Exam 19: Valuation and Financial Modeling: a Case Study

Exam 1: The Corporation37 Questions

Exam 2: Introduction to Financial Statement Analysis93 Questions

Exam 3: Financial Decision Making and the Law of One Price89 Questions

Exam 4: The Time Value of Money89 Questions

Exam 5: Interest Rates68 Questions

Exam 6: Valuing Bonds110 Questions

Exam 7: Investment Decision Rules86 Questions

Exam 8: Fundamentals of Capital Budgeting93 Questions

Exam 9: Valuing Stocks96 Questions

Exam 10: Capital Markets and the Pricing of Risk101 Questions

Exam 11: Optimal Portfolio Choice and the Capital Asset Pricing Model133 Questions

Exam 12: Estimating the Cost of Capital104 Questions

Exam 13: Investor Behavior and Capital Market Efficiency75 Questions

Exam 14: Capital Structure in a Perfect Market98 Questions

Exam 15: Debt and Taxes95 Questions

Exam 16: Financial Distress, managerial Incentives, and Information111 Questions

Exam 17: Payout Policy96 Questions

Exam 18: Capital Budgeting and Valuation With Leverage96 Questions

Exam 19: Valuation and Financial Modeling: a Case Study49 Questions

Select questions type

What range for the market value of equity for Ideko is implied by the range of EV/Sales multiples for the comparable firms if Ideko holds $6.5 million of cash in excess of its working capital needs?

(Essay)

4.8/5  (44)

(44)

Use the tables for the question(s) below.

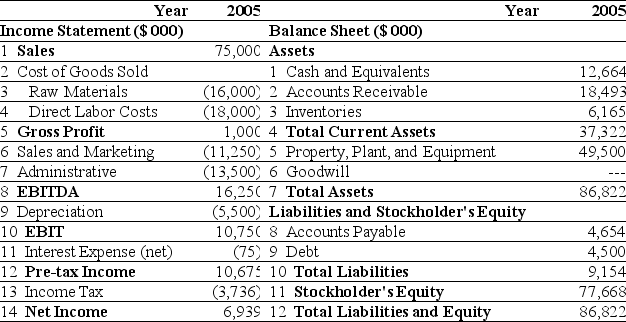

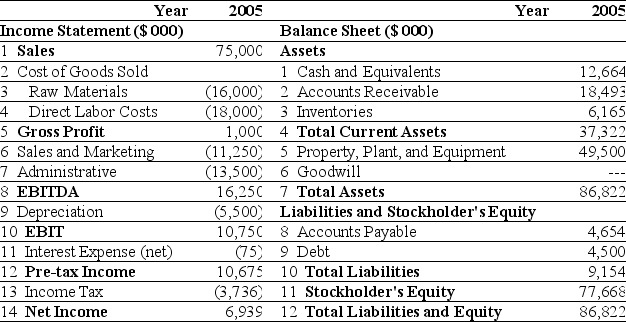

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

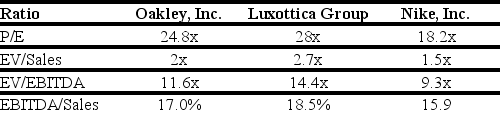

The following are financial ratios for three comparable companies:

The following are financial ratios for three comparable companies:

-Based upon the average EV/EBITDA ratio of the comparable firms,if Ideko holds $6.5 million of cash in excess of its working capital needs,then Ideko's target market value of equity is closest to:

-Based upon the average EV/EBITDA ratio of the comparable firms,if Ideko holds $6.5 million of cash in excess of its working capital needs,then Ideko's target market value of equity is closest to:

(Multiple Choice)

4.8/5  (34)

(34)

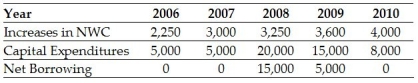

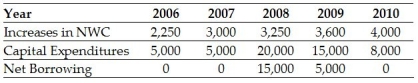

Use the following information to answer the question(s) below:

