Exam 3: The Time Value of Money

Exam 1: The Scope of Corporate Finance92 Questions

Exam 2: Financial Statement and Cash Flow Analysis104 Questions

Exam 3: The Time Value of Money145 Questions

Exam 4: Valuing Bonds114 Questions

Exam 5: Valuing Stocks109 Questions

Exam 6: The Trade-Off Between Risk and Return91 Questions

Exam 7: Risk,return,and the Capital Asset Pricing Model88 Questions

Exam 8: Capital Budgeting Process and Decision Criteria94 Questions

Exam 9: Cash Flow and Capital Budgeting98 Questions

Exam 10: Risk and Capital Budgeting97 Questions

Exam 11: Raising Long-Term Financing101 Questions

Exam 12: Capital Structure101 Questions

Exam 13: Long-Term Debt and Leasing103 Questions

Exam 14: Payout Policy103 Questions

Exam 15: Financial Planning95 Questions

Exam 16: Cash Conversion, inventory, and Receivables Management105 Questions

Exam 17: Cash, payables, and Liquidity Management104 Questions

Exam 18: International Financial Management99 Questions

Exam 19: Options98 Questions

Exam 20: Entrepreneurial Finance and Venture Capital94 Questions

Exam 21: Mergers, acquisitions, and Corporate Control100 Questions

Exam 22: Bankruptcy and Financial Distress97 Questions

Exam 23: Risk Management83 Questions

Select questions type

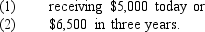

As a result of an injury settlement with your insurance you have the choice between  If you could invest your money at 8% compounded annually,which option should you pick?

If you could invest your money at 8% compounded annually,which option should you pick?

(Multiple Choice)

4.9/5  (41)

(41)

A young couple buys their dream house.After paying their down payment and closing costs,the couple has borrowed $400,000 from the bank.The terms of the mortgage are 30 years of monthly payments at an APR of 6% with monthly compounding.What is the monthly payment for the couple?

(Multiple Choice)

4.7/5  (38)

(38)

Suppose a professional sports team convinces a former player to come out of retirement and play for three seasons.They offer the player $2 million in year 1,$3 million in year 2,and $4 million in year 3.Assuming end of year payments of the salary,how would we find the value of his contract today if the player has a discount rate of 12%?

(Multiple Choice)

4.9/5  (37)

(37)

A young couple buys their dream house.After paying their down payment and closing costs,the couple has borrowed $400,000 from the bank.The terms of the mortgage are 30 years of monthly payments at an APR of 6% with monthly compounding.Suppose the couple wants to pay off their mortgage early,and will make extra payments to accomplish this goal.Specifically,the couple will pay an EXTRA $2,000 every 12 months (this extra amount is in ADDITION to the regular scheduled mortgage payment).The first extra $2,000 will be paid after month 12.What will be the balance of the loan after the first year of the mortgage?

(Multiple Choice)

4.8/5  (32)

(32)

Your parents set up a trust for you that you will not have access to until your 30th birthday,which is exactly 9 years from today.By prior arrangement,the trust will be worth exactly $200,000 on your 30th birthday.You need cash today and are willing to sell the rights to that trust today for a set amount.If the discount rate for such a cash flow is 12%,what is the maximum amount that someone should be willing to pay you today for the rights to the trust on your 30th birthday?

(Multiple Choice)

4.7/5  (35)

(35)

Your aunt is evaluating her retirement pension.She can retire at age 65 and collect $1,000 per month for the rest of her life.Assume that payments begin one month after her 65th birthday.If your aunt lives to be exactly 80 years old and can earn 7% interest (compounded monthly),what is the equivalent lump sum she would need at retirement to equal the value of the pension?

(Multiple Choice)

4.7/5  (39)

(39)

You wish to save $2,500,000 for your retirement by saving a certain sum every month for the next 40 years.If you can earn 9% compounded monthly,and you make your deposits at the BEGINNING of each month,how much would you have to deposit each month to achieve your objective?

(Multiple Choice)

4.8/5  (37)

(37)

If you invest $5,000 in a mutual fund with a total annual return (interest rate)of 8% and you re-invest the proceeds each year,what will be the value of your investment after five years?

(Multiple Choice)

4.9/5  (35)

(35)

If you deposit $9,000 at the BEGINNING of each year in an account earning 8% interest,what will be the value of the account in 25 years?

(Multiple Choice)

5.0/5  (33)

(33)

Hamilton Industries needs a bulldozer.The purchasing manager has her eye on a new model that will be available in three years at a price of $75,000.If Hamilton's discount rate is 11%,how much money does she need now to pay for the bulldozer when it's available?

(Multiple Choice)

4.9/5  (41)

(41)

In the equation below,the exponent "3" represents $133.10 = $100 ´ (1 + .1)3

(Multiple Choice)

4.9/5  (35)

(35)

You are asked to choose between a 4-year investment that pays 10% compound interest and a similar investment that pays 11.5% SIMPLE interest.Which investment will you choose?

(Multiple Choice)

4.9/5  (32)

(32)

Roxy is buying a house and the mortgage terms are 30 years,monthly payments.If the interest rate is 7% (APR),the loan is $300,000 loan,what is the balance of the loan after the seventh payment?

(Multiple Choice)

4.9/5  (32)

(32)

You will receive a stream of annual $70 payments to begin at the end of year 0 until the final payment at the BEGINNING of year 5.What amount will you have at the end of year 5 if you can invest all amounts at an 11% interest rate?

(Multiple Choice)

4.9/5  (37)

(37)

Having acquired great fortune based on your mastery of finance,you decide to set up a charity.You'd like to give the finance department of your alma mater $100,000 next year,and you want to make an annual contribution in perpetuity,with each year's contribution growing by 4%.The university can generate an 8% return on invested capital.What is the value of a lump-sum donation needed today to accomplish this?

(Multiple Choice)

4.9/5  (34)

(34)

The amount that someone is willing to pay today,for a single cash flow in the future is

(Multiple Choice)

4.8/5  (42)

(42)

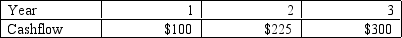

Consider the following set of cashflows to be received over the next 3 years:  If the discount rate is 10%,how would we write the formula to find the Future Value of this set of cash flows at year 3?

If the discount rate is 10%,how would we write the formula to find the Future Value of this set of cash flows at year 3?

(Multiple Choice)

4.9/5  (35)

(35)

Which of the following should have the greatest value if the discount rate applying to the cash flows is a positive value?

(Multiple Choice)

4.8/5  (40)

(40)

Showing 121 - 140 of 145

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)