Exam 4: The Time Value of Money

Exam 1: The Corporation41 Questions

Exam 2: Introduction to Financial Statement Analysis89 Questions

Exam 3: Arbitrage and Financial Decision Making80 Questions

Exam 4: The Time Value of Money82 Questions

Exam 5: Interest Rates67 Questions

Exam 6: Investment Decision Rules86 Questions

Exam 7: Fundamentals of Capital Budgeting93 Questions

Exam 8: Valuing Bonds104 Questions

Exam 9: Valuing Stocks89 Questions

Exam 10: Capital Markets and the Pricing of Risk98 Questions

Exam 11: Optimal Portfolio Choice and the Capital Asset Pricing Model108 Questions

Exam 12: Estimating the Cost of Capital108 Questions

Exam 13: Investor Behaviour and Capital Market Efficiency73 Questions

Exam 14: Capital Structure in a Perfect Market85 Questions

Exam 15: Debt and Taxes86 Questions

Exam 16: Financial Distress, managerial Incentives, and Information98 Questions

Exam 17: Payout Policy92 Questions

Exam 18: Capital Budgeting and Valuation With Leverage94 Questions

Exam 19: Valuation and Financial Modeling: a Case Study52 Questions

Exam 20: Financial Options56 Questions

Exam 21: Option Valuation40 Questions

Exam 22: Real Options57 Questions

Exam 23: The Mechanics of Raising Equity Capital50 Questions

Exam 24: Debt Financing49 Questions

Exam 25: Leasing57 Questions

Exam 26: Working Capital Management45 Questions

Exam 27: Short-Term Financial Planning49 Questions

Exam 28: Mergers and Acquisitions52 Questions

Exam 29: Corporate Governance48 Questions

Exam 30: Risk Management50 Questions

Exam 31: International Corporate Finance45 Questions

Select questions type

Use the information for the question(s) below.

Joe just inherited the family business, and having no desire to run the family business, he has decided to sell it to an entrepreneur. In exchange for the family business, Joe has been offered an immediate payment of $100,000. Joe will also receive payments of $50,000 in one year, $50,000 in two years, and $75,000 in three years. The current market rate of interest for Joe is 6%.

-Suppose a second entrepreneur approaches Joe and offers him $250,000 today for the business.Should Joe accept the new entrepreneur's offer or stick with the original offer of $100,000 and the series of payments over three years? Why?

(Essay)

4.8/5  (35)

(35)

Use the information for the question(s) below.

Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's college education. Currently college tuition, books, fees, and other costs average $12,500 per year. On average, tuition and other costs have historically increased at a rate of 4% per year.

-Assuming that costs continue to increase an average of 4% per year,tuition and other costs for one year for this student in 18 years when she enters college will be closest to:

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following is NOT a valid time value of money function in Excel?

(Multiple Choice)

4.9/5  (29)

(29)

Use the information for the question(s) below.

Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's college education. Currently college tuition, books, fees, and other costs average $12,500 per year. On average, tuition and other costs have historically increased at a rate of 4% per year.

-Since your first birthday,your grandparents have been depositing $1000 into a savings account on every one of your birthdays.The account pays 4% interest annually.Immediately after your grandparents make the deposit on your 18th birthday,the amount of money in your savings account will be closest to:

(Multiple Choice)

4.9/5  (35)

(35)

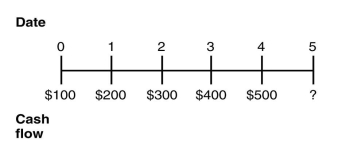

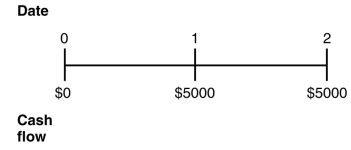

Consider the following timeline detailing a stream of cash flows:  If the current market rate of interest is 6%,then the future value of this stream of cash flows is closest to:

If the current market rate of interest is 6%,then the future value of this stream of cash flows is closest to:

(Multiple Choice)

4.8/5  (33)

(33)

You are interested in purchasing a new automobile that costs $35,000.The dealership offers you a special financing rate of 6% APR (0.5%)per month for 48 months.Assuming that you do not make a down payment on the auto and you take the dealer's financing deal,then your monthly car payments would be closest to:

(Multiple Choice)

4.8/5  (43)

(43)

Use the information for the question(s) below.

Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's college education. Currently college tuition, books, fees, and other costs average $12,500 per year. On average, tuition and other costs have historically increased at a rate of 4% per year.

-The British government has a consol bond outstanding that pays ₤100 in interest each year.Assuming that the current interest rate in Great Britain is 5% and that you will receive your first interest payment one year from now,then the value of the consol bond is closest to:

(Multiple Choice)

4.9/5  (32)

(32)

Use the information for the question(s) below.