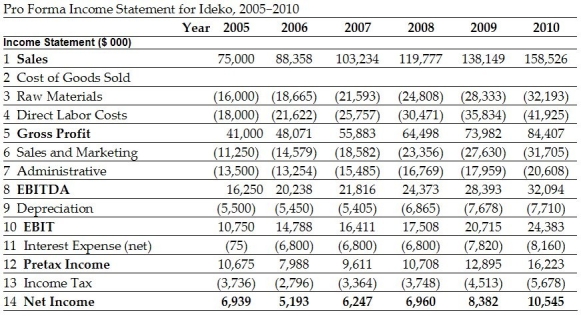

-The free cash flow to equity in 2008 is closest to:

-The free cash flow to equity in 2008 is closest to:

(Multiple Choice)

4.8/5  (28)

(28)

Use the following information to answer the question(s) below:

-The free cash flow to equity in 2010 is closest to:

-The free cash flow to equity in 2010 is closest to:

(Multiple Choice)

4.8/5  (36)

(36)

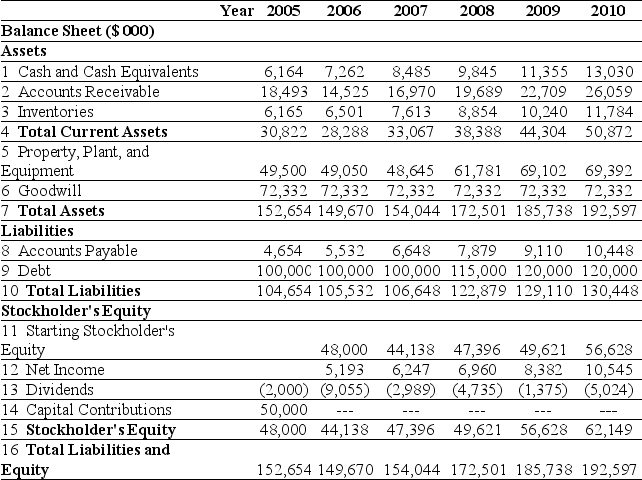

The amount of net working capital for Ideko in 2008 is closest to:

(Multiple Choice)

4.8/5  (39)

(39)

Use the tables for the question(s) below.

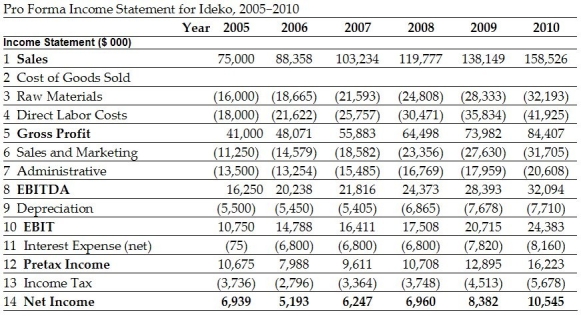

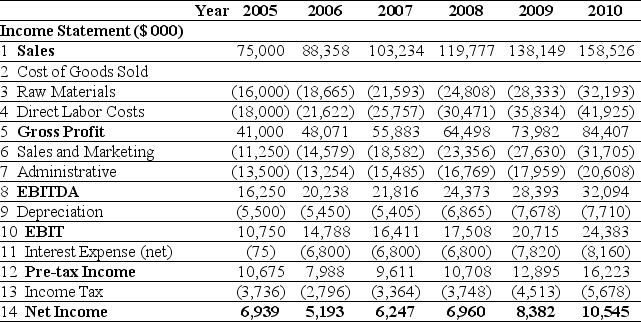

Pro Forma Income Statement for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

Pro Forma Balance Sheet for Ideko, 2005-2010

-Assuming that Ideko has a EBITDA multiple of 8.5,then the continuation levered P/E ratio of Ideko in 2010 is closest to:

-Assuming that Ideko has a EBITDA multiple of 8.5,then the continuation levered P/E ratio of Ideko in 2010 is closest to:

(Multiple Choice)

4.8/5  (38)

(38)

The amount of net working capital for Ideko in 2006 is closest to:

(Multiple Choice)

4.8/5  (35)

(35)

Use the tables for the question(s) below.

Estimated 2005 Income Statement and Balance Sheet Data for Ideko Corporation

-Ideko's Accounts Receivable Days is closest to:

-Ideko's Accounts Receivable Days is closest to:

(Multiple Choice)

4.7/5  (30)

(30)

Showing 41 - 49 of 49

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)