Exam 14: Financial Performance Measurement

Exam 1: Uses of Accounting Information and the Financial Statements181 Questions

Exam 2: Analyzing Business Transactions204 Questions

Exam 3: Measuring Business Income235 Questions

Exam 4: Supplement - Closing Entries and the Work Sheet62 Questions

Exam 5: Financial Reporting and Analysis168 Questions

Exam 6: The Operating Cycle and Merchandising Operations199 Questions

Exam 7: Inventories168 Questions

Exam 8: Cash and Receivables188 Questions

Exam 9: Current Liabilities and Fair Value Accounting197 Questions

Exam 10: Long Term Assets238 Questions

Exam 11: Long-Term Liabilities197 Questions

Exam 12: Stockholders Equity237 Questions

Exam 13: The Statement of Cash Flows163 Questions

Exam 14: Financial Performance Measurement198 Questions

Exam 15: Investments173 Questions

Select questions type

Trend analysis requires the establishment of a base year for comparison purposes.

(True/False)

4.8/5  (36)

(36)

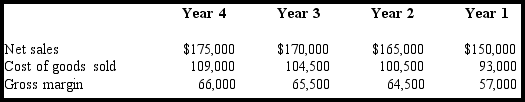

The following selected amounts were extracted from the financial statements of Flamingo Corporation.

Prepare a trend analysis for net sales,cost of goods sold,and gross margin.(Round answers to the nearest tenth of 1 percent.)Use Year 1 as the base year.

Prepare a trend analysis for net sales,cost of goods sold,and gross margin.(Round answers to the nearest tenth of 1 percent.)Use Year 1 as the base year.

(Essay)

4.7/5  (30)

(30)

What is the effect of the payment of an account payable on the current ratio and the quick ratio,respectively? (Assume the current ratio was 2.3 times and the quick ratio was 2.1 times before this transaction.)

(Multiple Choice)

4.8/5  (38)

(38)

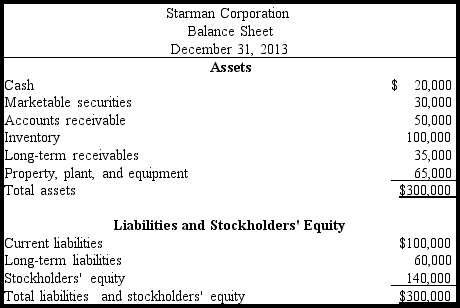

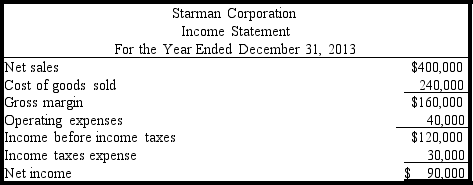

Following are the financial statements for Starman Corporation for the year ended December 31,2013.Assume that all balance sheet amounts represent both average and ending figures.

What is the inventory turnover for this corporation?

What is the inventory turnover for this corporation?

(Multiple Choice)

4.7/5  (34)

(34)

What is the best way to study the relationship of the components of financial statements?

(Multiple Choice)

4.8/5  (37)

(37)

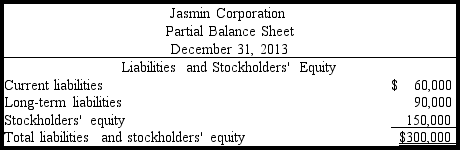

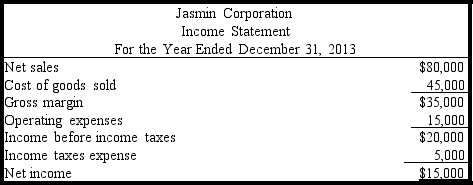

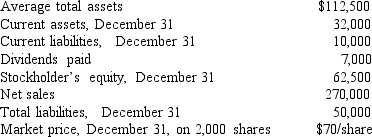

The following information pertains to Jasmin Corporation.Assume that all balance sheet amounts represent both average and ending figures.

Jasmin Corporation had 6,000 shares of common stock issued and outstanding.The market price of Jasmin common stock on December 31,2013,was $20.Jasmin paid dividends of $0.90 per share during 2013.

What is the return on assets for this corporation?

Jasmin Corporation had 6,000 shares of common stock issued and outstanding.The market price of Jasmin common stock on December 31,2013,was $20.Jasmin paid dividends of $0.90 per share during 2013.

What is the return on assets for this corporation?

(Multiple Choice)

4.7/5  (35)

(35)

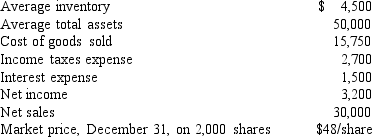

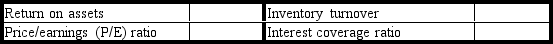

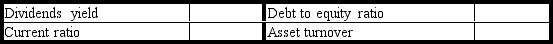

Use the following information to calculate the ratios requested below.Round answers to one decimal place.Show your work.

(Essay)

4.9/5  (35)

(35)

Use the following information to calculate the ratios requested below.Round answers to one decimal place.Show your work.

(Essay)

4.9/5  (34)

(34)

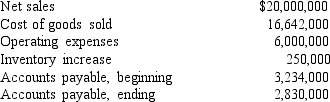

Given the following information,calculate the payables turnover and days' payable.Round to two decimal places.

a.Payables turnover

b.Days' payable

a.Payables turnover

b.Days' payable

(Essay)

4.7/5  (43)

(43)

Net income is needed to calculate all of the following ratios,except

(Multiple Choice)

4.8/5  (44)

(44)

All of the following are limitations on the use of industry norms,except

(Multiple Choice)

4.9/5  (38)

(38)

An increase in which of the following ratios is considered unfavorable?

(Multiple Choice)

4.7/5  (40)

(40)

The index number used in trend analysis is computed by dividing the base year amount by the index year amount,and multiplying that result by 100.

(True/False)

4.8/5  (41)

(41)

A limitation of using industry norms in financial performance evaluation is that some companies in the same industry may not be comparable.

(True/False)

4.7/5  (28)

(28)

It is possible for horizontal analysis to indicate a decrease in revenues from one year to another and an increase in net income.

(True/False)

4.9/5  (39)

(39)

An increase in which of the following ratios is considered unfavorable?

(Multiple Choice)

4.9/5  (34)

(34)

Horizontal analysis will reveal,for example,the percentage of net sales consumed by salaries expense.

(True/False)

4.9/5  (33)

(33)

Executive officers' compensation is typically comprised of all of the following except

(Multiple Choice)

4.8/5  (41)

(41)

A corporation's compensation committee,as required by the Sarbanes-Oxley Act of 2002,determines the pay of

(Multiple Choice)

4.9/5  (26)

(26)

Showing 21 - 40 of 198

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)