In evaluating whether to go ahead with the project,which of the following items should NOT be explicitly considered when cash flows are estimated?

(Multiple Choice)

4.9/5  (35)

(35)

The use of accelerated versus straight-line depreciation causes net income reported to stockholders to be lower,and cash flows higher,during every year of a project's life,other things held constant.

(True/False)

4.9/5  (25)

(25)

When evaluating a new project,firms should include in the projected cash flows all of the following EXCEPT:

(Multiple Choice)

4.7/5  (46)

(46)

Opportunity costs include those cash inflows that could be generated from assets the firm already owns if those assets are not used for the project being evaluated.

(True/False)

4.8/5  (35)

(35)

Marshall-Miller & Company is considering the purchase of a new machine for $50,000,installed.The machine has a tax life of 5 years,and it can be depreciated according to the depreciation rates below.The firm expects to operate the machine for 4 years and then to sell it for $12,500.If the marginal tax rate is 40%,what will the after-tax salvage value be when the machine is sold at the end of Year 4?

(Multiple Choice)

4.8/5  (41)

(41)

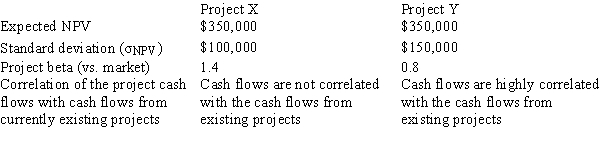

Taussig Technologies is considering two potential projects,X and Y.In assessing the projects' risks,the company estimated the beta of each project versus both the company's other assets and the stock market,and it also conducted thorough scenario and simulation analyses.This research produced the following data:

Which of the following statements is CORRECT?

Which of the following statements is CORRECT?

(Multiple Choice)

4.9/5  (40)

(40)

If a firm's projects differ in risk,then one way of handling this problem is to evaluate each project with the appropriate risk-adjusted discount rate.

(True/False)

4.8/5  (37)

(37)

Which of the following rules is CORRECT for capital budgeting analysis?

(Multiple Choice)

4.8/5  (43)

(43)

Your company,CSUS Inc.,is considering a new project whose data are shown below.The required equipment has a 3-year tax life,and the accelerated rates for such property are 33%,45%,15%,and 7% for Years 1 through 4.Revenues and other operating costs are expected to be constant over the project's 10-year expected operating life.What is the project's Year 4 cash flow?

(Multiple Choice)

4.9/5  (37)

(37)

Typically,a project will have a higher NPV if the firm uses accelerated rather than straight-line depreciation.This is because the total cash flows over the project's life will be higher if accelerated depreciation is used,other things held constant.

(True/False)

4.8/5  (33)

(33)

Showing 21 - 40 of 81

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)