Exam 19: Valuation and Financial Modeling: a Case Study

Exam 1: The Corporation37 Questions

Exam 2: Introduction to Financial Statement Analysis93 Questions

Exam 3: Financial Decision Making and the Law of One Price89 Questions

Exam 4: The Time Value of Money89 Questions

Exam 5: Interest Rates68 Questions

Exam 6: Valuing Bonds110 Questions

Exam 7: Investment Decision Rules86 Questions

Exam 8: Fundamentals of Capital Budgeting93 Questions

Exam 9: Valuing Stocks96 Questions

Exam 10: Capital Markets and the Pricing of Risk101 Questions

Exam 11: Optimal Portfolio Choice and the Capital Asset Pricing Model133 Questions

Exam 12: Estimating the Cost of Capital104 Questions

Exam 13: Investor Behavior and Capital Market Efficiency75 Questions

Exam 14: Capital Structure in a Perfect Market98 Questions

Exam 15: Debt and Taxes95 Questions

Exam 16: Financial Distress, managerial Incentives, and Information111 Questions

Exam 17: Payout Policy96 Questions

Exam 18: Capital Budgeting and Valuation With Leverage96 Questions

Exam 19: Valuation and Financial Modeling: a Case Study49 Questions

Select questions type

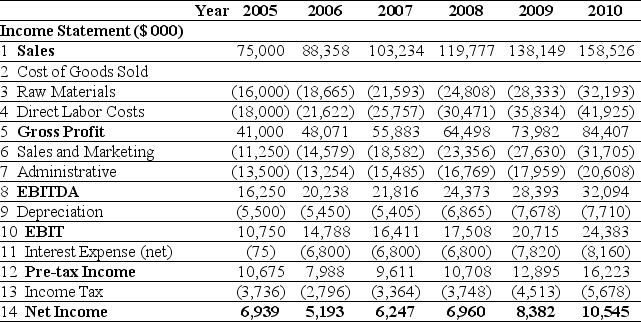

Use the tables for the question(s) below.

