Exam 9: A: Foreign Currency Transactions and Hedging Foreign Exchange Risk

Exam 1: The Equity Method of Accounting for Investments121 Questions

Exam 1: A: the Equity Method of Accounting for Investments121 Questions

Exam 2: Consolidation of Financial Information116 Questions

Exam 2: A: Consolidation of Financial Information116 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition120 Questions

Exam 3: A: Consolidations - Subsequent to the Date of Acquisition120 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership117 Questions

Exam 4: A: Consolidated Financial Statements and Outside Ownership117 Questions

Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions123 Questions

Exam 5: A: Consolidated Financial Statements Intra-Entity Asset Transactions123 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues117 Questions

Exam 6: A: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues117 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes112 Questions

Exam 7: A: Consolidated Financial Statements - Ownership Patterns and Income Taxes112 Questions

Exam 8: Segment and Interim Reporting105 Questions

Exam 8: A: Segment and Interim Reporting115 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk99 Questions

Exam 9: A: Foreign Currency Transactions and Hedging Foreign Exchange Risk99 Questions

Exam 10: Translation of Foreign Currency Financial Statements96 Questions

Exam 10: A: Translation of Foreign Currency Financial Statements96 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards63 Questions

Exam 11: A: Worldwide Accounting Diversity and International Accounting Standards63 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission76 Questions

Exam 12: A: Financial Reporting and the Securities and Exchange Commission76 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations75 Questions

Exam 13: A: Accounting for Legal Reorganizations and Liquidations78 Questions

Exam 14: Partnerships: Formation and Operation89 Questions

Exam 14: A: Partnerships: Formation and Operation89 Questions

Exam 15: Partnerships: Termination and Liquidation69 Questions

Exam 15: A: Partnerships: Termination and Liquidation69 Questions

Exam 16: Accounting for State and Local Governments, Part I83 Questions

Exam 16: A: Accounting for State and Local Governments, Part I83 Questions

Exam 17: Accounting for State and Local Governments, Part II42 Questions

Exam 17: A: Accounting for State and Local Governments, Part II47 Questions

Exam 18: Accounting for Not-For-Profit Entities72 Questions

Exam 18: A: Accounting for Not-For-Profit Entities72 Questions

Exam 19: Accounting for Estates and Trusts81 Questions

Exam 19: A: Accounting for Estates and Trusts81 Questions

Select questions type

A forward contract may be used for which of the following? 1) A fair value hedge of an asset.

2) A cash flow hedge of an asset.

3) A fair value hedge of a liability.

4) A cash flow hedge of a liability.

(Multiple Choice)

4.8/5  (43)

(43)

(A.) Assume this hedge is designated as a fair value hedge.Prepare the journal entries relating to the transaction and the forward contract.

(B.) Compute the effect on 2018 net income.

(C.) Compute the effect on 2019 net income.

(Essay)

4.8/5  (38)

(38)

How much foreign exchange gain or loss should be included in Shannon's 2018 income statement?

(Multiple Choice)

4.8/5  (28)

(28)

What are the two separate transactions that require recording under the two-transaction perspective?

(Essay)

4.8/5  (37)

(37)

Which statement is true regarding a foreign currency option?

(Multiple Choice)

5.0/5  (28)

(28)

Assuming this is a fair value hedge; prepare journal entries for this sales transaction and forward contract.

(Essay)

4.8/5  (40)

(40)

What amount of foreign exchange gain or loss should be recorded on January 30?

(Multiple Choice)

4.8/5  (46)

(46)

Mills Inc.had a receivable from a foreign customer that is due in the local currency of the customer (stickles).On December 31, 2018, this receivable for §200,000 was correctly included in Mills' balance sheet at $132,000.When the receivable was collected on February 15, 2019, the U.S.dollar equivalent was $144,000.In Mills' 2019 consolidated income statement, how much should have been reported as a foreign exchange gain?

(Multiple Choice)

4.9/5  (43)

(43)

What was the net impact on Mattie's 2019 income including the fair value hedge of a firm commitment?

(Multiple Choice)

4.8/5  (39)

(39)

Lawrence Company, a U.S.company, ordered parts costing 1,000,000 Thailand bahts from a foreign supplier on July 7 when the spot rate was $.025 per baht.A one-month forward contract was signed on that date to purchase 1,000,000 bahts at a rate of $.027.The forward contract is properly designated as a fair value hedge of the 1,000,000 baht firm commitment.On August 7, when the parts are received, the spot rate is $.028.What is the amount of accounts payable that will be paid at this date?

(Multiple Choice)

4.9/5  (39)

(39)

A U.S.company sells merchandise to a foreign company denominated in the foreign currency.Which of the following statements is true?

(Multiple Choice)

4.8/5  (39)

(39)

Assuming a forward contract was not entered into, what would be the net impact on Car Corp.'s 2018 income statement related to this transaction?

(Multiple Choice)

4.9/5  (39)

(39)

What was the net impact on Mattie's 2018 income as a result of this fair value hedge of a firm commitment?

(Multiple Choice)

4.8/5  (35)

(35)

Alpha, Inc., a U.S.company, had a receivable from a customer that was denominated in Mexican pesos.On December 31, 2017, this receivable for 75,000 pesos was correctly included in Alpha's balance sheet at $8,000.The receivable was collected on March 2, 2018, when the U.S.equivalent was $6,900.How much foreign exchange gain or loss will Alpha record on the income statement for the year ended December 31, 2018?

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following statements is true concerning hedge accounting?

(Multiple Choice)

4.9/5  (38)

(38)

Williams, Inc., a U.S.company, has a Japanese yen account receivable resulting from an export sale on March 1 to a customer in Japan.The exporter signed a forward contract on March 1 to sell yen and designated it as a cash flow hedge of a recognized receivable.The spot rate was $.0094, and the forward rate was $.0095.Which of the following did the U.S.exporter report in net income?

(Multiple Choice)

4.9/5  (32)

(32)

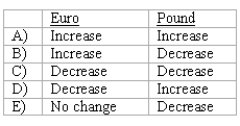

Angela, Inc., a U.S.company, had a euro receivable from exports to Spain and a British pound payable resulting from imports from England.Angela recorded foreign exchange gain related to both its euro receivable and pound payable.Did the foreign currencies increase or decrease in dollar value from the date of the transaction to the settlement date?

(Short Answer)

4.8/5  (43)

(43)

What amount should be included as a foreign exchange gain or loss from the two transactions for 2019?

(Multiple Choice)

4.8/5  (35)

(35)

Showing 61 - 80 of 99

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)