Assume that you are 30 years old today, and that you are planning on retirement at age 65. Your current salary is $45,000 and you expect your salary to increase at a rate of 5% per year as long as you work. To save for your retirement, you plan on making annual contributions to a retirement account. Your first contribution will be made on your 31st birthday and will be 8% of this year's salary. Likewise, you expect to deposit 8% of your salary each year until you reach age 65. Assume that the rate of interest is 7%.

-Define the following terms:

(a)perpetuity

(b)annuity

(c)growing perpetuity

(d)growing annuity

(Essay)

4.9/5  (43)

(43)

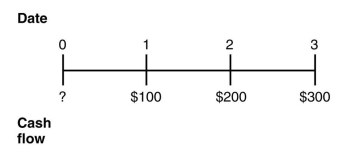

Consider the following timeline:  If the current market rate of interest is 9%,then the present value of this timeline as of year 0 is closest to:

If the current market rate of interest is 9%,then the present value of this timeline as of year 0 is closest to:

(Multiple Choice)

4.7/5  (32)

(32)

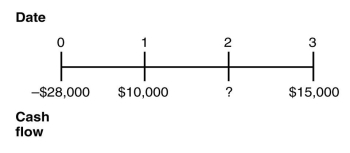

You are offered an investment opportunity that costs you $28,000,has an NPV of $2278,lasts for three years,has interest rate of 10%,and produces the following cash flows:  The missing cash flow from year 2 is closest to:

The missing cash flow from year 2 is closest to:

(Multiple Choice)

4.7/5  (36)

(36)

Use the information for the question(s) below.

Joe just inherited the family business, and having no desire to run the family business, he has decided to sell it to an entrepreneur. In exchange for the family business, Joe has been offered an immediate payment of $100,000. Joe will also receive payments of $50,000 in one year, $50,000 in two years, and $75,000 in three years. The current market rate of interest for Joe is 6%.

-Draw a timeline detailing Joe's cash flows from the sale of the family business.

(Essay)

4.8/5  (40)

(40)

Use the information for the question(s) below.

Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's college education. Currently college tuition, books, fees, and other costs average $12,500 per year. On average, tuition and other costs have historically increased at a rate of 4% per year.

-Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's college education.They decide to make deposits into an educational savings account on each of their daughter's birthdays,starting with her first birthday.Assume that the educational savings account will return a constant 7%.The parents deposit $2000 on their daughter's first birthday and plan to increase the size of their deposits by 5% each year.Assuming that the parents have already made the deposit for their daughter's 18th birthday,then the amount available for the daughter's college expenses on her 18th birthday is closest to:

(Multiple Choice)

4.8/5  (40)

(40)

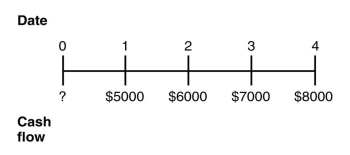

Consider the following timeline detailing a stream of cash flows:  If the current market rate of interest is 8%,then the present value of this stream of cash flows is closest to:

If the current market rate of interest is 8%,then the present value of this stream of cash flows is closest to:

(Multiple Choice)

4.8/5  (27)

(27)

Use the information for the question(s) below.

Suppose that a young couple has just had their first baby and they wish to ensure that enough money will be available to pay for their child's college education. Currently college tuition, books, fees, and other costs average $12,500 per year. On average, tuition and other costs have historically increased at a rate of 4% per year.

-Assume that college costs continue to increase an average of 4% per year and that all her college savings are invested in an account paying 7% interest.Draw a timeline that details the amount of money she will need to have in the future four each of her four years of her undergraduate education (assuming that she begins college at age 18).

(Essay)

4.8/5  (30)

(30)

Use the figure for the question(s) below.  -Which of the following statements regarding the timeline is false?

-Which of the following statements regarding the timeline is false?

(Multiple Choice)

4.8/5  (35)

(35)

In terms of present value,how much will Joe receive for selling the family business?

(Essay)

4.7/5  (35)

(35)

By quitting smoking,Lisa could save $350 per month in an account with an effective rate of interest at 8.75%.How long will it take her to accumulate $100,000?

(Multiple Choice)

4.9/5  (36)

(36)

You have been offered the following investment opportunity: if you pay $2500 today,you will receive $1000 at the end of each of the next three years.Assuming that you could otherwise earn 10% per year on your money,the NPV for this opportunity is closest to:

(Multiple Choice)

4.7/5  (38)

(38)

Showing 61 - 80 of 82

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)