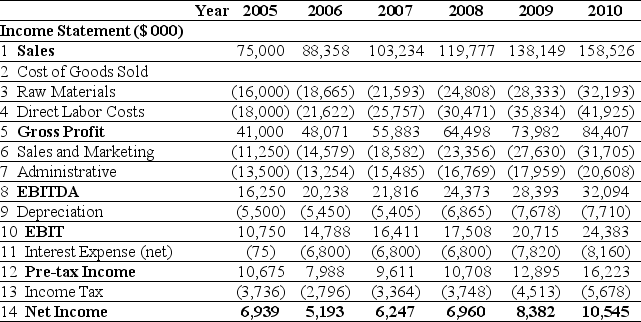

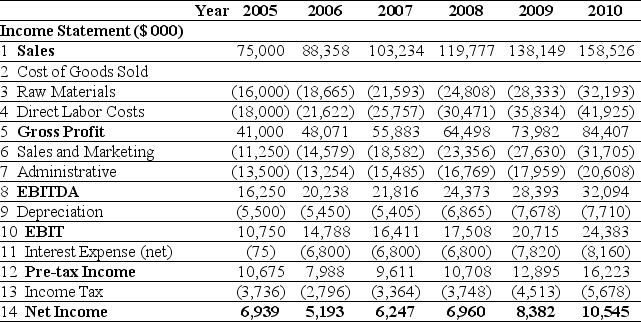

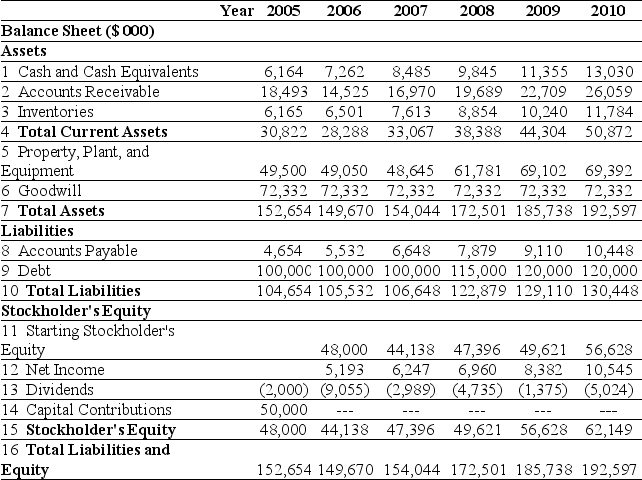

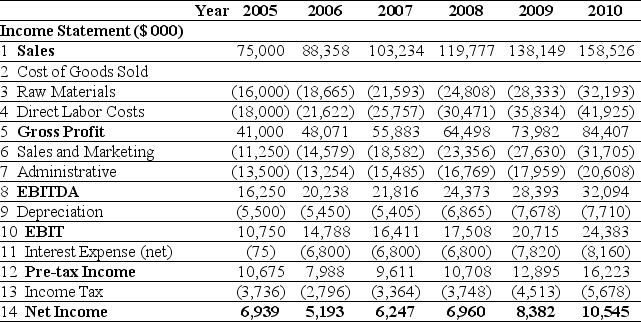

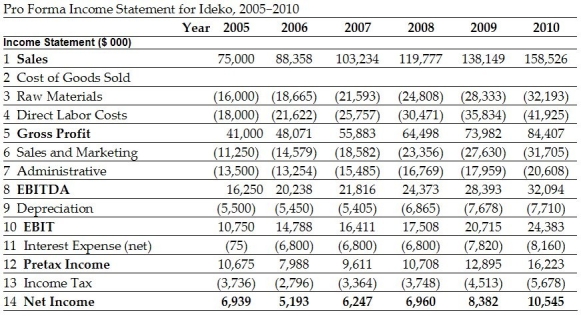

Pro Forma Income Statement for Ideko, 2005-2010

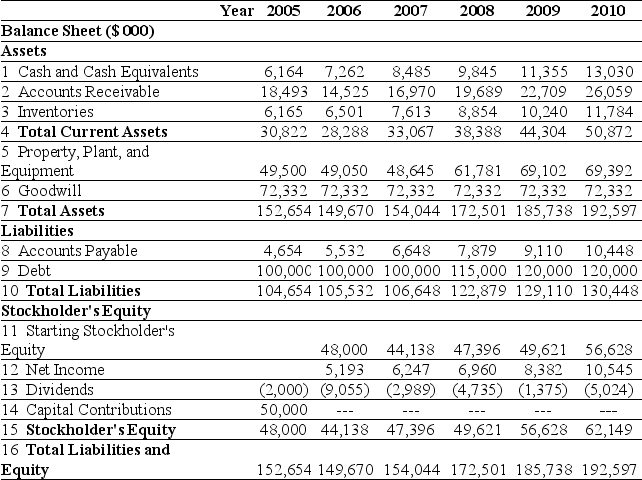

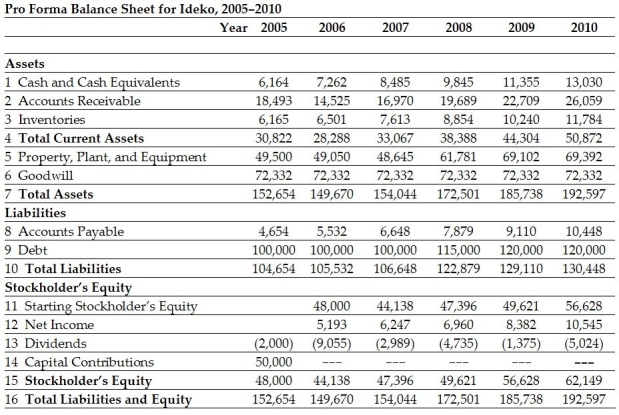

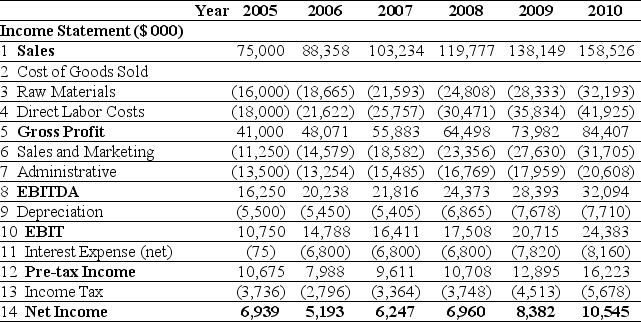

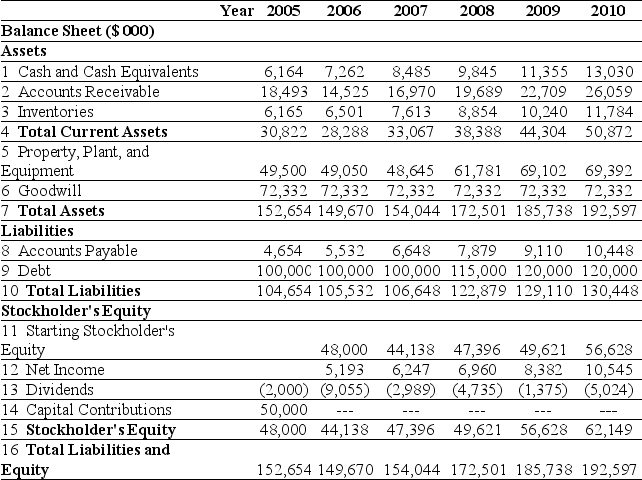

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

-Assuming that Ideko has a EBITDA multiple of 8.5,then the continuation enterprise value of Ideko in 2010 is closest to:

-Assuming that Ideko has a EBITDA multiple of 8.5,then the continuation enterprise value of Ideko in 2010 is closest to:

Free

(Multiple Choice)

4.8/5  (30)

(30)

Correct Answer:

B

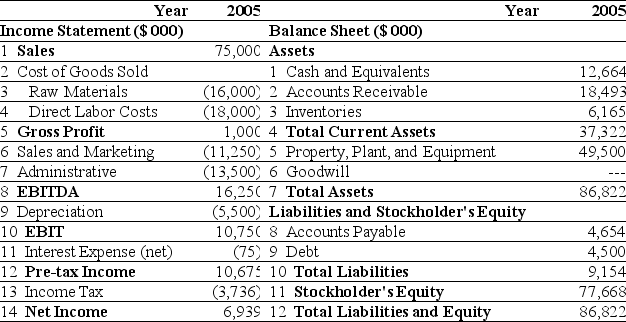

What range for the market value of equity for Ideko is implied by the range of EV/EBITDA multiples for the comparable firms if Ideko holds $6.5 million of cash in excess of its working capital needs?

Free

(Essay)

4.9/5  (46)

(46)

Correct Answer:

Low EV/EBITDA (Nike)= 9.3

Low EV = EBITDA × EV/EBITDA = $16.25 million × 9.3 = $151.13 million

Low EV = Equity + Debt - Cash in excess of NWC needs

Low Equity Price = EV - Debt + cash in excess of NWC needs = $151.13 - $4.5 + $6.5 = $153.13 million

High EV/EBITDA (Luxottica)= 14.4

High EV = EBITDA × EV/EBITDA = $16.25 million × 14.4 = $234.00 million

High EV = Equity + Debt - Cash in excess of NWC needs

High Equity Price = EV - Debt + cash in excess of NWC needs = $234.00 - $4.5 + $6.5 = $236.00 million

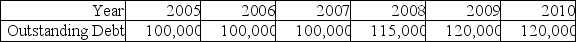

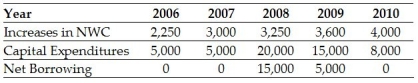

Use the following information to answer the question(s) below:

