Exam 9: A: Foreign Currency Transactions and Hedging Foreign Exchange Risk

Exam 1: The Equity Method of Accounting for Investments121 Questions

Exam 1: A: the Equity Method of Accounting for Investments121 Questions

Exam 2: Consolidation of Financial Information116 Questions

Exam 2: A: Consolidation of Financial Information116 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition120 Questions

Exam 3: A: Consolidations - Subsequent to the Date of Acquisition120 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership117 Questions

Exam 4: A: Consolidated Financial Statements and Outside Ownership117 Questions

Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions123 Questions

Exam 5: A: Consolidated Financial Statements Intra-Entity Asset Transactions123 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues117 Questions

Exam 6: A: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues117 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes112 Questions

Exam 7: A: Consolidated Financial Statements - Ownership Patterns and Income Taxes112 Questions

Exam 8: Segment and Interim Reporting105 Questions

Exam 8: A: Segment and Interim Reporting115 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk99 Questions

Exam 9: A: Foreign Currency Transactions and Hedging Foreign Exchange Risk99 Questions

Exam 10: Translation of Foreign Currency Financial Statements96 Questions

Exam 10: A: Translation of Foreign Currency Financial Statements96 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards63 Questions

Exam 11: A: Worldwide Accounting Diversity and International Accounting Standards63 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission76 Questions

Exam 12: A: Financial Reporting and the Securities and Exchange Commission76 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations75 Questions

Exam 13: A: Accounting for Legal Reorganizations and Liquidations78 Questions

Exam 14: Partnerships: Formation and Operation89 Questions

Exam 14: A: Partnerships: Formation and Operation89 Questions

Exam 15: Partnerships: Termination and Liquidation69 Questions

Exam 15: A: Partnerships: Termination and Liquidation69 Questions

Exam 16: Accounting for State and Local Governments, Part I83 Questions

Exam 16: A: Accounting for State and Local Governments, Part I83 Questions

Exam 17: Accounting for State and Local Governments, Part II42 Questions

Exam 17: A: Accounting for State and Local Governments, Part II47 Questions

Exam 18: Accounting for Not-For-Profit Entities72 Questions

Exam 18: A: Accounting for Not-For-Profit Entities72 Questions

Exam 19: Accounting for Estates and Trusts81 Questions

Exam 19: A: Accounting for Estates and Trusts81 Questions

Select questions type

On June 1, CamCo received a signed agreement to sell inventory for ¥500,000.The sale would take place in 90 days.CamCo immediately signed a 90-day forward contract to sell the yen as soon as they are received.The spot rate on June 1 was ¥1 =$.004167, and the 90-day forward rate was ¥1 = $.00427.At what amount would CamCo record the Forward Contract on June 1?

(Multiple Choice)

4.9/5  (26)

(26)

For each of the following situations, select the best answer concerning accounting for foreign currency transactions:

(G) Results in a foreign exchange gain.

(L) Results in a foreign exchange loss.

(N) No foreign exchange gain or loss.

_____1.Export sale by a U.S.company denominated in dollars, foreign currency of buyer appreciates.

_____2.Export sale by a U.S.company denominated in foreign currency, foreign currency of buyer appreciates.

_____3.Import purchase by a U.S.company denominated in foreign currency, foreign currency of buyer appreciates.

_____4.Import purchase by a U.S.company denominated in dollars, foreign currency of buyer appreciates.

_____5.Import purchase by a U.S.company denominated in foreign currency, foreign currency of buyer depreciates.

_____6.Import purchase by a U.S.company denominated in dollars, foreign currency of buyer depreciates.

_____7.Export sale by a U.S.company denominated in dollars, foreign currency of buyer depreciates.

_____8.Export sale by a U.S.company denominated in foreign currency, foreign currency of buyer depreciates.

(Essay)

4.8/5  (30)

(30)

Compute the fair value of the foreign currency option at December 31, 2018.

(Multiple Choice)

4.7/5  (29)

(29)

What amount will Coyote Corp.report in its 2018 balance sheet for Inventory?

(Essay)

4.9/5  (36)

(36)

Assuming a forward contract was entered into, the foreign currency was originally sold in the foreign currency market on December 16, 2018 at a

(Multiple Choice)

4.8/5  (45)

(45)

What happens when a U.S.company purchases goods denominated in a foreign currency and the foreign currency appreciates?

(Essay)

4.8/5  (33)

(33)

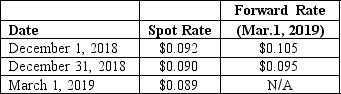

On December 1, 2018, Joseph Company, a U.S.company, entered into a three-month forward contract to purchase 50,000 pesos on March 1, 2019, as a fair value hedge of a foreign currency denominated account payable.The following U.S.dollar per peso exchange rates apply:  Joseph's incremental borrowing rate is 12 percent.The present value factor for two months at an annual interest rate of 12 percent is .9803.Which of the following is included in Joseph's December 31, 2018 balance sheet for the forward contract?

Joseph's incremental borrowing rate is 12 percent.The present value factor for two months at an annual interest rate of 12 percent is .9803.Which of the following is included in Joseph's December 31, 2018 balance sheet for the forward contract?

(Multiple Choice)

4.9/5  (31)

(31)

Where can you find exchange rates between the U.S.dollar and most foreign currencies?

(Essay)

4.9/5  (45)

(45)

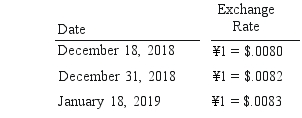

Gaw Produce Company purchased inventory from a Japanese company on December 18, 2018.Payment of 4,000,000 yen (¥) was due on January 18, 2019.Exchange rates between the dollar and the yen were as follows:

Required:

Prepare all journal entries for Gaw Produce Co.in connection with the purchase and payment.

Required:

Prepare all journal entries for Gaw Produce Co.in connection with the purchase and payment.

(Essay)

4.8/5  (38)

(38)

What happens when a U.S.company purchases goods denominated in a foreign currency and the foreign currency depreciates?

(Essay)

4.9/5  (44)

(44)

What happens when a U.S.company sells goods denominated in a foreign currency and the foreign currency appreciates?

(Essay)

4.8/5  (35)

(35)

What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

(Multiple Choice)

4.7/5  (30)

(30)

Which of the following is not a condition of accounting for hedge derivatives?

(Multiple Choice)

4.9/5  (38)

(38)

What amount should be included as a foreign exchange gain or loss from the two transactions for 2019?

(Multiple Choice)

4.9/5  (38)

(38)

U.S.GAAP provides guidance for hedges of all the following sources of foreign exchange risk except

(Multiple Choice)

4.8/5  (33)

(33)

What is the amount of Cost of Goods Sold for 2019 as a result of these transactions?

(Multiple Choice)

4.8/5  (33)

(33)

What amount should be included as a foreign exchange gain or loss from the two transactions for 2018?

(Multiple Choice)

4.8/5  (44)

(44)

Showing 81 - 99 of 99

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)