Exam 7: A: Consolidated Financial Statements - Ownership Patterns and Income Taxes

Exam 1: The Equity Method of Accounting for Investments121 Questions

Exam 1: A: the Equity Method of Accounting for Investments121 Questions

Exam 2: Consolidation of Financial Information116 Questions

Exam 2: A: Consolidation of Financial Information116 Questions

Exam 3: Consolidations - Subsequent to the Date of Acquisition120 Questions

Exam 3: A: Consolidations - Subsequent to the Date of Acquisition120 Questions

Exam 4: Consolidated Financial Statements and Outside Ownership117 Questions

Exam 4: A: Consolidated Financial Statements and Outside Ownership117 Questions

Exam 5: Consolidated Financial Statements Intra-Entity Asset Transactions123 Questions

Exam 5: A: Consolidated Financial Statements Intra-Entity Asset Transactions123 Questions

Exam 6: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues117 Questions

Exam 6: A: Variable Interest Entities, Intra-Entity Debt, Consolidated Cash Flows, and Other Issues117 Questions

Exam 7: Consolidated Financial Statements - Ownership Patterns and Income Taxes112 Questions

Exam 7: A: Consolidated Financial Statements - Ownership Patterns and Income Taxes112 Questions

Exam 8: Segment and Interim Reporting105 Questions

Exam 8: A: Segment and Interim Reporting115 Questions

Exam 9: Foreign Currency Transactions and Hedging Foreign Exchange Risk99 Questions

Exam 9: A: Foreign Currency Transactions and Hedging Foreign Exchange Risk99 Questions

Exam 10: Translation of Foreign Currency Financial Statements96 Questions

Exam 10: A: Translation of Foreign Currency Financial Statements96 Questions

Exam 11: Worldwide Accounting Diversity and International Accounting Standards63 Questions

Exam 11: A: Worldwide Accounting Diversity and International Accounting Standards63 Questions

Exam 12: Financial Reporting and the Securities and Exchange Commission76 Questions

Exam 12: A: Financial Reporting and the Securities and Exchange Commission76 Questions

Exam 13: Accounting for Legal Reorganizations and Liquidations75 Questions

Exam 13: A: Accounting for Legal Reorganizations and Liquidations78 Questions

Exam 14: Partnerships: Formation and Operation89 Questions

Exam 14: A: Partnerships: Formation and Operation89 Questions

Exam 15: Partnerships: Termination and Liquidation69 Questions

Exam 15: A: Partnerships: Termination and Liquidation69 Questions

Exam 16: Accounting for State and Local Governments, Part I83 Questions

Exam 16: A: Accounting for State and Local Governments, Part I83 Questions

Exam 17: Accounting for State and Local Governments, Part II42 Questions

Exam 17: A: Accounting for State and Local Governments, Part II47 Questions

Exam 18: Accounting for Not-For-Profit Entities72 Questions

Exam 18: A: Accounting for Not-For-Profit Entities72 Questions

Exam 19: Accounting for Estates and Trusts81 Questions

Exam 19: A: Accounting for Estates and Trusts81 Questions

Select questions type

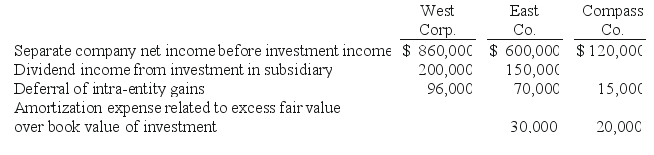

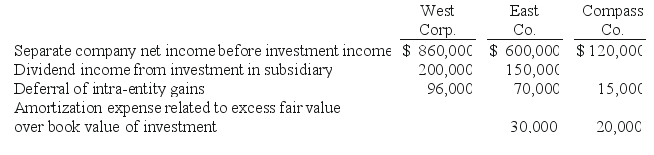

West Corp. owns 70% of the voting common stock of East Co. East owns 60% of Compass Co. West and East both use the initial value method to account for their investments. The following information is available from the financial statements and records of the three companies:

Separate company net income includes intra-entity gains before the consolidating deferral but does not include dividend income from investment in subsidiary.

-For West Corp.and consolidated subsidiaries, what total amount would be reported for the net income attributable to the noncontrolling interest?

Separate company net income includes intra-entity gains before the consolidating deferral but does not include dividend income from investment in subsidiary.

-For West Corp.and consolidated subsidiaries, what total amount would be reported for the net income attributable to the noncontrolling interest?

(Multiple Choice)

4.8/5  (28)

(28)

Reggie, Inc.owns 70 percent of Nancy Corporation.During the current year, Nancy reported operating income before tax of $100,000 and paid a dividend of $30,000.The income tax rate for both companies is 30 percent.What deferred income tax liability arising in the current year must be recognized in the consolidated balance sheet?

(Multiple Choice)

5.0/5  (39)

(39)

Use the following to answer questions 68 - 74:

-Which of the following statements is true?