Ideko's Planned Debt

-If Ideko's loans will have an interest rate of 6.8%,then the interest expense paid in 2009 is closest to:

-If Ideko's loans will have an interest rate of 6.8%,then the interest expense paid in 2009 is closest to:

Free

(Multiple Choice)

4.8/5  (34)

(34)

Correct Answer:

C

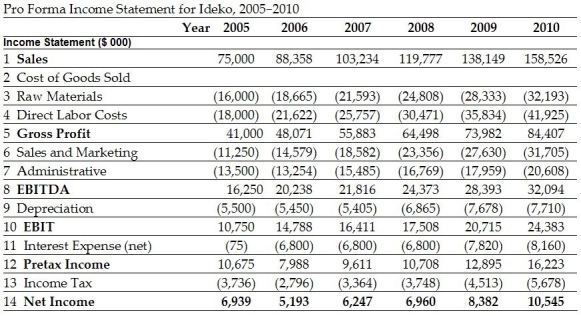

Use the following information to answer the question(s) below:

-If Ideko's future expected growth rate is 5% and its WACC is 9%,then the continuation value in 2010 is closest to:

-If Ideko's future expected growth rate is 5% and its WACC is 9%,then the continuation value in 2010 is closest to:

(Multiple Choice)

4.9/5  (32)

(32)

What range for the market value of equity for Ideko is implied by the range of P/E multiples for the comparable firms?

(Essay)

4.8/5  (28)

(28)

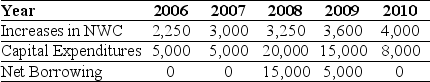

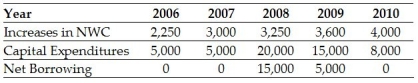

Using the income statement above and the following information:

Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2009.

Calculate Ideko's Free Cash Flow to the Firm and Free Cash Flow to Equity in 2009.

(Essay)

4.8/5  (32)

(32)

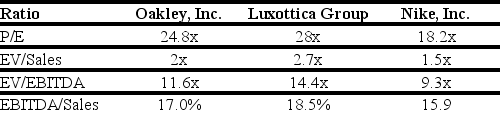

Use the table for the question(s) below.

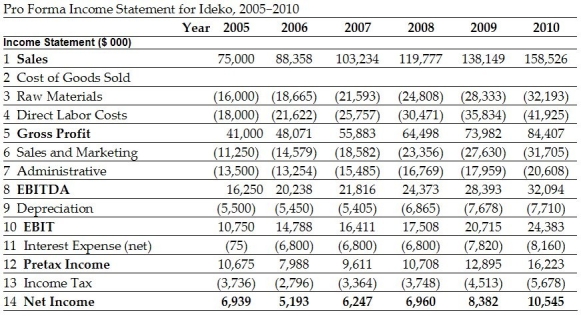

Pro Forma Income Statement for Ideko, 2005-2010

-With the proper changes it is believed that Ideko's credit policies will allow for an account receivables days of 60.The forecasted accounts receivable for Ideko in 2008 is closest to:

-With the proper changes it is believed that Ideko's credit policies will allow for an account receivables days of 60.The forecasted accounts receivable for Ideko in 2008 is closest to:

(Multiple Choice)

4.9/5  (50)

(50)

Use the tables for the question(s) below.

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

-Assuming that Ideko has a EBITDA multiple of 9.4,then the continuation EV/Sales ratio of Ideko in 2010 is closest to:

-Assuming that Ideko has a EBITDA multiple of 9.4,then the continuation EV/Sales ratio of Ideko in 2010 is closest to:

(Multiple Choice)

4.9/5  (37)

(37)

If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Oakley is closest to:

(Multiple Choice)

4.8/5  (31)

(31)

Use the tables for the question(s) below.

