Exam 2: Consolidation of Financial Information

Exam 1: The Equity Method of Accounting for Investments121 Questions

Exam 1: A: the Equity Method of Accounting for Investments121 Questions

Exam 2: Consolidation of Financial Information116 Questions

Exam 2: A: Consolidation of Financial Information116 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition120 Questions

Exam 3: A: Consolidations - Subsequent to the Date of Acquisition120 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership117 Questions

Exam 4: A: Consolidated Financial Statements and Outside Ownership117 Questions

Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions123 Questions

Exam 5: A: Consolidated Financial Statements Intra-Entity Asset Transactions123 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues117 Questions

Exam 6: A: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues117 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes112 Questions

Exam 7: A: Consolidated Financial Statements - Ownership Patterns and Income Taxes112 Questions

Exam 8: Segment and Interim Reporting105 Questions

Exam 8: A: Segment and Interim Reporting115 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk99 Questions

Exam 9: A: Foreign Currency Transactions and Hedging Foreign Exchange Risk99 Questions

Exam 10: Translation of Foreign Currency Financial Statements96 Questions

Exam 10: A: Translation of Foreign Currency Financial Statements96 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards63 Questions

Exam 11: A: Worldwide Accounting Diversity and International Accounting Standards63 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission76 Questions

Exam 12: A: Financial Reporting and the Securities and Exchange Commission76 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations75 Questions

Exam 13: A: Accounting for Legal Reorganizations and Liquidations78 Questions

Exam 14: Partnerships: Formation and Operation89 Questions

Exam 14: A: Partnerships: Formation and Operation89 Questions

Exam 15: Partnerships: Termination and Liquidation69 Questions

Exam 15: A: Partnerships: Termination and Liquidation69 Questions

Exam 16: Accounting for State and Local Governments, Part I83 Questions

Exam 16: A: Accounting for State and Local Governments, Part I83 Questions

Exam 17: Accounting for State and Local Governments, Part II42 Questions

Exam 17: A: Accounting for State and Local Governments, Part II47 Questions

Exam 18: Accounting for Not-For-Profit Entities72 Questions

Exam 18: A: Accounting for Not-For-Profit Entities72 Questions

Exam 19: Accounting for Estates and Trusts81 Questions

Exam 19: A: Accounting for Estates and Trusts81 Questions

Select questions type

With respect to recognizing and measuring the fair value of a business combination in accordance with the acquisition method of accounting, which of the following should the acquirer consider when determining fair value?

(Multiple Choice)

4.8/5  (38)

(38)

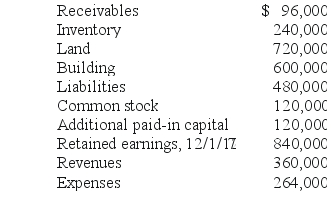

Jernigan Corp.had the following account balances at 12/1/17:

Several of Jernigan's accounts have fair values that differ from book value.The fair values are: Land - $480,000; Building - $720,000; Inventory - $336,000; and Liabilities - $396,000.

Inglewood Inc.acquired all of the outstanding common shares of Jernigan by issuing 20,000 shares of common stock having a $6 par value per share, but a $66 fair value per share.Stock issuance costs amounted to $12,000.

Required:

Prepare a fair value allocation and goodwill schedule at the date of the acquisition.

Several of Jernigan's accounts have fair values that differ from book value.The fair values are: Land - $480,000; Building - $720,000; Inventory - $336,000; and Liabilities - $396,000.

Inglewood Inc.acquired all of the outstanding common shares of Jernigan by issuing 20,000 shares of common stock having a $6 par value per share, but a $66 fair value per share.Stock issuance costs amounted to $12,000.

Required:

Prepare a fair value allocation and goodwill schedule at the date of the acquisition.

(Essay)

4.8/5  (37)

(37)

Compute the consolidated common stock at the date of acquisition.

(Multiple Choice)

4.9/5  (49)

(49)

Compute fair value of the net assets acquired at the date of the acquisition.

(Multiple Choice)

4.9/5  (29)

(29)

Assume that Bullen issued 12,000 shares of common stock with a $5 par value and a $47 fair value for all of the outstanding stock of Vicker.What is the consolidated balance for Land as a result of this acquisition transaction?

(Multiple Choice)

4.8/5  (37)

(37)

Assume that Bullen paid a total of $480,000 in cash for all of the shares of Vicker.In addition, Bullen paid $35,000 for secretarial and management time allocated to the acquisition transaction.What will be the balance in consolidated goodwill?

(Multiple Choice)

4.8/5  (47)

(47)

How are stock issuance costs accounted for in an acquisition business combination?

(Essay)

4.8/5  (42)

(42)

Compute the investment to be recorded at the date of acquisition.

(Multiple Choice)

4.9/5  (34)

(34)

What amount will be reported for consolidated long-term liabilities?

(Multiple Choice)

4.7/5  (41)

(41)

In a transaction accounted for using the acquisition method where consideration transferred exceeds book value of the acquired company, which statement is true for the acquiring company with regard to its investment?

(Multiple Choice)

4.9/5  (35)

(35)

By how much will Flynn's additional paid-in capital increase as a result of this acquisition?

(Multiple Choice)

4.7/5  (41)

(41)

Peterman Co.owns 55% of Samson Co.Under what circumstances would Peterman not be required to prepare consolidated financial statements?

(Essay)

4.7/5  (39)

(39)

Compute consolidated retained earnings at the date of the acquisition.

(Multiple Choice)

4.8/5  (30)

(30)

What amount will be reported for consolidated equipment (net)?

(Multiple Choice)

4.9/5  (40)

(40)

Which of the following statements is true regarding the acquisition method of accounting for a business combination?

(Multiple Choice)

4.9/5  (32)

(32)

In this acquisition business combination, what total amount of common stock and additional paid-in capital should Goodwin recognize on its consolidated financial statements?

(Multiple Choice)

4.9/5  (30)

(30)

Compute consolidated goodwill immediately following the acquisition.

(Multiple Choice)

4.7/5  (49)

(49)

Compute consolidated long-term liabilities at the date of the acquisition.

(Multiple Choice)

4.9/5  (42)

(42)

Under the acquisition method, what amount will be reported for consolidated retained earnings?

(Multiple Choice)

4.8/5  (41)

(41)

Showing 81 - 100 of 116

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)