(Multiple Choice)

4.8/5  (41)

(41)

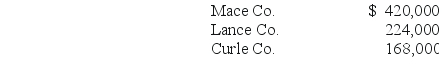

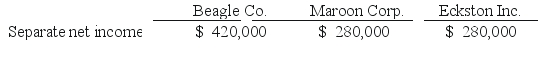

On January 1, 2017, Mace Co. acquired 75% of Lance Co.'s outstanding common stock. On the same date, Lance acquired an 80% interest in Curle Co. Both of these investments were acquired when book value was equal to fair value of identifiable net assets acquired. Both of these investments were accounted using the initial value method. Only Mace declared dividends in any year. Mace declared dividends each year equal to 40% of its separate net income before the calculation of any of its investment income. Separate net income totals for 2017, not including investment income for any company, were as follows:

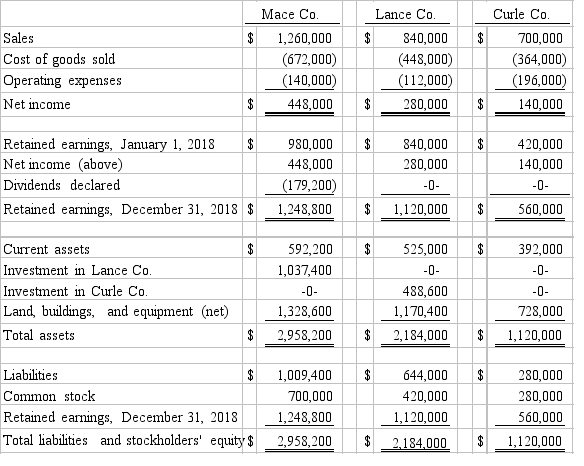

Following are the 2018 financial statements for these three companies. Curle made numerous transfers of inventory to Lance since the takeover: $112,000 (2017) and $140,000 (2018). These transfers included the same markup applicable to Curle's outside sales. In each of these years, Lance held 20% of the inventory it bought from Curle and then sold that inventory to outsiders in the following year.

An effective income tax rate of 45% was applicable to all companies.

Following are the 2018 financial statements for these three companies. Curle made numerous transfers of inventory to Lance since the takeover: $112,000 (2017) and $140,000 (2018). These transfers included the same markup applicable to Curle's outside sales. In each of these years, Lance held 20% of the inventory it bought from Curle and then sold that inventory to outsiders in the following year.

An effective income tax rate of 45% was applicable to all companies.

-Required:

Determine the total amount of goodwill for the January 1, 2017 acquisition of Curle Co.and for the acquisition of Lance Co.on the same date.

-Required:

Determine the total amount of goodwill for the January 1, 2017 acquisition of Curle Co.and for the acquisition of Lance Co.on the same date.

(Essay)

4.8/5  (34)

(34)

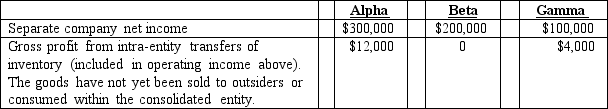

Alpha Corporation owns 100 percent of Beta Company, and Beta owns 80 percent of Gamma, Inc., all of which are domestic corporations. There were no excess allocation values at the date of acquisition of the subsidiaries. Information for the three companies for the year ending December 31, 2018 follows:

-What is Alpha's accrual-based net income for 2018?

-What is Alpha's accrual-based net income for 2018?

(Multiple Choice)

4.8/5  (35)

(35)

Assuming that separate income tax returns are being filed, what deferred income tax asset is created?

(Multiple Choice)

4.9/5  (33)

(33)

X Co.owned 80% of Y Corp., and Y Corp.owned 15% of X Co.Under the treasury stock approach, how would the dividends paid by X Co.to Y Corp.be handled on a consolidation worksheet?

(Essay)

4.9/5  (32)

(32)

Tower Company owns 85% of Hill Company. The two companies engaged in several intra-entity transactions. There were no excess fair-value amortization amounts to account for. Each company's income before income tax and dividend income for the current time period follow, as well as the effects of intra-entity gross profits on remaining inventory which are included in the separate net income amounts. No income tax accruals have been recognized within these totals. The tax rate for each company is 30%.

-Using the percentage allocation method for assigning income tax expense, the income tax expense assigned to Hill is closest to:

-Using the percentage allocation method for assigning income tax expense, the income tax expense assigned to Hill is closest to:

(Multiple Choice)

4.8/5  (39)

(39)

-The accrual-based net income of Maroon Corp.is calculated to be

-The accrual-based net income of Maroon Corp.is calculated to be

(Multiple Choice)

4.9/5  (37)

(37)

West Corp. owns 70% of the voting common stock of East Co. East owns 60% of Compass Co. West and East both use the initial value method to account for their investments. The following information is available from the financial statements and records of the three companies:

Separate company net income includes intra-entity gains before the consolidating deferral but does not include dividend income from investment in subsidiary.

-The accrual-based net income of East Co.is calculated to be

Separate company net income includes intra-entity gains before the consolidating deferral but does not include dividend income from investment in subsidiary.

-The accrual-based net income of East Co.is calculated to be

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following statements is true concerning connecting affiliations and mutual ownerships?

(Multiple Choice)

4.9/5  (33)

(33)

Showing 101 - 112 of 112

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)