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

-Assuming that Ideko has a EBITDA multiple of 8.5,then the continuation EV/Sales ratio of Ideko in 2010 is closest to:

-Assuming that Ideko has a EBITDA multiple of 8.5,then the continuation EV/Sales ratio of Ideko in 2010 is closest to:

(Multiple Choice)

4.8/5  (42)

(42)

If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Luxottica is closest to:

(Multiple Choice)

4.8/5  (45)

(45)

Use the following information to answer the question(s) below:

-The free cash flow to the firm in 2010 is closest to:

-The free cash flow to the firm in 2010 is closest to:

(Multiple Choice)

4.8/5  (38)

(38)

Use the tables for the question(s) below.

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

The following are financial ratios for three comparable companies:

The following are financial ratios for three comparable companies:

-Based upon the average EV/Sales ratio of the comparable firms,Ideko's target economic value is closest to:

-Based upon the average EV/Sales ratio of the comparable firms,Ideko's target economic value is closest to:

(Multiple Choice)

5.0/5  (36)

(36)

Use the tables for the question(s) below.

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

-Assuming that Ideko has a EBITDA multiple of 9.4,then the continuation equity value of Ideko in 2010 is closest to:

-Assuming that Ideko has a EBITDA multiple of 9.4,then the continuation equity value of Ideko in 2010 is closest to:

(Multiple Choice)

4.8/5  (38)

(38)

Use the table for the question(s) below.

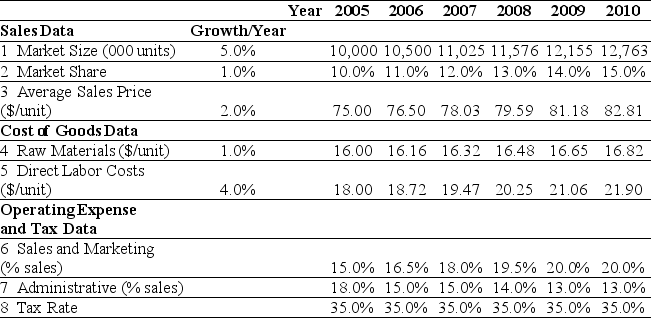

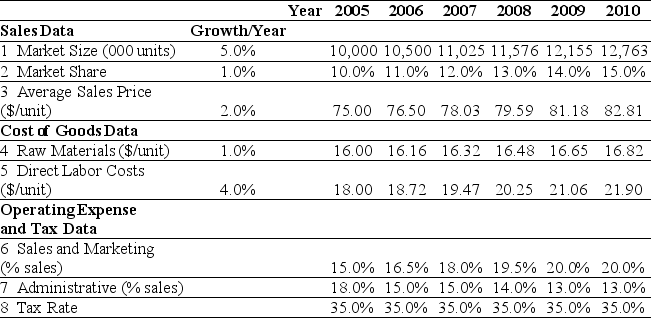

Ideko Sales and Operating Cost Assumptions

-Based upon Ideko's Sales and Operating Cost Assumptions,what production capacity will Ideko require in 2008?

-Based upon Ideko's Sales and Operating Cost Assumptions,what production capacity will Ideko require in 2008?

(Multiple Choice)

4.7/5  (34)

(34)

If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Nike is closest to:

(Multiple Choice)

4.8/5  (32)

(32)

Use the table for the question(s) below.

Ideko Sales and Operating Cost Assumptions

-Based upon Ideko's Sales and Operating Cost Assumptions,what production capacity will Ideko require in 2007?

-Based upon Ideko's Sales and Operating Cost Assumptions,what production capacity will Ideko require in 2007?

(Multiple Choice)

4.8/5  (42)

(42)

Use the following information to answer the question(s) below:

-The after tax interest expense in 2008 is closest to:

-The after tax interest expense in 2008 is closest to:

(Multiple Choice)

4.9/5  (31)

(31)

The amount of net working capital for Ideko in 2007 is closest to:

(Multiple Choice)

4.9/5  (42)

(42)

The amount of the increase in net working capital for Ideko in 2007 is closest to:

(Multiple Choice)

4.9/5  (40)

(40)

Showing 1 - 20 of 49

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)